The Fed Will Raise 75 Basis Points Wednesday, “Critical Junctures” Coming

(Click on image to enlarge)

A 0.75 percentage point Fed rate rise is more likely this week after a series of alarming inflation reports https://t.co/F0LO6y0aJz

— Nick Timiraos (@NickTimiraos) June 13, 2022

The Fed changed its mind – and told The Wall Street Journal’s Fed reporter Nick Timiraos. They were going to raise 50 basis points but after considering last Friday’s hot CPI number they’ve decided to raise 75. They told Timiraos – who said they were going to raise 50 in an article in Monday’s paper – who then wrote an article yesterday afternoon that will be in today’s paper saying they are “considering” 75. Bullshit. They told him they’re raising 75 and everybody knows it. That’s how it works.

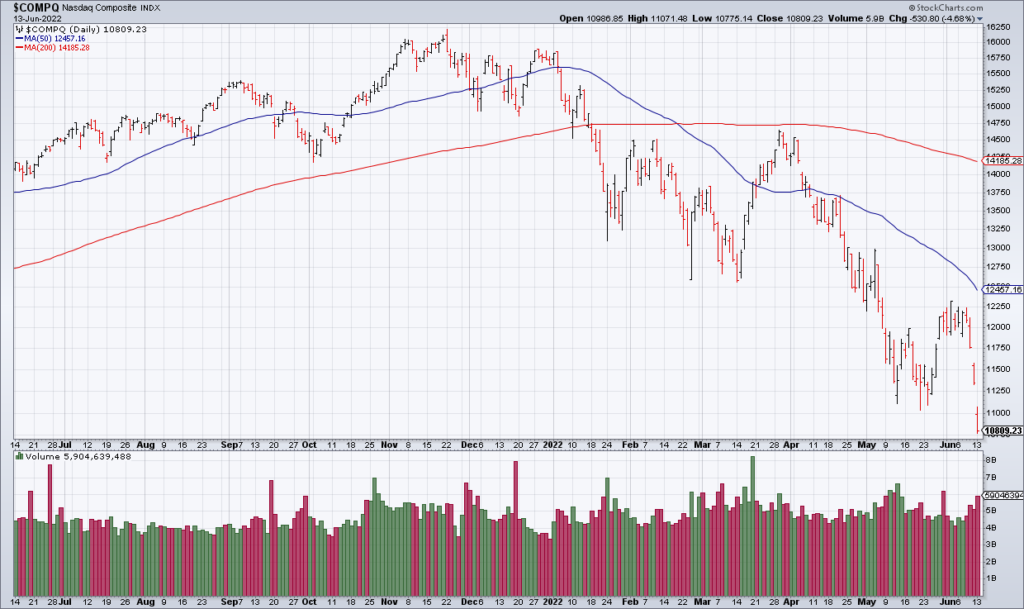

So that’s a done deal. The question is: How will the market react? The Nasdaq is down more than 10% in the last three sessions in anticipation and in the wake of the hot CPI report. As I write (3 am PST), Nasdaq Futures are up almost 1%. Is it priced in then? I don’t know but it very well may be.

However, a second 75-point hike in July is NOT priced in. The key data point will be the June CPI report on Wednesday, July 13. If it too comes in hot, the Fed will be faced with the choice between crushing inflation at the cost of a stock market crash and guaranteed hard landing with another 75-point hike or trying to “manage” things with a 50-point hike at its July 27th meeting.

Or the June CPI report could come in okay making a 50 basis point hike consensus and pushing the “critical junctures” into the future. The point is The “critical junctures” i.e. hard decisions for Powell and the Fed are coming and the choices they make will have long-term ramifications for the American – and global – economy.