DoubleVerify Could Falter When The IPO Lockup Expires

When the 180 lockup period for DoubleVerify Holdings, Inc. (DV) ends on October 18th, the company's pre-IPO shareholders and insiders will be able to sell more than 142 million currently restricted shares for the first time. This number dwarfs the 13 million shares currently trading pursuant to the IPO. Any large sales could flood the secondary market and cause a sudden, short-term downturn in the share price of DoubleVerify.

Aggressive, risk-tolerant investors should consider shorting shares of DV ahead of the IPO lockup expiration.

Business Overview: Digital Platform That Helps Organizations Track and Analyze Digital Marketing

DoubleVerify operates a software platform that measures and analyzes digital marketing efforts. Its primary products include quality tracking, predictive digital ad performance, programmatic ad enhancement, and supply-side solutions.

The advertising industry has expanded beyond many conventional media to include a wide spectrum of digital platforms and channels. Tracking and measuring the performance across the spectrum of social channels, publishers, and digital platforms has been challenging, which makes it more difficult for marketing departments to determine where to spend their budgets. In addition, the digital marketplace can allow ad fraud and objectionable content to spread unchecked. Many organizations rely on third-party solutions like DoubleVerify to protect their brand names while optimizing the performance of their digital marketing campaigns.

The DoubleVerify platform provides data analytics that allow marketing professionals to improve the performance of their advertising efforts. The platform uses its proprietary technology, DV Authentic Ad, which tracks whether the digital ad is displayed in an appropriate digital environment and in the correct geographical locations. The platform does this in real-time, and the data analytics are measured across the entire digital marketing ecosystem, which includes social media channels, programmatic platforms, and digital publishers.

DoubleVerify analyzes approximately 200 billion transactions per day as well as over 5 billion digital ad transactions per day. Their client base is currently over 1,000 customers including large global organizations. The industries that DoubleVerify serves include healthcare, automotive, technology, telecommunications, financial services, and consumer goods. The company has 23 offices across 15 countries including Japan, Germany, France, Brazil, Australia, Singapore, Israel, the United Kingdom, and the United States. The average client has been with DoubleVerify for at least 6 years and the company has a client retention rate of between 95% and 100%.

DoubleVerify is headquartered in New York City and has approximately 650 employees.

Financial Highlights

DoubleVerify reported second-quarter financial highlights for the period ending June 30, 2021:

- Revenue was $76.5 million, representing an increase of 44%.

- Advertiser Direct revenue totaled $31.7 million for an increase of 34%.

- Media Transactions Measured for Social grew by 100%. MTM for CTV grew by 89%.

- APAC revenue grew 73%.

- EMEA revenue grew 62%.

- Advertiser Programmatic revenue totaled $37.9 million, representing an increase of 57%.

- Supply-Side revenue grew 35% to $7 million.

- Net loss totaled $12.6 million.

- Adjusted EBITDA totaled $21.2 million.

Management

CEO Mark Zagorski has served in his position since July 2020. He has previously held executive positions at Telaria, eXelate, the Nielsen Company, MediaSpan, WorldNow, and Modem Media. He earned an MBA from the University of Rochester and a BS in Finance from Gannon University, from which he was awarded an Honorary Doctorate of Humane Letters.

CFO Nicola Allais has served in his position since November 2017. His previous experience comes from executive financial positions at Penton, Downtown, Primedia, Ernst & Young, and Home Box Office. He earned an MBA from the Columbia Business School and a BA from Princeton.

Biographical information is sourced from the company's S-1/A.

Competition: Tremor International, Quantcast, Webtrends, and More

The digital ad analytics sector has many competitors including Tremor International, Quantcast, Webtrends, Sizmek, Comscore, Integral Ad Science, White Ops, Meetrics, MOAT, OpenSlate, Alenty, and Adometry.

Early Market Performance

The underwriters priced the IPO at $27 per share. The stock closed on its first day of trading at $35.77. Although the price dipped initially reaching a low of $27.33 on May 19, it reached a high of $47.06 on June 29. DV currently has a return from IPO of more than 17%.

Conclusion: Short Shares Ahead of October 18th Lockup Expiration

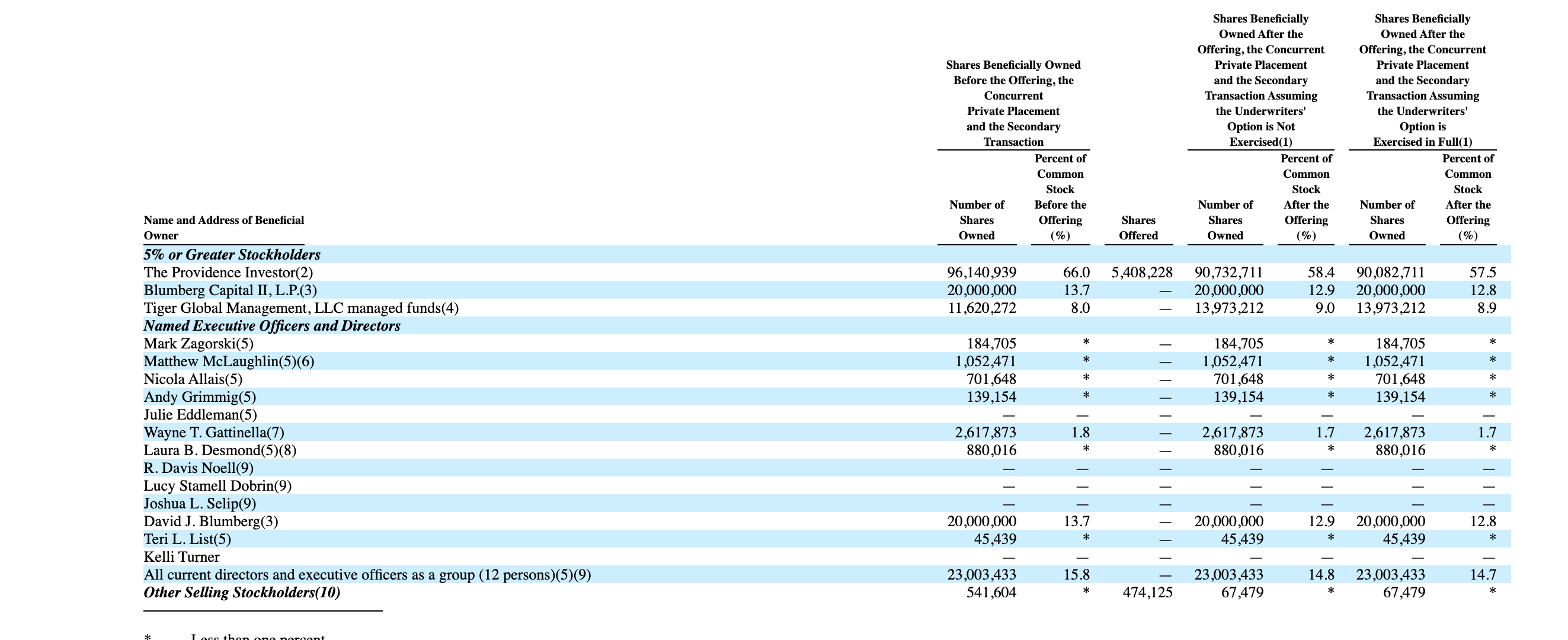

When the DV lockup expires on October 18th, a slate of company insiders and pre-IPO shareholders will finally be able to take some money off the table and sell their currently restricted shares.

(Click on image to enlarge)

We believe that these pre-IPO shareholders and company insiders will be especially eager to cash in considering the stock has a return from IPO of more than 17%. Any significant sales could flood the market with shares and cause a short-term downturn. We recommend that investors short shares ahead of the lockup expiration and cover positions during the October 19 and 20 trading sessions.

Disclosure: I/we have a beneficial short position in the shares of DV either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, and it expresses my ...

more