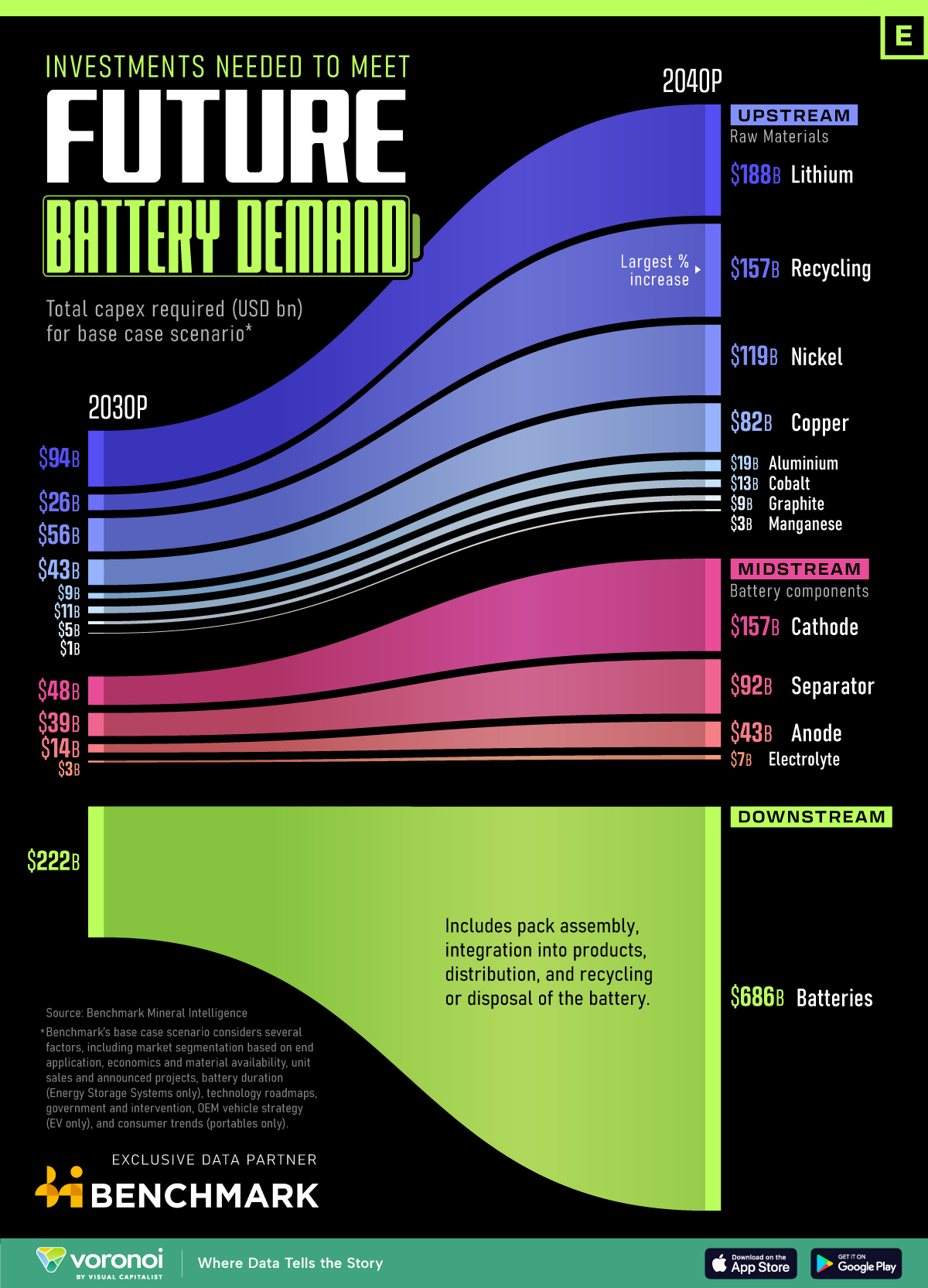

Charted: Investment Needed To Meet Battery Demand By 2040

(Click on image to enlarge)

Visualizing the Top Sectors for Battery Investment

With the growth of battery-powered devices, from smartphones to electric vehicles and energy storage systems, investment in the battery sector is expected to surpass $1.6 trillion by 2040.

This graphic shows the latest forecasts from Benchmark Mineral Intelligence to show the total capital expenditure (capex) requirements to build capacity to meet future battery demand by 2030 and 2040. Forecasts are current as of July 2024.

Raw Materials and Battery Components

Battery demand is projected to increase ninefold by 2040. As a result, the battery industry’s total capex is expected to nearly triple, rising from $567 billion in 2030 to $1.6 trillion in 2040.

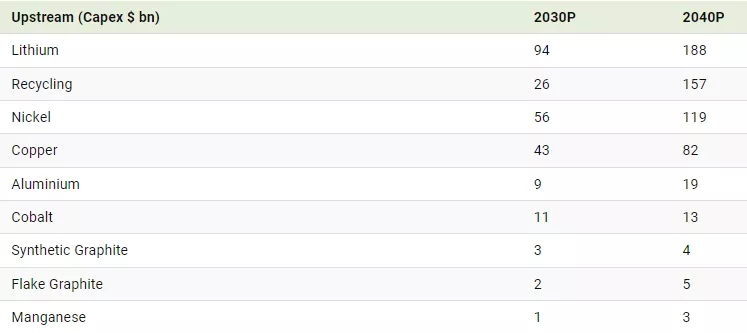

Upstream, companies will focus mainly on lithium, nickel, copper, and recycling at the extraction stage.

Demand for recycled materials will increase 26 times by 2040, representing the largest percentage growth in our graphic, with total capex rising from $26 billion to $157 billion.

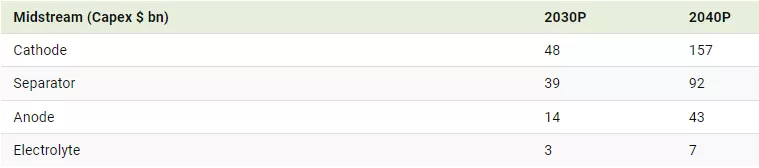

Midstream, companies will direct most of their funds towards the cathode (the positive electrode during battery discharge), with investment increasing from $48 billion in 2030 to $157 billion in 2040.

Biggest Growth Expected Downstream

Although most of the discussion about clean technologies revolves around raw materials (mines needed to supply the demand) and new battery technologies, in the future, the downstream stage of the battery industry is expected to receive most of the investment.

This stage includes pack assembly, integration into products, distribution, and recycling or disposal of the battery.

Downstream, the total capex is expected to reach $222 billion in 2030 and increase to $686 billion by the year 2040.

More By This Author:

Charted: Growth In U.S. Real Wages, By Income Group (1979-2023)

Mapped: How Europe’s Population Has Changed

Mapped: The World’s Largest Stock Markets (1900 Vs. 2023)

Disclosure: None