The Significant Decline In US Corporate Tax Revenues Is A Symptom Of The Growing US Debt And Deficit Problem

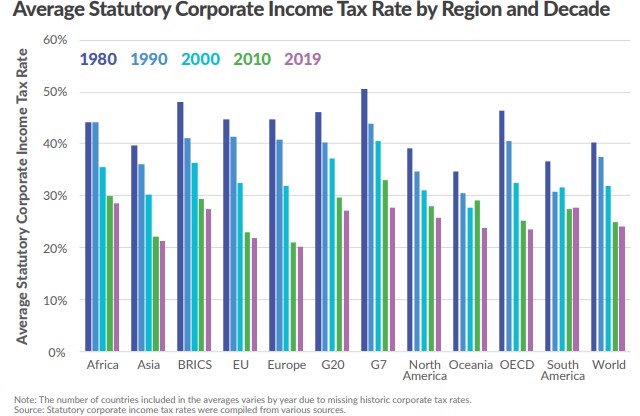

“Over the past 39 years, corporate tax rates have consistently declined on a global basis. In 1980, the unweighted average worldwide statutory tax rate was 40.38 percent. Today, the average statutory rate stands at 24.18 percent, representing a 40 percent reduction over the 39 years surveyed. ……Over time, more countries have shifted to taxing corporations at rates lower than 30 percent, with the United States following this trend with its tax changes at the end of 2017.” (Tax Foundation, Corporate Tax Rates around the World, 2019)

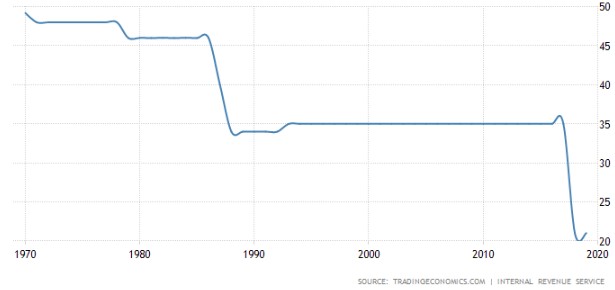

With the January 2018 passage of the Tax Cuts and Jobs Act of 2017, the federal corporate tax rate in the United States shifted down to a flat 21% from its former 35% rate. In other words, the 2018 tax cuts were huge and had major financial and economic implications.

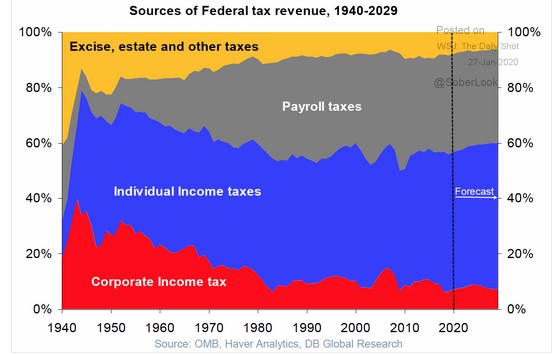

In fact, the role of corporate taxation in the US has been steadily declining since the end of World War II, thought the 2017 Tax Act also gave this development a huge boost.

Corporate tax revenue as a percent of GDP peaked in 1952 at 6.1% and recently declined to approximately 1.3% of GDP.At its post-WWII peak in 1952, the corporate tax generated 32.1% of all federal tax revenue compared to personal taxes which generated 42.2% of federal revenue, and the payroll tax which accounted for 9.7% of revenue.

Today, the corporate tax accounts for 8.9% of federal tax revenue, whereas the individual and payroll taxes account for 41.5% and 40.0%, respectively.

There were three main factors that accounted for the longer-term decline in corporate tax revenues.

First, the average effective corporate tax rate has decreased over time, mostly as a result of reductions in the statutory rate and changes affecting the tax treatment of investment and capital recovery (depreciation). Recently, of course, there was the massive tax rate cut introduced by the Trump Administration.

A less obvious factor behind the relative shrinkage of corporate tax revenues was the trend within the private sector to organize business partnerships, which are not subject to the corporate income tax.

A third less obvious factor is that reported corporate profits may have also declined over the longer term, further eroding the corporate tax base.

But Trump’s recent erosion of the corporate tax base has occurred as the economy was booming. The US budget figures for fiscal year 2018 reported that corporate income tax revenues fell from $297 billion in 2017 to $205 billion in fiscal year 2018 — a 31% decline.Such a large year-over-year drop in corporate income tax revenue is unprecedented during a period of strong economic growth.

Finally, as the last chart below indicates, the average statutory corporate tax rate has declined in every virtually region of the world since 1980, with the largest declines occurring in the early 2000s.

Not surprisingly, the large industrialized countries tend to have higher corporate income tax rates than the developing countries.

As the comparative data show, the average statutory corporate income tax rate measured across 176 different countries was 24.18% in 2019. European countries have the lowest average corporate tax rate, while African countries have the highest corporation tax rates, averaging at 28.45%.

The Corporate Tax Rate in the United States stands at 21 percent

While we hope the Coronavirus is mild in the USA there is no guarantee. If it is not mild, low tax revenue will become a disaster in itself.