The Affordability Of New Homes In March 2023

New homes became less affordable in March 2023.

The two driving factors for that change was an increase in mortgage rates during the month and an increase in the median price of new homes sold. The average 30-year conventional mortgage rate rose above 6.5% during March 2023, after recently ticking down to 6.3% a month earlier. Meanwhile, the median sale price for a new home increased to an initial estimate of $449,800, up from $435,900 a year earlier.

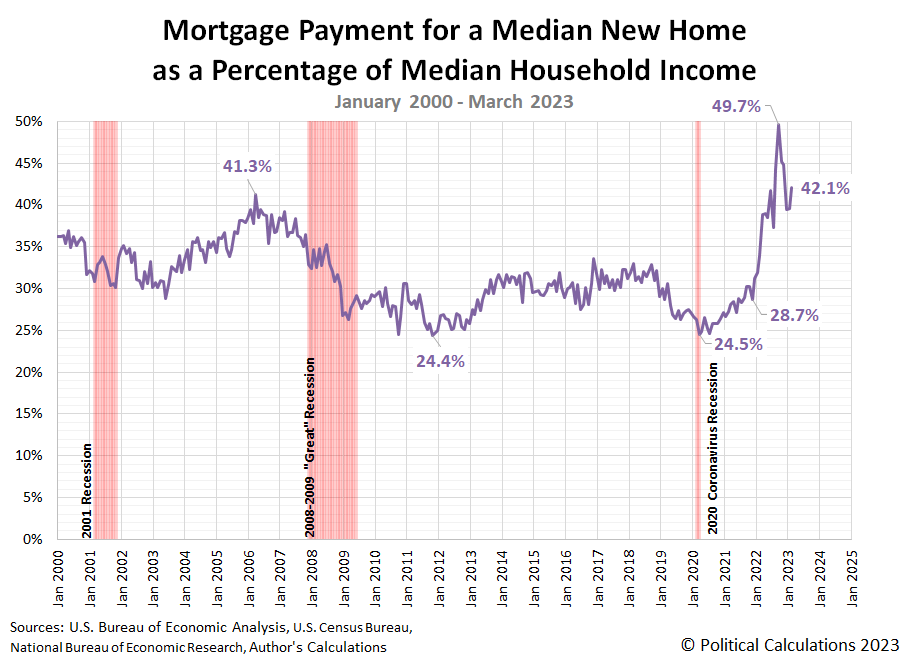

The key to affordability however is to also factor in the income earned by the median U.S. household. Here, we find the principal and interest portion of the mortgage payment for a median new home sold in the U.S. during March, assuming it was fully financed (no down payment), would consume over 42% of the income earned by the typical household.

That's an increase over the revised figure of 39.6% in February 2023, confirming new homes became less affordable. The following chart shows the basic mortgage payment for the median new home sold in the U.S. as a percentage of median household income. The chart shows that after dipping to a revised 39.3% in January 2023, the mortgage payment for a median new home sold in February consumed an initial estimate of 40.1% of median household income.

The month over month change puts the level of unaffordability of new homes in the U.S. fully back above the peak recorded during the housing bubble years in the first decade of the 21st century. It's not as bad as the peak level of unaffordability of 49.7% recorded for October 2022, but there's no question the basic cost of owning a typical new home is out of reach for the typical household in the U.S.

That raises a good question. Where does the threshold of unaffordability begin?

As a general rule, lenders become reluctant to issue mortgages when their basic payments consume more than 28% of gross household income, but that depends on how much other debt a household may have. Lenders will generally avoid offering any financing beyond a level that would increase a household's total debt above 36% of its pre-tax income.

By that reckoning, a home would be considered fully affordable if its mortgage payment consumes less than 28% of household income. In between 28% and 36% is a gray zone, where the answer depends on how much other debt a household has. Any mortgage that consumes more than 36% of a household's income falls completely within unaffordable territory.

The median new home sold in the U.S. has fully qualified as unaffordable for the typical American household in each month since March 2022.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 March 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 25 April 2023.

Freddie Mac. 30-Year Fixed Rate Mortgages Since 1971. [Online Database]. Accessed 25 April 2023. Note: Starting from December 2022, the estimated monthly mortgage rate is taken as the average of weekly 30-year conventional mortgage rates recorded during the month.

More By This Author:

Dividends By The Numbers In April 2023Median Household Income In March 2023

U.S. Recession Probability Reaches 67%

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more