Two Long Leading Indicators - Real Money Supply And Credit Conditions

M1 and M2 money supply for May were reported yesterday by the Fed. The former was unchanged for the month, and the latter was up a tiny 0.1%:

(Click on image to enlarge)

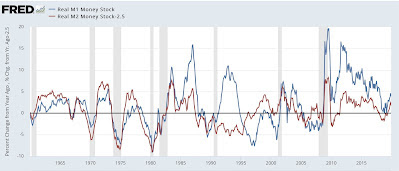

That is significant. Why? Because the real money supply is a long leading indicator. Real M2 fell out of favor after failing to actually decline YoY prior to the 2001 and 2008 recessions, but a YoY% decline in real M1 and a real YoY% gain of M2 of less than 2.5% is nevertheless an excellent leading indicator for recession:

(Click on image to enlarge)

Here is a close-up of the past year:

(Click on image to enlarge)

Both real M1 and real M2 are outright negative as of May.

There have been several false positives for this indicator: 1967, 1987, and 1994. But otherwise, every time this has happened, a recession has followed within 9 months to 2 years.

Additionally, the Chicago Fed updated its financial conditions indexes this morning. The Adjusted National Conditions Index rose to +.15, and the Leverage Index rose to +.53. With the exceptions of 1987 and 2011, both of these are at levels typically associated with oncoming recessions:

(Click on image to enlarge)

In sum, the long leading indicators continue to worsen. The only unambiguously positive indicator at the moment is the Treasury yield curve (and even there, the 10-year minus 2-year spread is *almost* - but not quite - inverted).

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.