Ukraine Crisis Boosts Gold Names

Ukraine Crisis Boosts Gold Miners

A few days ago, we posted Russian journalist Anatoly Karlin's assessment that there was an 85% chance of a Russian invasion of Ukraine.

Subsequently, we posted a follow up noting that a missing piece--a casus belli--had fallen into place.

Now, the President of the United States has predicted that Russia will invade Ukraine.

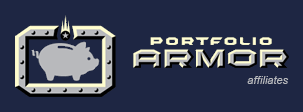

The increasing certainty of war breaking out there seems to have finally given a boost to gold names including the VanEck Vectors Gold Miners ETF (GDX). That was enough for our system, which gauges stock and options market sentiment, to put GDX into its top ten on Friday.

Screen capture via Portfolio Armor on 2/18/2022.

GDX represents a new theme in our top ten, which this year has often included industrial commodities names such as the iPath Series B Bloomberg Coffee Subindex Total Return ETN (JO) and the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares ETF (GUSH), chip names such as Nvidia (NVDA), and post-COVID reopenning names such as United Continental Holdings, Inc. (UAL).

The Possibility Of A False Breakout

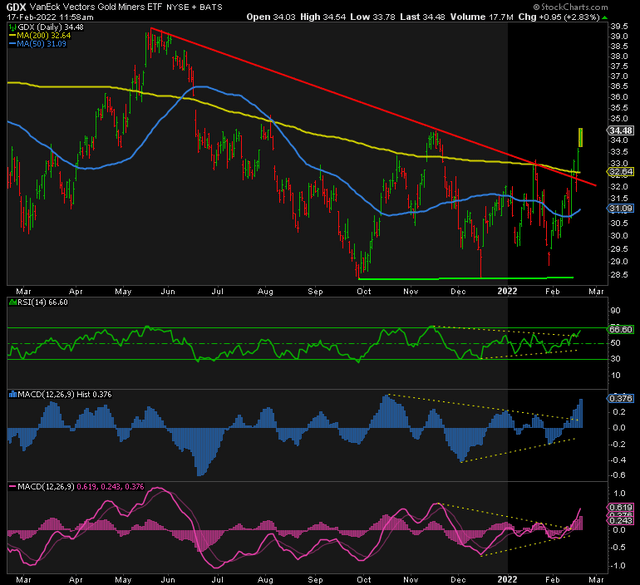

As Sprott Money suggested on Friday, however (Gold Breaks Out To The Upside), there is a possibility this has been a false breakout for GDX:

GDX

The bullish flag structure that I cited in each of the past 2 weeks has certainly come to fruition. GDX sliced through resistance at its red downtrend line and the 200MA and has broken the prior high of 34.48 back in November. However, it needs to close above 34.48. A drop back down below there would signal a fake breakout which is bearish.

In Case We're Wrong About GDX

In the event our system is wrong about GDX and this has been a false breakout, below are a couple of ways longs can limit their downside risk over the next several months.

Uncapped Upside, Positive Cost

As of Friday's close, these were the optimal puts to hedge 1,000 shares of GDX against a greater-than-25% decline by mid-June.

This and subsequent screen captures are via the Portfolio Armor iPhone app.

The cost here was $510, or 1.48% of position value, calculated conservatively, based on the ask price of the puts (in practice you can often buy and sell options at some price between the bid and ask).

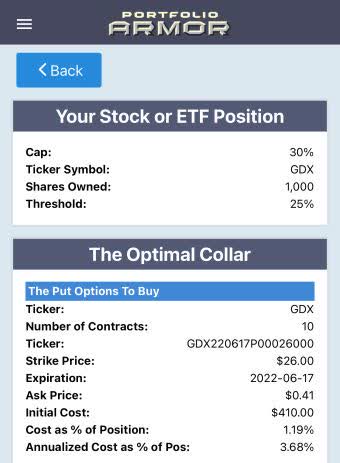

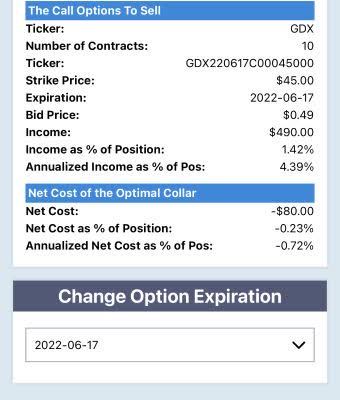

Capped Upside, Negative Cost

If you were willing to cap your possible upside at 30% between now and mid-June, this was the optimal collar to hedge against a >25% drop over the same time frame as of Friday's close.

Here the cost was negative, meaning you would have collected a net credit of $80 when opening this collar, assuming, to be conservative, that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

The Best Hedge Against A Market Drop

Although gold and oil names may rally further in the event Russia invades Ukraine, if you're concern is protecting your stock portfolio against a market downturn, the best hedge against that would be to buy optimal puts on index ETFs that correlate closely with your stocks, such as the SPDR S&P 500 Trust ETF (SPY).

If You Want To Stay In Touch

You can follow Portfolio Armor on Twitter here, subscribe to our occasional email list here, subscribe to our YouTube channel here, or visit our website by clicking on the image below.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more