The Rebound Slows: Business Cycle Indicators, August 28th

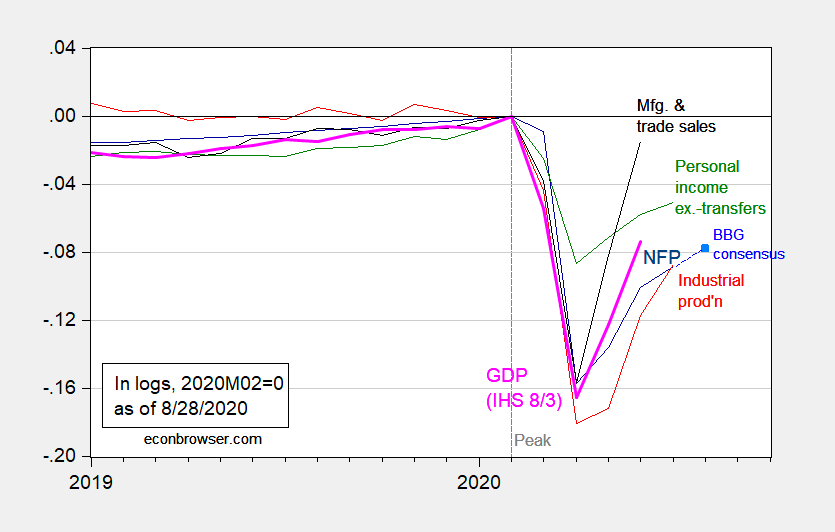

Several of the five key indicators referenced by the NBER’s Business Cycle Dating Committee are decelerating, as shown in Figure 1.

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for August employment (light blue square), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M02=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (8/3 release), NBER, and author’s calculations.

We will get August employment numbers in a week. Manufacturing and trade industry sales rebounded smartly in data going through June.

Income and outlay data were released today. While real disposable income is above pre-Covid-19 levels, it is declining. Consumption on the other hand has slowed its ascent, and is some 5% below NBER-defined peak levels.

Figure 2: Consumption in Ch.2012$ (blue), and real retail sales in CPI-deflated 1982-84$ (brown), both in logs, 2020M02=0. Source: BEA, Census, BLS via FRED, NBER, and author’s calculations.

Disclosure: None.