Trouble In Estimating Seasonals As A Reason For The Low NFP Growth?

Image Source: Pixabay

NEC Director Hassett makes reference to a GS note that indicates that August preliminary figures typically get revised up (NBCNews). The GS note (Walkers/Rindel, Sept 4) cites a 61K downward bias in preliminary vs. third release… so +22 becomes +83K.

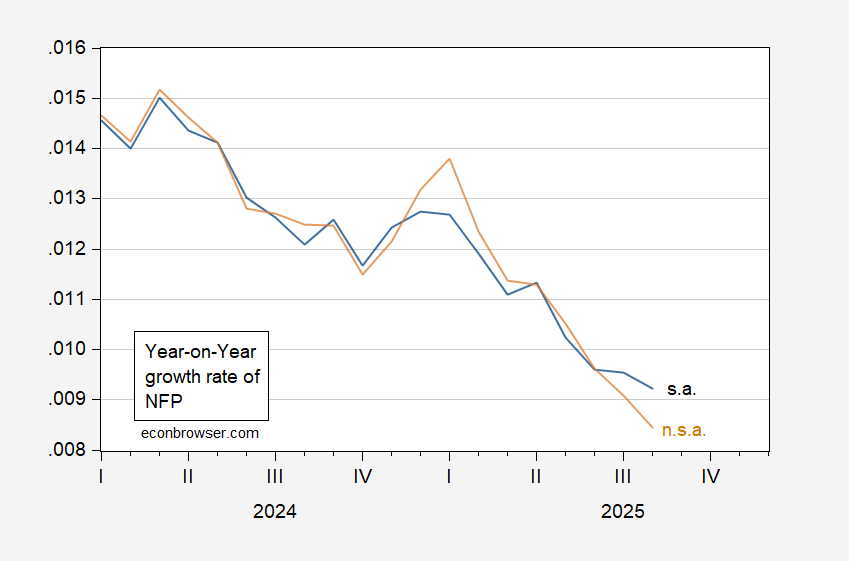

I think I understand this point; what I do to check what seasonal adjustment processes affect things is to compare how different a 12 month change in the not-seasonally-adjusted series is from the corresponding change in the seasonally-adjusted series. Here’s the comparison.

Figure 1: 12-month log difference in seasonally adjusted NFP (FRED series PAYEMS) (blue), and in not-seasonally-adjusted NFP (FRED series PAYNSA) (tan). Source: FRED, author’s calculations.

The 12 month growth rate for the n.s.a. series is lower than that for the s.a. series. Not proof positive that seasonal adjustment processes aren’t doing something strange – just putting bounds on how much you can look to seasonal adjustment to make the outlook appear less dismal.

As an aside, industrial production is not at an all time high; the July reading was slightly below the June reading. More significantly, capacity utilization in July (77.5%) was down from the June 2024 rate of 78.2%.

More By This Author:

Mid-Session Review Technical Supplement Is OutHow’s Manufacturing Doing?

The Data Are Pretty Clear That We Are Not In A Recession