The Economic Recovery Is Slowing Before Our Very Eyes

The evidence is mounting that the long-awaited recovery is still not in sight. Consumers continue to be reluctant to spend on personal services, while consumption of goods has been more than satisfied and now is tapering off. The business sector continues to struggle and is barely adding to its capital stock, despite the persistence in supply bottlenecks for many commodities and investment goods.

No region has been spared this slowdown. The Delta wave is turning out to be a major setback for the global economy, hitting countries that earlier had Covid under firmer control. Long considered as an engine of growth, China has downshifted into a much lower gear; rate of expansion is much lower than any time pre-pandemic. The Delta virus hit China in late summer, forcing the authorities to re-introduce lockdown measures. Still plagued with the recent surge in the Delta virus, retail sales in August rose just 2.5% y/y, down sharply from July’s 8.5% y/y growth rate. The Chinese slowdown will have repercussions globally, affecting the goods and commodity sectors already stretched thin by persistent supply bottlenecks. With consumption at home dropping fast, China’s GDP will likely fall well short of targets set earlier.

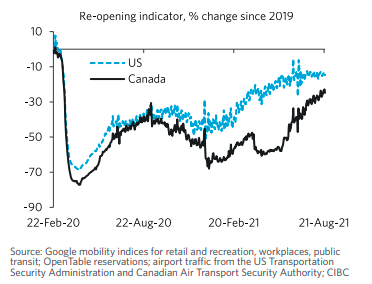

The Delta wave of infection has now worked its way into the re-opening efforts, putting a serious damper on growth prospects in North America. Figure 1 uses a variety of measures to indicate how re-opening is progressing. The US opened earlier but clearly has stalled in the latter part of the summer. It is most likely that Canada’s re-opening will slow in a similar way, after a late start, as the same fears regarding the Delta virus affect consumer attitudes to in-store retail, returning to work, and participating in recreational activities. Canada’s GDP actually contracted in the latest quarter, even in the midst of a re-opening, and early data indications are that the third quarter will likely disappoint those anticipating a rebound.

Figure 1

Source: CIBC, Economics

The forecast from the Atlantic Fed incorporates data from the labor statistics, supply management indices, and a wide assortment of personal consumption expenditures. It is summarized in the accompanying chart (Figure 2). While there is a wide range of estimates among private economists, the unofficial Atlantic Fed estimates have been unmistakeably downgraded. Supporting the downward revisions is the estimate for ‘real final sales’ which measures total output less changes in inventories---- the best measure of economic activity. The key point is that the GDPNow forecast is not the plunge in the GDP per se, rather that final sales has dropped precipitously. Without a build-up in inventories, GDP forecasts would be considerably worse.

Figure 2

Meanwhile, government spending has been the mainstay of economic activity. Transfer payments will need to continue to help fill the gap, as the private sector is unable to restore the economy to its pre-pandemic conditions.

It is a reflection on some priorities that the fixation on increasing wealth is so much more importnt to these people than the plague going around.

The fixation on getting more, more, more, with nothing else mattering one bit comes across as rather vulgar.

I REALIZE THAT THIS WHOLE SITE IS ABOUT BUSINESS, but really, the world will not end just because one's wealth does not increase a lot every day.