Why Apple Should Buy Sony

Apple (NASDAQ: AAPL) is often linked with large take-over possibilities. However, the company has always maintained a policy of frequent purchases of only small companies with niche strengths to add to Apple’s existing ones.

Sony (NASDAQ: SNE) is involved in both hardware and software areas which Apple aims to penetrate further in the next few years. A purchase of Sony would give tremendous momentum to the company’s strategic direction. This especially applies to Asia where Apple’s latest offerings may have limited appeal. A tie-up with Sony would give Apple the acceleration in service revenues it needs to transition away from its reliance on iPhone revenue.

Apple’s huge cash reserves and raised stock price compares to Sony’s stock decline in the past couple of months. This makes the deal very affordable at present.

——————

THE FINANCES

At the close of 2018, Apple had US$245 billion in cash. Its net cash position was US$130 billion.

Sony’s market cap is US$52.7 billion. Its enterprise value is US$48 billion. In general stocks with an enterprise value lower than their market cap are an attractive proposition on a purely numbers game.

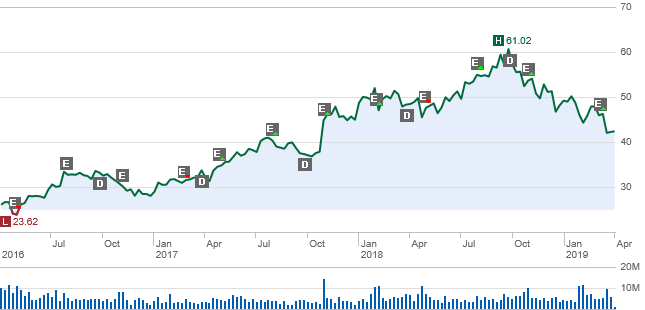

The 3-year stock chart of Sony is illustrated below:

The growth in the stock price shows what a good business model the company possesses.

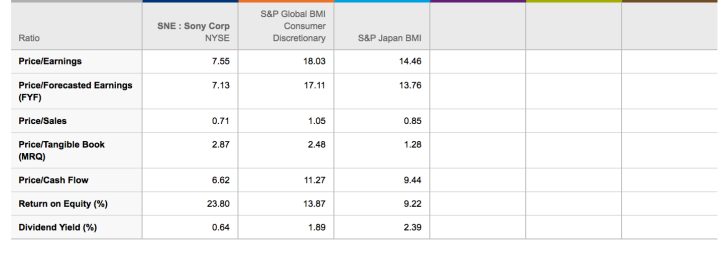

The valuation of Sony is very favorable at present as illustrated below:

Such a good opportunity to buy Sony at a reasonable price might not come again. It is likely that the Sony stock price will soon continue its upwards path. It has just been given a strong Buy rating by Jefferies ahead of its results announcement on 26th April.

It was recently announced that Apple’s M&A head Adrian Perica would now be reporting direct to Tim Cook. Perhaps that signals an increased interest by Cook in M&A developments. The largest purchases the company has made so far were Beats Electronics for US$3 billion in 2014 and Shazam in December 2017 for US$400 million. The company has focused on buying small companies, often those involved in semiconductors. This has been successful in producing very smart processors to improve the performance of its hardware devices. In future, the emphasis for the company may be away from hardware and more on software.

Apple could make a pure cash offer or a cash/stock offer without stretching itself at all. The cash in hand they have will otherwise most likely be spent on a combination of stock buybacks and dividends. Whilst having some short-term attraction for stockholders,t his is not a strategy for using cash for long-term growth. Early last year Apple announced it had US$100 billion of funds to use for buybacks. Up to the end of Q3 2018, they had spent US$63 billion on share buybacks and were showing a loss of US$9 billion on these, according to the Wall Street Journal. That loss/gain picture might look better now.

It is expected that the company will raise their dividend again this year. The total cost of the raise is unlikely to be very substantial. Because of the share buybacks, they will have fewer shares outstanding on which to pay the increased dividend. The last quarterly results, in fact, showed an increase in cash reserves.

SONY PICTURES

There has been speculation recently that Apple might swoop to buy the Sony Pictures division. This seems quite unlikely. The presumably well-connected “Variety” magazine had predicted in December that this would happen sometime in 2019. Rumors were heightened when Wedbush recently suggested Apple should buy either Sony Pictures or another production house. They mentioned A24 (with whom Apple already has a production agreement) or Lionsgate (NYSE:LGF-A) as possible alternatives to Sony Pictures.

Speculation over Sony divesting some of its assets has been heightened. This follows the news that the Third Point hedge fund, controlled by Daniel Loeb, has taken a new possibly quite substantial position in Sony stock. Third Point previously owned 7% of Sony. They made a gain but in fact, sold out before the big rise in Sony’s stock price in recent years.

There have been further rumors that Amazon (NASDAQ: AMZN) is also interested in Sony Pictures.

A sale of Sony Pictures is unlikely for a variety of reasons. Sony has tremendous synergies around its Digital Entertainment Hub strategy. Its Pictures division is an integral part of its offerings on its PlayStation division and gaming in general.

Last year Apple poached 6 senior executives from Sony Pictures and Sony TV. This was presumably with the Apple TV Plus service announced recently in mind.

Of course, the Sony Pictures library of movies and upcoming products would be the ultimate kick-start for Apple’s new movie streaming business. The streaming market worldwide is highly competitive as cutting the cord becomes widespread.

Apple’s streaming offerings look unappetizing at first glance to the fast-growing Asian youth market. To get Sony Pictures content, I think Apple would need to buy the whole of Sony.

GAMING

The other bug strategic new direction for Apple in their March 25th announcement concerned gaming.”Arcade” is intended to be a whole new subscription gaming experience. Full details are awaited but one can assume it will take time for Apple to build up a meaningful offering of attractive games.

In some ways, Apple has little option but to go this route. The rate of growth of gaming revenue from the App Store has declined. Cloud gaming will become a threat to revenue unless Apple takes this pre-emptive step.

The company is reported to be investing US$500 million in the initial launch of about 100 games. There are however plenty of other companies launching first party or third party gaming subscription services. It is hard to see Apple having an edge in games people want to play.

In contrast, Sony has the world’s largest installed base of gaming console users. It has shipped over 92 million PS4’s worldwide. It has over 50% of the world games console market. It has its own in-house developed games. There were recently rumors that Sony would try to buy Take-Two Interactive (NASDAQ: TTWO). These have been denied by Sony. Such a move seems unlikely. This is not least because the rising stock price of Take-Two Interactive over the past couple of years would make it an expensive purchase.

Sony has its own mobile gaming offering on the Cloud called PS Now. In the 3rd quarter of 2018, this produced US$143 million of revenue. This made it the biggest mobile gaming offering on the market. This could grow even more strongly if linked with the new iPads whose performance makes them ideal for gaming use.

Sony is the market leader based on the strength of its PS4 user base and its mobile streaming service. Google (NASDAQ: GOOGL) will soon be launching its “Stadia” mobile gaming offering. Unlike a combined Sony and Apple offering, this will not be available in Asia in the first instance. Strong competition is coming from elsewhere. Nvidia (NASDAQ: NVDA) recently announced its “GoForce Now” to be available soon. Microsoft (NYSE: MSFT) will have its “Xbox Game Pass” in due course.

The PS Network online music and games service has over 80 million monthly users. Its VR (virtual reality) strength would give Apple an immediate entry into VR, an area where it is not going to be a player otherwise.

Sony has a similar strategic advantage form its PS4 user base as Apple has from its iPhone base. It has recently been clarified that Sony’s next console, the PS5, should be released in mid-2020. This will also cater retroactively to PS4 games.

Sony would give Apple an immensely strong gaming presence overnight. Doing it alone, it will not be easy for Apple to build up a suite of games that gamers are keen to subscribe to.

As with the Pictures division, there would be particular advantages in Asia. The continent contains the world’s largest gaming market, in China. That country already provides one-third of App Store gaming revenues. Apple is though only scratching at the surface of the total market.

A Sony/Apple offering in the mobile gaming sphere would instantly provide a hugely competitive strong offering in what is set to become a crowded field.

MOBILE PHONES

In this arena there is some mutual benefit. Sony makes its high quality range of “Xperia” smartphones. It has though been unable to make a meaningful dent in the upmarket sector dominated by Apple and Samsung (OTC: SSNLF). Its phone unit loses money but it is a core element in the company’s Digital Entertainment Hub and mobile offering.

Apple is currently probably the largest customer of Sony’s very successful image sensor product line. One constraining factor on smartphone growth for Apple is their access to parts such as sensors, screens, and glass. Sony would meet a critical element of this uncertainty. Apple has moved to making some of the components themselves but image sensors require a huge amount of capital and expertise. Apple is also believed to be contracting with Japan Display, in which Sony has a stake, for the supply of OLED screens for the Apple Watch.

Sony is the dominant world leader in image sensors. It is estimated to have about 50% of the world market for image sensors in smartphones.

The company is working on augmented reality chips, something Apple is reputedly also working on. Their image sensors will have future applications in areas such as drones and robots in which the company is investing substantial sums. Image sensors represent a hardware advantage to add to the mainly software advantages of a tie-up.

MUSIC

Apple Music has been very successful for the company. Its penetration in Asia has however been limited. This is because it is solely a paid subscription model. Apple does not break down its subscriber base on a geographical basis. However worldwide they have about 56 million paying subscribers. Compare this to the 655 million monthly active users enjoyed by the music division of Tencent (OTCPK: TCEHY) in China. Tencent’s main competitor NetEase (NASDAQ: NTES) also has very substantial numbers of subscribers. They both dwarf whatever number of subscribers Apple may have in Asia.

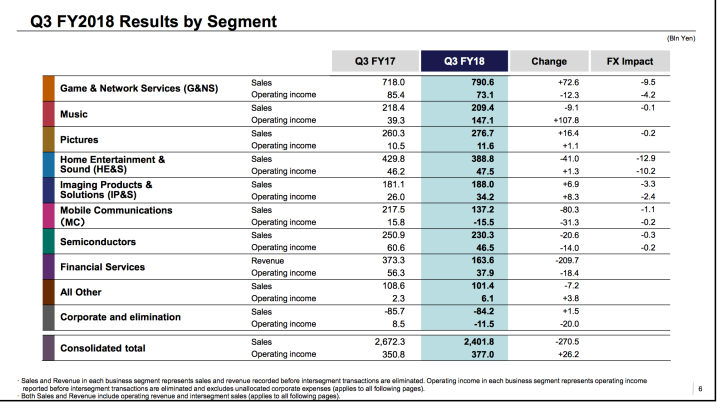

Ever since the days of the Walkman, Sony has been a big player in the music sphere. In its latest Q3 results, Sony’s Music division made a profit of US$1.3 billion. This made it the company’s most profitable division.

Sony is the world’s largest music publisher. Last year they acquired a further stake in EMI, giving them 90% of the company. They have some licensing connections with Tencent Music for China. Turnover in the Music division has increased 109% in the past 3 years. Streaming revenues for music, in general, are forecast to grow strongly in the next few years. They have a profitable strategic stake in Spotify (NASDAQ: SPOT).

Apple’s purchase of Shazam would indicate the company has further ambitions to expand in the music space. A link-up with Sony would have obvious attractions. In particular, it would provide opportunities to expand further in the booming Chinese market. Streaming sales there have tripled in the past 3 years. A combined Apple/Sony music division would represent a giant world player and provide particular added strength to Apple in Asia.

ENTERTAINMENT STREAMING

Apple TV Plus was a major element in the 25th March initiative. The company is thought to be investing US$1 billion in the first instance. As with gaming, it is uncertain whether the company will gain much traction in the short term. One doubts whether the youth market in China will rush to subscribe to new content from ageing American icons such as Oprah Winfrey and Steven Spielberg.

The competition is fierce. It has just been made more so by the launch of the new service from Disney (NYSE: DIS). One can compare Disney’s vast catalogue of titles with what Apple could produce in the short term. The Disney + service will be priced at US$7 per month. Interestingly Disney CEO Bob Iger is of course on Apple’s board. Disney expects two-thirds of their service to be targeted to overseas audiences. Apple would need to link with Sony to approach this sort of coverage.

Original content could be made available to Apple from Sony Pictures production. Sony has strong franchise rights which include “Spiderman”,” Jumanji” and “Men in Black”.There are upcoming movies for all three of these franchises. Apart from revenue from box office receipts, these can be used for streaming across a range of formats. The Digital Entertainment Hub of a combined Sony & Apple would indeed by formidable.

Since 2015 Sony has had its PSVue streaming service. This has had limited success. Its cost proposal has not been that attractive compared to offerings from Netflix (NASDAQ: NFLX) and from what is available on YouTube and others. Roku (NASDAQ: ROKU) is the streaming market leader in the USA.

A tie-up would be of mutual benefit although it is not clear how exactly the different businesses could be consolidated. The benefit could again particularly be in Asia. It is hard to see the Apple TV Plus offering have much impact in Asia without such a tie-up.

OTHER PRODUCTS

Some parts of Sony would naturally not fit in with Apple’s objectives. These could be sold off to help pay for the deal as a whole.

The divisions Apple would not want to keep would probably be Home Entertainment, Financial Services and “All Other”.These comprise 34% of revenue. That would make the net cost to Apple even less if they were sold off.

* Cameras: Sony is a world leader in high-end cameras. Such high-quality hardware fits in with Apple’s image, but it is doubtful Apple would want to become a branded camera retailer.

* TV’s: again Sony ia a world leader in this area. There could be synergies with the Apple TV product which has stalled somewhat. The new Apple TV Plus service is already slated to be embedded in Sony TV’s. Again, it is doubtful Apple would want to become a branded TV retailer.

* New Product initiatives: these include robotics and drones. These could fit in with Apple’s DNA. Sony’s “Startup Acceleration Division” is also working on AI for autonomous driving. This could be integral to any autonomous driving product Apple eventually produces. The auto side of Apple’s future plans are though somewhat shrouded in mystery.

* Sony has successful offerings in their smart wireless speakers and Bluetooth minimalist wireless headphones. These are both currently selling in competition with products from Apple. Consolidation of products may or may not be feasible on technical grounds.

* Financial Services: this is somewhat of an outlier in the Sony business model anyway. It would no doubt be floated off in any deal. It represented 14% of company revenue in the latest quarter.

* Medical devices: Sony is developing CMOS image sensors specifically for medical imaging. This could provide integration with Apple’s push towards health products being lead by the Apple Watch. Health is likely to be a substantial growth area for Apple in the medium term.

NEGATIVES FOR THE MOVE

* Apple has always been averse to large-scale take-overs.

* There would undoubtedly be real cultural differences between the “modus operandi” of the two companies.

* There would be areas of product overlap as well as synergies.

* There might be a short-term hit to the Apple stock price. It could be share dilutive if Apple were to offer a stock and cash combination.

* It would require a huge amount of management time and resources to integrate the two businesses.

CONCLUSION

In strategic product areas, Apple and Sony are an excellent fit. The synergies are clear in both hardware and software.

In geographical terms, the two are a good fit. Although diversified geographically, Sony is essentially an Asian company with great strengths in Asia. Last year their revenue breakdown was as follows:

Japan 30.8%

USA 21.5%

Europe 21.6%

China 7.9%

Rest of Asia Pacific 12%

Other Areas 6.2%

That makes 50.7% of Sony’s revenues coming from Asia. This compares to the 32% Apple achieved in its last quarter.

Asia is a target market for Apple because of its huge population and constant economic growth.

Both on the count of strategic product areas and geographic areas, the synergies between Apple and Sony would be enormous. Apple needs to accelerate its transition from iPhone revenues to services. A link-up with Sony would give them the acceleration they need in services to maintain confidence in the stock price.

This was good, would like to see more by you.

Hi there thanks yours.I don't usually write here but I write regularly on Seeking Alpha.

The Q4 results show again what an attractive company Sony island the stock price just got higher for an Apple purchase of the company (which I am fairly sure won't happen!)

Hi Kurt,

Well it's true that Sony is quite large and also a bit of a national icon for Japan.But as I think my article pointed out,it's not very high in value compared to Apple's cash reserves.

Yes, I agree on that point. I did not mean it was too big as in expensive. But too big as in complex. Different products, different philosophy, different culture. It would not be easy. Not saying it's impossible though.

Hi Barry,

Yes I agree some of the products would have compatibility issues, but I do not believe they are insuperable

Fascinating idea with a lot of obvious synergies. But isn't the fact that their products are completely incompatible cause a number of problems that would be too difficult to overcome? $AAPL $SNE

I for one love the idea. #Sony could benefit from #Apple's innovation.

I'd argue that Sony is the innovator. Apple doesn't invest anything. They simply improve on other company's products. I would say that Sony has the superior products but could benefit from Apple's ability to make things easier to use.

Good thorough analysis and very intriguing idea. But realistically, Sony is likely too large to be acquired by Apple easily.