The Bitcoin Crash Of 2021 Compared To Past Sell-Offs

(Click on image to enlarge)

Bitcoin’s Latest Crash: Not the First, Not the Last

While bitcoin has been one of the world’s best-performing assets over the past 10 years, the cryptocurrency has had its fair share of volatility and price corrections.

Using data from CoinMarketCap, this graphic looks at bitcoin’s historical price corrections from all-time highs.

With bitcoin already down ~15% from its latest all-time high, Elon Musk’s tweet announcing Tesla would stop accepting bitcoin for purchases helped send the cryptocurrency down more than 50% from its all-time high, dipping into the $30,000 price area.

“Tesla has suspended vehicle purchases using Bitcoin. We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

– @ELONMUSK

Crypto Cycle Top or Bull Run Pullback?

It’s far too early to draw any conclusions from bitcoin’s latest drop despite 30-40% pullbacks being common pit stops across bitcoin’s various bull runs.

While this drop fell a bit more from high to low than the usual bull run pullback, bitcoin’s price has since recovered and is hovering around $39,000, about a 40% drop from the top.

Whether or not this is the beginning of a new downtrend or the ultimate dip-buying opportunity, there has been a clear change in sentiment (and price) after Elon Musk tweeted about bitcoin’s sustainability concerns.

The Decoupling: Blockchain, not Bitcoin

Bitcoin and its energy-intensive consensus protocol “proof-of-work” has come under scrutiny for the 129 terawatt-hours it consumes annually for its network functions.

Some other cryptocurrencies already use less energy-intensive consensus protocols, like Cardano’s proof-of-stake, Solana’s proof-of-history, or Nyzo’s proof-of-diversity. With the second-largest cryptocurrency, Ethereum, also preparing to shift away from proof-of-work to proof-of-stake, this latest bitcoin drop could mark a potential decoupling in the cryptocurrency market.

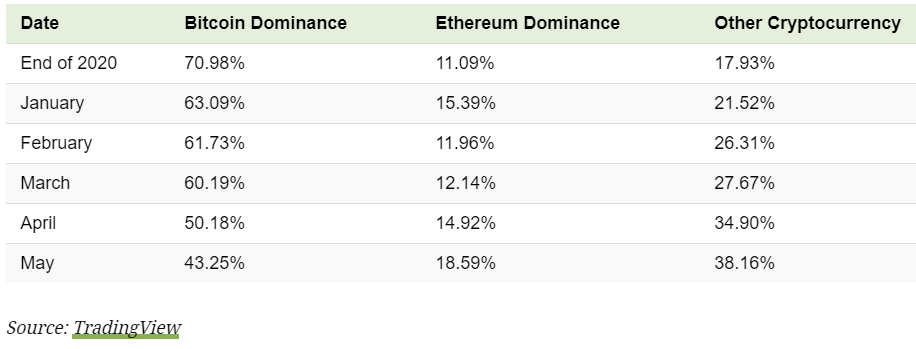

In just the past two months, bitcoin’s dominance in the crypto ecosystem has fallen from over 70% to 43%.

(Click on image to enlarge)

While the decoupling narrative has grown alongside Ethereum’s popularity as it powers NFTs and decentralized finance applications, it’s worth noting that the last time bitcoin suffered such a steep drop in dominance was the crypto market’s last cycle top in early 2018.

For now, the entire crypto market has pulled back, with the total cryptocurrency space’s market cap going from a high of $2.56T to today’s $1.76T (a 30% decline).

While the panic selling seems to have finished, the next few weeks will define whether this was just another dip to buy or the beginning of a steeper decline.

Disclosure: None.

There are ALWAYS going to be drops after the run-ups, because that is the way it works. As the price rises people buy to get in on the profit from the rising prices. The concept being to sell at the peak and make the most profit. But since that peak is unknown, some of the more cautious will sell first. Of course the selling lowers the price, which in turn provokes more folks to sell, which lowers the price, prompting more folks to sell. and on some occasions this constitutes a crash.