Tuesday Talk: More China Blues

Chatter can be heard about the U.S. consumer and their desire to spend as a positive catalyst for stock prices. Be that as it may, supply chain related commodities and energy shortages with China origins continue to weigh heavily on market action.

At the end of Monday's trading day the S&P 500 was down 30 points, closing at 4,361, the Dow Jones Industrial Average closed at 34,496, down 250 points, and the Nasdaq Composite down 94 points, closed at 14,486. Currently market futures are very light green; the S&P 500 is up 3 points, the Dow is up 14 points and Nasdaq 100 futures are up 35 points. Yesterday's most actives were almost all down with communications sector equities taking it on the chin.

Chart: The New York Times

From the seeming collapse of the Chinese real estate industry to energy shortages on the mainland caused by both natural disasters and geo-political tensions the effect on world markets as well as China's population is beginning to ripple across the globe.

TalkMarkets contributor John Mauldin in an Editor's Choice column, China's Gilded Age Is Over starts off with a historical comparison to America's own gilded age and concludes with a list of ten dominos which could topple the Chinese economy and create global havoc.

"In United States history, the Gilded Age was an era that occurred during the late 19th century, from the 1870s to about 1900. It was an era of rapid economic growth...The average annual wage per industrial worker (including men, women, and children) rose from $380 in 1880, to $564 in 1890, a gain of 48%...(in addition) high concentration(s) of wealth became more visible and contentious...(creating vast social problems)...The pendulum eventually swings to correct such excesses. Around 1900, the Gilded Age gave way to a “Progressive Era.”...Thirty or so years of rapid economic growth brought many changes to the US. You could say the same of the last 30 or so years in China."

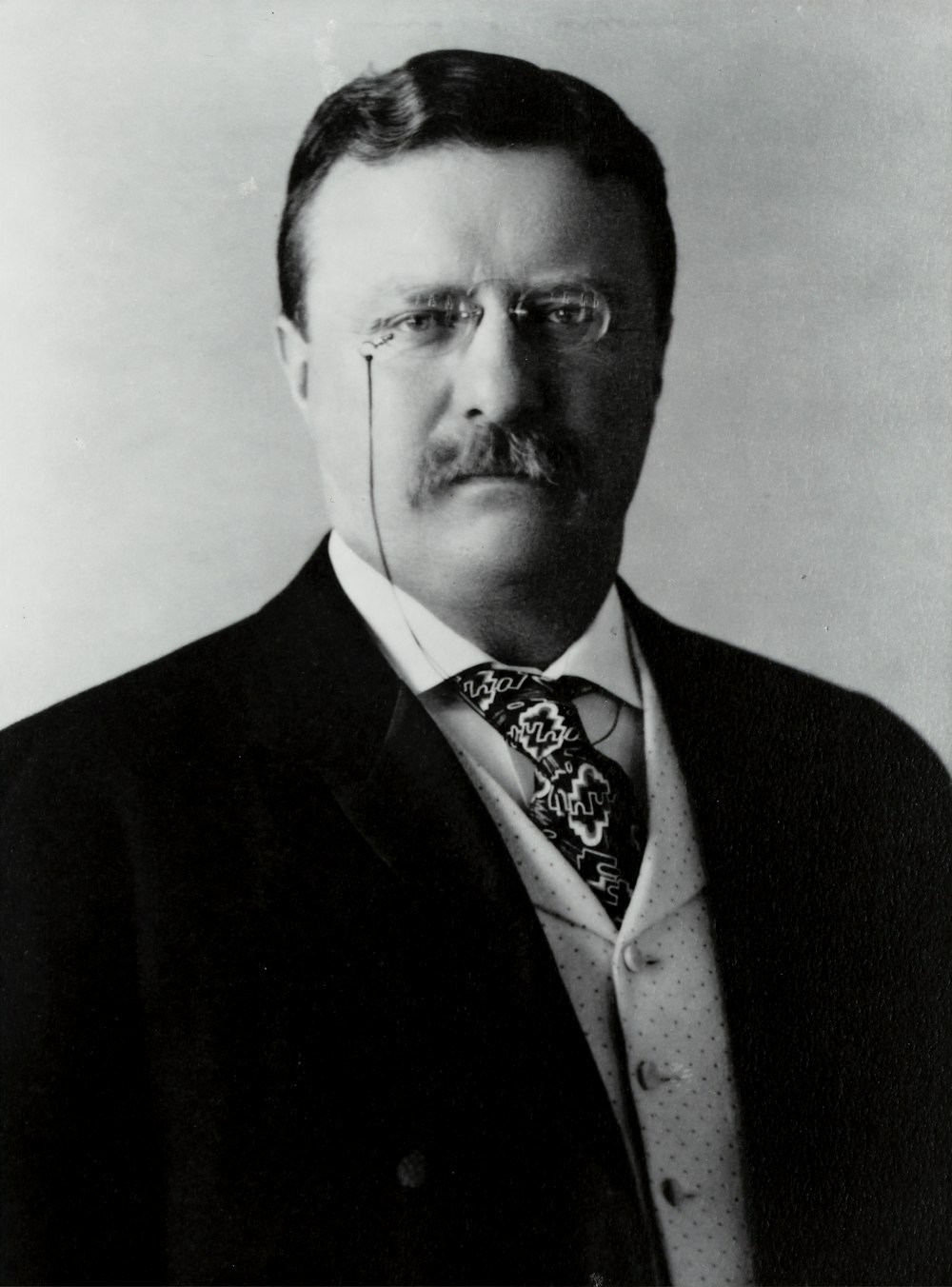

"The president most associated with that time is Theodore Roosevelt...His domestic agenda promised a “Square Deal” for average citizens, breakup of the powerful business trusts, environmental conservation and safe food and drugs..."

"Xi Jinping is certainly no Roosevelt...but he’s facing a similar time in China. China had its own kind of Gilded Age, beginning back in the 1980s and extending into the 2010s and 2020, until (this year when) Xi began to crack down...Xi’s (new) crackdown on successful technology and other companies is basically telling entrepreneurs to be careful about getting too big. This is a monster experiment in changing the human entrepreneurial equation. Xi needs entrepreneurs to drive the Chinese economy forward. But moving away from Deng Xiaoping’s “Some must get rich first” will certainly change how entrepreneurs run their businesses. Maybe it will work but it does give credence to the concept of “Peak China.”

And here (abbreviated) are the dominoes as Mauldin sees them:

"Domino 1: Property developer Evergrande (EGRNF) is the top-of-mind concern right now. Its business risks are largely confined to China; the fear is more about possible financial contagion, which could extend outside China to foreign investors and lenders. Non-Chinese debt is around $20 billion and will likely be written off."

"Domino 2: Companies Similar to Evergrande. A significant number of companies are borrowing above 20% rates and can no longer fund from the dollar funding market. These companies can either default, they can try to sell assets, they can go to government banks to borrow money..."

"Domino 3: Minsheng Bank. In 2008, Bear Stearns imploded due to subprime debt. Citigroup is watching Minsheng Bank, which has lost over half of its market cap over the last few months. It is currently modelling a 20% probability of default. It could create contagion effects within the banking system..."

"Domino 4: Small Banks. There are numerous banks in China that are very similar to Northern Rock, a small bank in the UK which imploded due to its exposure to subprime debt and a balance sheet that was wrong-sized. These banks have low transparency but create exposure to larger banks and insurers. If more property developers go supernova these banks are vulnerable."

"Domino 5: Ping An. This is a private insurer with a lot of problems. They own a property company called China Fortune Land. 5% of the investment portfolio is leveraged 10X. The CEO and company are under regulatory investigations...[There is never just one cockroach.]"

"Domino 6: The Equity Market. There are $300 billion worth of margin loans. If an insurer like Ping An went into stress, there could be more share selling on other banks creating a cascading impact that triggers margin calls."

"Domino 7: Big Banks. ICBC and other systemic banks interface with international markets. Their equity prices could plummet and their CDS [Credit Default Swaps] could widen. Regulators and the banks have been assessing their risk exposures optimistically much like Morgan Stanley (MS) and other large US banks did during the subprime crisis."

"Domino 8: The Credit Market. If China bank CDS blows out everything else blows out too and credit contracts dramatically. With $50 trillion of bank assets, that’s a lot of contraction."

"Domino 9: The RMB Breaks. Chinese banks would have to go on a worldwide hunt for dollars, which would lead to pressure on RMB and volatility and potentially force China to break its peg."

"Domino 10: The Crisis Goes Global. European, Korean, and Indian banks with yuan exposure could collapse and start to create an international contagion impact."

If you need scary tales to tell at the company Halloween party, Mauldin supplies more than a few.

In another Editor's Choice piece, contributor Mish Shedlock writes that A $5 Trillion Property Bust In China Has Huge Implications For Commodities .

"...China is confronting a staggering bill: More than $5 trillion in debt that developers took on when times were good, according to economists at Nomura Holdings Inc. That debt is nearly double what it was at the end of 2016 and is more than the entire economic output of Japan, the world’s third-largest economy...Total sales among China’s 100 largest developers were down by 36% in September from a year earlier,...and the 10 biggest developers, including China Evergrande, Country Garden Holdings Co. and China Vanke Co., saw sales down 44% from a year ago."

"Think of the implications a property bust of this magnitude will have on steel, copper, concrete, and Chinese GDP targets. China had largely been dependent on Australia for raw commodities..."

"(Forget about France for the moment) China was not at all pleased with (the US-Australian submarine) deal, especially the US sharing nuclear technology and military intelligence with Australia. Despite a shortage of coal, China suddenly stopped importing Australian coal..."

"China is short of coal. Australia and the US have plenty of coal. China would rather deal with power outages than take Australian coal. China also reduced lobster imports from Australia. Given the property bust, China does not need Australian copper or iron ore..."

Shedlock has more interesting bits like the ones above in his article but concludes with this:

"There's lots to think about here including commodity demand, global politics, Chinese debt and equities, and trade hardball over Aukus. A slowdown in China for any reason would have global repercussions even without the above notable headwinds. This looks ominous."

Contributors Warren Patterson and Wenyu Yao in their article this morning, Commodities Roundup: More Pressure On OPEC+ take a look at what is happening in the Energy and Metals markets and how China issues are part of that action.

"WTI managed to settle above $80/bbl for the first time since 2014. Continued concerns over tightness in energy markets, and the expectation of stronger oil demand due to gas to oil switching continues to support the oil market..."

"Although, while the futures market is clearly strong, the physical market is not reflecting this. Iraq cut its official selling prices for all grades of crude into Asia for November. Basrah Light was cut by $0.40/bbl to $0.45/bbl over the benchmark, Basrah Medium was cut by $0.50/bbl to a discount of $0.40/bbl, while Basrah Heavy was cut by $0.50/bbl to a discount of $2.75/bbl to the benchmark. This follows Saudi Arabia also cutting official selling prices for November. If the market was as tight as the futures market suggests, we should not be seeing cuts in OSPs. This indicates that a large part of the move in the futures market is speculatively driven."

"LME 3m aluminum (JJU) prices surged more than 3% to hit an intra-day high of US$3,072/t (highest since July 2008), while other base metals also extended their gains yesterday. The worsening energy crisis, which is stretching from Asia to Europe, is resulting in factory slowdowns and a risk of more supply cuts, supporting the metals complex."

"The latest survey from Mysteel shows that, base metals output in China declined in September, primarily due to the nationwide power shortage impacting smelting activities. Copper (JJC) output fell 2.9% MoM to 830kt last month, due to reduced operations in Jiangsu, Anhui and Guangdong provinces. Among other metals, aluminum output fell 3.6% MoM to 3.16mt, while zinc production fell 5.1% YoY to 450kt in September."

TalkMarkets contributor Thomas Westwater notes that today AUD/USD Rises Despite Wall Street Selloff As Chinese Flooding Lifts Coal Prices. Here is what he has to say:

"AUD/USD rose as coal prices surged in Asia. Beijing ordered energy producers to increase production last week, which relieved some upward pressure on prices. However, flooding across China is halting mining operations. That sent coal futures in China to record highs on Monday, which lifted the Australian Dollar. Australia is a major coal exporter, and China has reportedly allowed small amounts to clear customs despite a ban on coal imports from the southern neighbor."

"Oil prices also rose overnight, further spurring inflationary concerns as crude oil hit its highest level since October 2014. The demand for energy products is rising as economies come back online following COVID restrictions put in place versus the highly contagious Delta strain. (BNO)"

"...Rising energy costs are fueling concerns that inflation may be stickier than most economists and central bankers have predicted. Those higher costs could very well eat into consumer spending in other parts of the economy. A downbeat GDP report from Goldman Sachs (GS) also weighed on sentiment. The US bank cut its growth target to 5.6% for 2021."

Which brings us to contributor Michael Kramer who notes that Stocks Dive On October 11 As Market Dynamics Change Rapidly.

"Stocks started the day higher, but that didn’t last for very long, with the S&P 500 finishing the day lower by almost 70 bps closing at 4,360, erasing that big rally we had last Thursday while filling the gap. The S&P 500 is in a clear downtrend at this point, and there is no denying that with each high lower than the previous. The only thing left to be seen is if the next low is lower than the last. For that, we will need to break 4280; I don’t think that will happen tomorrow, but I think it will happen over the next few trading sessions."

"The market mentality has changed; it is just that simple. It is not the same market it was before September; the tone has changed."

I try not to use bold print all that much, but it seems that Kramer's point needs to be considered solidly. His article continues with comments regarding the VIX, as well as JPM, DIS and MU.

Asian indices, among them the Nikkei and Hang Seng have closed lower today.

Chart: The New York Times

As you get ready for the open of the NY markets I leave you with this song from the Chinese band No Party For Cao Dong.

Have a good week.

Interesting, educational, and a bit entertaining! Quite an article indeed. And all of this with a load of bad news. "The times, they are a-changing" (Bob Dylan) And certainly this is true. Our own Federal Reserve circus claowns have launched an inflation machine, not considering that severalmother influences are also causing more inflation. So instead of applying brakes it is going towards overdrive. And aside from the inflation problem this plague is still killing folks all over the place. And still Wall Street is fixated on maximizing the short term no matter what.

Thanks, William. Glad you enjoyed the article and that it spurred further discussion