UNISWAP (UNIUSDT) Technical Analysis Shows Lower Prices

Weekly Chart

Observations - Weekly

-

Bull trend showed signs of strengthening as it triggered a higher swing high of $19.47 in early-December.

-

Subsequently, a trend high of $19.47 was reached on December 8, which led to the current bearish correction. Once the first bottom at $11.22 was established UNIUSDT formed a triangle consolidation pattern on support of top rising channel line (resistance becomes support). Notice that the light blue AVWAP around $12.87 was also in the area of support for the pattern.

-

Bear trend continuation triggered on Saturday with a drop below the lower boundary line at $12.39, followed by the of the triangle at $11.22, the initial swing low in the correction. Support seen today at a low of $10.34, thereby completing a 61.8% retracement.

-

Since UNIUSDT has reentered the range of the rising trend channel, there is the possibility it falls to the lower channel line before the correction is complete.

Daily Chart

Observations - Daily

Lower Support

-

There is a potential lower support zone from $9.59 to the 200-day MA at $9.53. Also, the 78.6% Fibonacci retracement is slightly lower at $9.37 and a 78.6% (less than 100%) target for a falling ABCD pattern (purple) is at $9.17.

-

It is interesting to note that the AVWAP from the August bottom failed to hold as support during Monday’s drop.

Potential Resistance

-

Prior swing low from triangle pattern is at $12.02.

-

AVWAP from August low is around $12.88.

-

20-day MA is at $13.21 and the 50-day MA is at $14.15.

Bull Strategy

-

Wait for the trend to evolve and for a more significant potential support zone to be reached. Watch for signs of support around the 200-day MA and lower rising channel line and subsequent bullish reversal.

-

Anticipated rally back to the top channel line. An AVWAP level is at $12.88 today, close to converging with the channel line.

Bear Strategy

-

Watch for a rally into resistance at or below the top channel. Then, watch for a bearish reversal setup on the daily or lower time frame for a short and potential continuation of the bearish correction to the 200-day MA target zone.

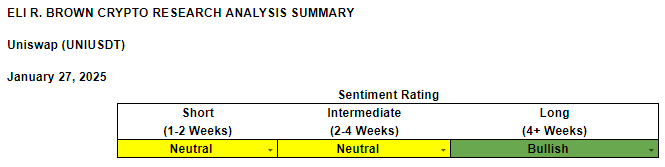

Sentiment Rating & Signals

More By This Author:

XRP (XRP/USD) Analysis Shows Bull Trend Intact

Bull Flag Breakout In SOL/USD Shows Strength

EUR/USD Double Bottom Breakout Begins

Above analysis is for educational purposes only. Proceed at your own risk. All information given here is largely based on technical analysis and the analysis is very dynamic in nature and stays ...

more