The Danger Of Fed Credibility Under Assault

Image Source: Pixabay

If credibility is degraded, then tariff-induced cost-push shocks are less likely to manifest as one-off price level increases and more likely to spur a bout of inflation.

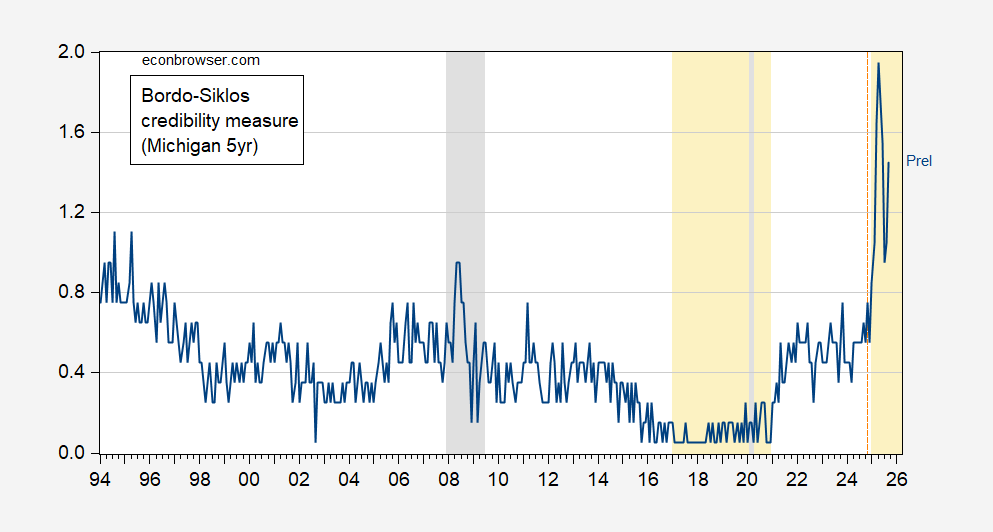

Figure 1: Bordo-Siklos measure of Fed inflation credibility (blue). Calculation assumes CPI target consistent with PCE target is 2.45%. September observation is preliminary. Light orange shading denotes Trump administrations. Orange dashed line at “Liberation Day”. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, author’s calculations.

From Bloomberg:

“To the extent that the Fed’s decision this week is seen as a capitulation to political pressure, a new layer of risk is being added to US financial markets and the dollar,” [ David Kelly, chief global strategist at JPMorgan Asset Management] said.

See also Griffin-Kashyap in WSJ.

Appellate court decision on Cook v. Trump

More By This Author:

The Thanks Of A Grateful (Coffee-Drinking) Nation

CBO, CEA-OMB-Treasury, And SPF GDP Forecasts

Food At Home CPI – Accelerating Growth