“The Crown” Stock Market (And Sentiment Results)

Crown Castle (CCI)

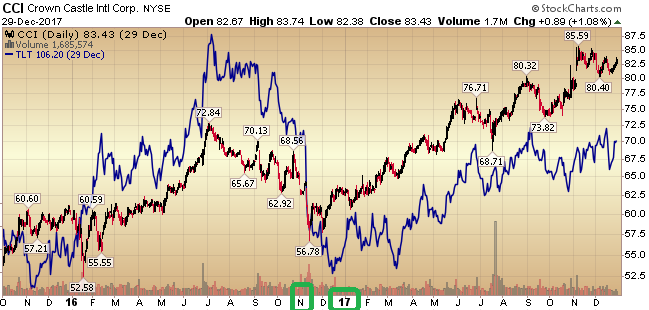

The number one thing you need to know about Crown Castle is that like all other REITs, it trades with interest rates. When the 10yr yield goes down, ALL REITs benefit (including CCI). In the chart below you can find CCI in black/red overlaid with TLT (20yr Treasury ETF in BLUE) and IYR (REIT Index ETF in PURPLE).As bonds have fallen (yields went up), REITs have fallen as they are plays on yields. Right now the dividend yield on CCI is 6.9%.

We have made the case for bonds getting “bid” (yields going down) in 2025. Hedge Funds and Large Traders (red line at bottom of chart) have not been positioned this short 10-year Treasuries since September 2018 – which preceded a major rally in bonds.Commercials (the true “smart money” – green line at bottom of chart) are near record long. Commercials are always early and mostly right:

(Click on image to enlarge)

We can debate the reasons why bonds will get bid from positive to negative: Fiscal Responsibility (DOGE), Fight to Safety, Geopolitical uncertainty, Less Issuance due to higher tax receipts. They are just guesses. Positioning tells me a lot more than predicting the “best” catalyst.

Someone (of course – with no skin in the game) reached out to me saying, “CCI is down because they are only getting $8B for the fiber business.”This is utter nonsense.Disposing the money losing fiber business will leave behind a cash-flowing machine that requires little maintenance – with lower capex spend moving forward.They should pay someone to take it off their hands!CCI is down because EVERY REIT is down.EVERY REIT is down because bonds are temporarily down.End of story.Here’s the daily CCI with TLT overlay – effectively the same chart.Nothing to do with “fiber” disposition:

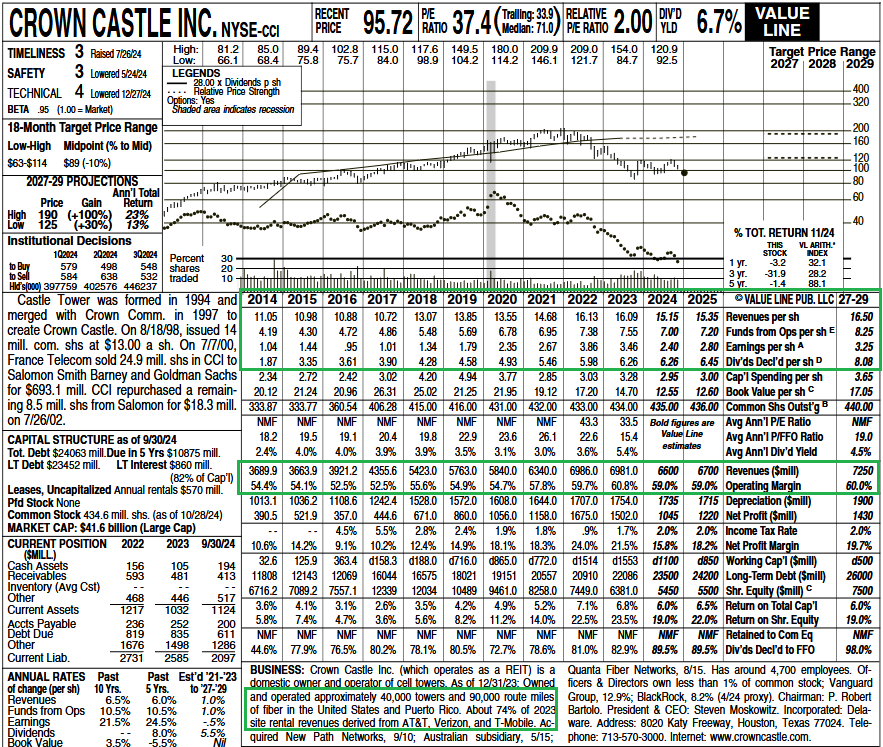

In case we haven’t mentioned it enough in the last few weeks, THE SAME THING HAPPENED AFTER PRESIDENT TRUMP WAS ELECTED IN NOV 2016 (Bonds and REITs/CCI sold off).After the INAUGURATION in January 2017, they all rallied.Sell the rumor, BUY THE NEWS!

Here’s the 2016 to 2017 calendar flip with CCI and Bonds (TLT in Blue) before and after the inauguration:

Sold after election, bought after inauguration.

(Click on image to enlarge)

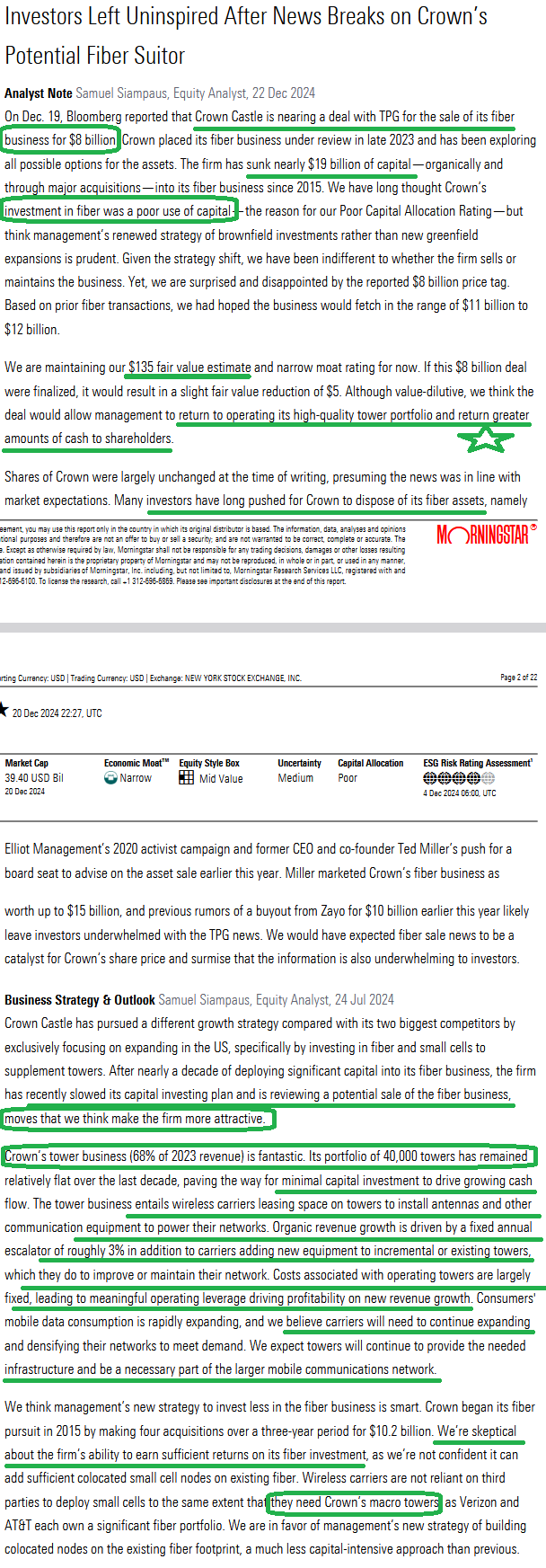

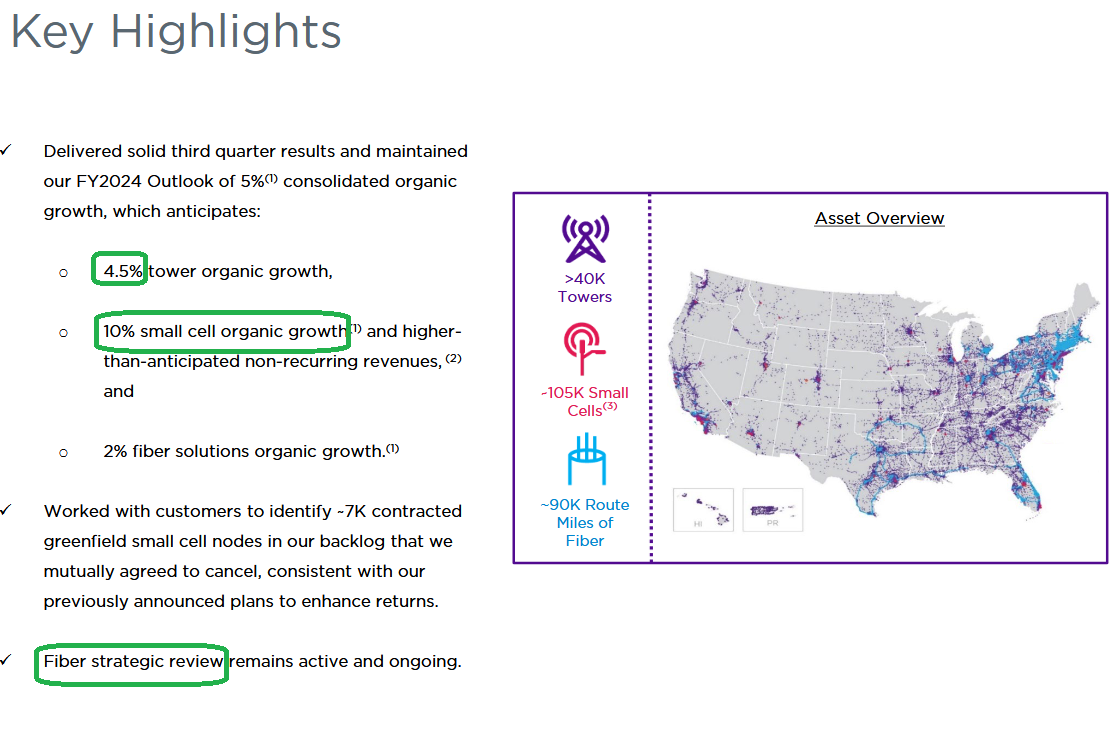

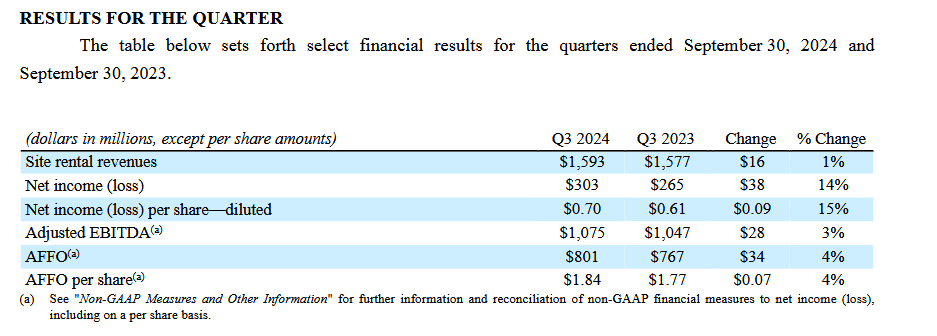

Crown Castle International’s Q3 2024 earnings call transcript highlighted numerous accomplishments and initiatives. Here are the top 10 points:

- Consolidated organic revenue growth of 5.2% in Q3, driven by strong performance across all segments.

- Tower segment growth of 4.3%, demonstrating continued strength in the company’s core business.

- Impressive 25% growth in the small cells segment, indicating strong demand for this technology.

- Maintained full-year outlook for adjusted EBITDA and AFFO, showing confidence in financial performance.

- U.S. wireless data usage surpassed 100 trillion megabytes in 2023, supporting Crown Castle’s optimistic view on future growth.

- Expected consolidated organic revenue growth of approximately 5% for 2024, including 4.5% in towers and 10% in small cells.

- Plans to add 11,000 to 13,000 new small cell nodes in 2024, indicating continued expansion.

- Strong financial position, with the company raising $1.25 billion in long-term debt and reducing leverage to 5.5 times net debt to EBITDA.

- Strategic cancellation of 7,000 low-yielding nodes, expected to save approximately $800 million in future capital expenditures.

- Ongoing digitization of the tower portfolio to enhance marketable space visibility and improve customer service efficiency.

(Click on image to enlarge)

General Market

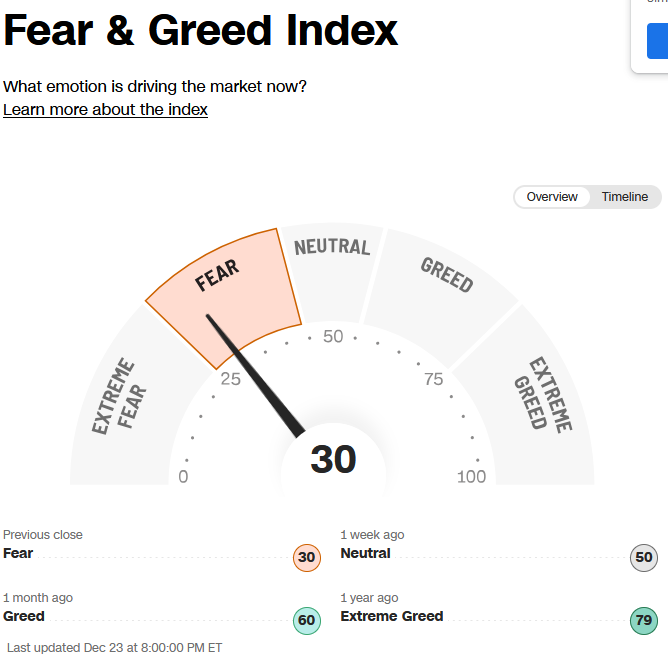

The CNN “Fear and Greed” declined from 34 last week to 30 this week.You can learn how this indicator is calculated and how it works here: (Video Explanation)

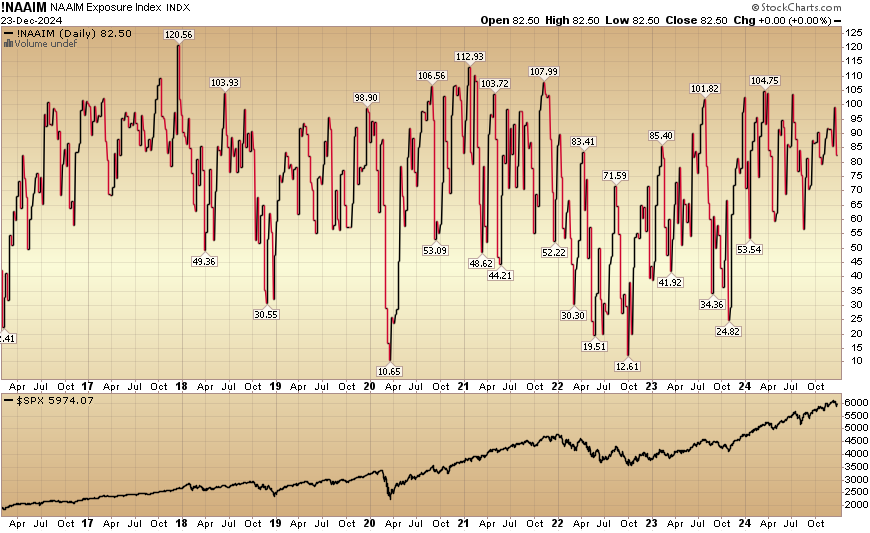

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) declined to 82.50% this week from 85.49% equity exposure last week.

(Click on image to enlarge)

More By This Author:

“Healthcare Left For Dead” Stock Market (And Sentiment Results)

“Top 2025 Picks” Stock Market (and Sentiment Results)…

“To EV Or Not To EV?” Stock Market (And Sentiment Results)

Long all mentioned tickers

Disclaimer: Not investment advice. For educational purposes only: Learn more at more