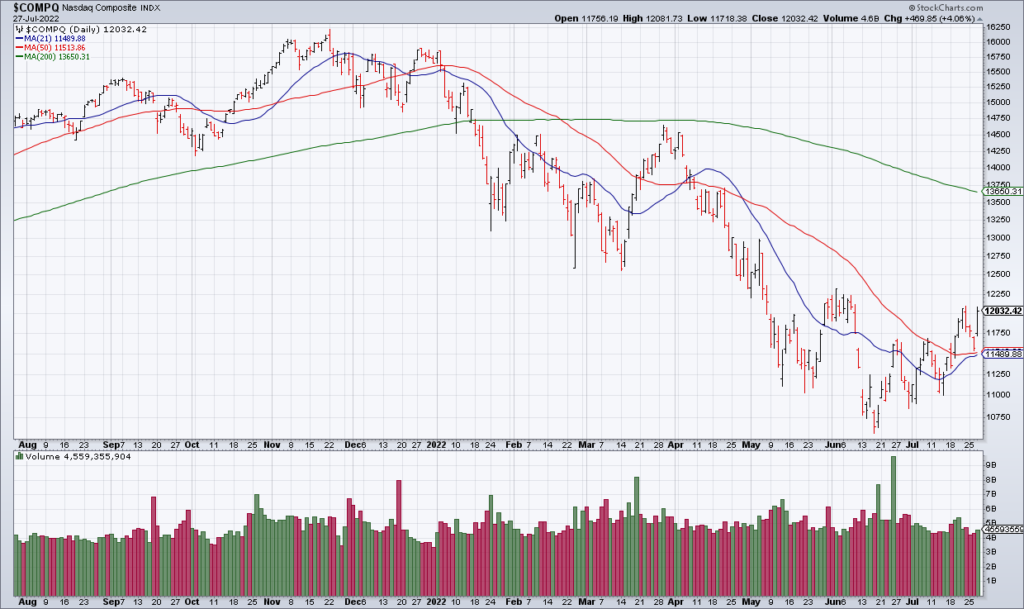

The Lows Of The Year Are In

(Click on image to enlarge)

Powell points to the lags of monetary policy: "These rate hikes have been large, and they’ve come quickly. And it’s likely that their full effect has not been felt by the economy so there’s probably some significant additional tightening in the pipeline."

— Nick Timiraos (@NickTimiraos) July 27, 2022

Powell: "While another unusually large increase [of 75 bps] could be appropriate at our next meeting, that is a decision that will depend on the data we get between now and then."

— Nick Timiraos (@NickTimiraos) July 27, 2022

You heard it here first: the lows of the year are in. The bear market is not over. That was simply chapter 1. We’re a long way from home. This is a tactical call for the next few months.

While the technicians continue to see downtrends and consolidations, the market is now headed higher for the intermediate term. By the time the technicians have their price “confirmation”, the rally will be mostly over and it will be time to start taking profits.

Why? Because the Fed Pivot that I have been waiting on for months is finally here. Jerome Powell suggested yesterday in his press conference that after a series of large rate hikes (50, 75, 75), the Fed is close to slowing its pace and taking stock (see the quotes in the Timiraos tweets above).

The WSJ’s Justin Lahart has his finger on the pulse in his column this morning “How The Fed Could Lose Its Nerve” [SUBSCRIPTION REQUIRED]. Lahart points out that the CPI is likely to cool in the coming months as gas prices have fallen significantly, retailers are offering discounts, supply chain pressures are easing and commodity prices have plummeted. More importantly, the economy is showing signs of weakening. Demand for consumer durables is slipping and the housing market is rolling over. While the job market remains strong, that could change by the time fall rolls around. Lahart concludes thus:

That portends an environment where at least some Fed officials might become more wary of tightening. It is one thing to raise rates when people are cursing at the gas pump and seeing for-hire sings everywhere. It is another when that is no longer the case.

As I’ve said all along, it’s been easy to raise rates aggressively thus far but the “critical junctures” i.e. hard decisions remain ahead. For the now, it actually does make sense for the Fed to pause and take stock and that will give stocks the backdrop to move higher in the coming months. If inflation continues to prove sticky into 2023, the “critical junctures” will be upon us and we’ll find out what the Fed is made of.

More By This Author:

Google, Microsoft: MediocreThe Case For Gold Now II

Oh SNAP!