TalkMarkets Tuesday Talk: FAIT Awaits

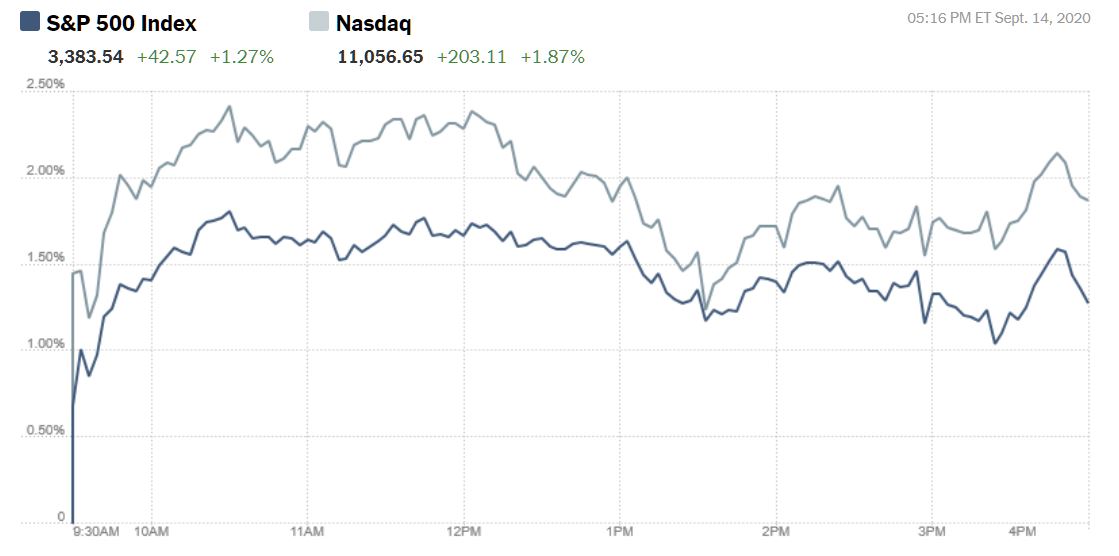

Good morning and a good Tuesday to you. Markets are green at the open though futures had been fluctuating flat to up overnight, so maybe a sideways day as the markets await the FOMC meeting tomorrow. Monday proved to be a good start to the week with the Dow up 1.18%, the S&P 500 1.27% and the Nasdaq 1.87%.

Chart: The New York Times

Asian Markets closed mixed today with the Nikkei down about .50% and both the Shanghai Composite and Hang Seng up by about a similar amount. European markets are trending upwards today. As I write the Dow is up at 28,155, the S&P 500 at 3,412 and the Nasdaq Composite is at 11,175. Go green.

Flexible Average Inflation Targeting (How's that for a mouthful?), is the Fed's new tool for managing inflation and was first unveiled by Fed chairman Jerome Powell at last month's virtual Jackson Hole Symposium. As the Fed Chair noted then, the change in policy is to allow for inflation to crest above the bank's target inflation rate of 2% but still remain at an average of 2% over time. Since the Fed announced it's 2% inflation rate target in 2012, inflation has only reached that level once in 2018 and has otherwise averaged 1.6%.

TalkMarkets contributor Mircea Vasiu of Vantage Point Trading, writing in FAIT – The Focus On Tomorrow’s Fed Meeting makes the following observations ahead of tomorrow's Federal Open Market Committee (FOMC) meeting:

- "The Fed has a hard time explaining to markets why higher inflation is good for an economy. The market expects more details tomorrow about FAIT and what exactly the Fed’s plan is moving forward."

- "Many market participants already believe that the Fed is cornered, trapped in continuous accommodation. If that is the case, higher inflation is unlikely to materialize anytime soon unless it becomes self-fulfilling."

- " If the population and the market participants believe the Fed is able to create inflation, the Fed will have an easy time reaching its new mandate. So far, stocks are up, Bitcoin is up, gold is up, silver is up, dollar is down. Judging by this metric, inflation is coming."

- "Any hint by the Fed tomorrow that it eases the monetary policy further will send the USD much lower."

Well none of these observations have any calming effect on me. As far as anticipated actions go, the street consensus is that the Fed will announce a rate cut of 25 bps at tomorrow's meeting.

James Picerno in his article Treasury Market Yawns At Fed’s New Inflation Policy, says that while one might have expected an upward trend in US Treasuries since Jackson Hole, quite the opposite has been the case, " There are few signs that US Treasuries are reacting to last month’s roll out of the Fed’s average inflation targeting policy. Since Powell outlined the policy change on Aug. 27 the benchmark 10-year Treasury (SPTL) yield has traded in a tight range, slipping slightly to 0.68% on Monday (Sep. 14), based on daily data. In other words, the sharp drop triggered by the coronavirus in the spring continues to hold and the Fed’s efforts to persuade the crowd that a new regime’s in town have so far fallen on deaf ears."

Furthermore notes Picerno, "The implied estimates for the 5- and 10-year maturities after rebounding in recent months, have stalled above the 1.5% mark – roughly in line with the pre-pandemic forecasts. The market, in other words, seems to be saying that while the sharply lower forecasts triggered by the initial coronavirus shock in March are too extreme, the low-flation trend that prevailed previously still applies." See his chart for these securities below:

The fact that unemployment still remains high is a strong sign that low inflation or disinflation will continue. Though Picerno does ask, "What could change this trend? Dramatic increases in government spending in response to the economic fallout from the coronavirus is a possibility. By some accounts, it’s just a matter of time before the huge upward shift in fiscal stimulus brings higher inflation and higher interest rates." A good read to prep for Wednesday.

Alex Barrow in a TalkMarkets "Editor's Choice" piece, Why Inflation Isn’t Coming makes some excellent points about inflation or the lack thereof and has some great charts (from Citigroup (C)) that illustrate just that. Here are a few of them:

a) " the futility of average inflation targeting"- Central Bankers Forecasts vs Actual

b) "credit growth will spur inflation" -

c) "Instead of credit driving real growth or inflation, it inflates asset prices." - This creates an increasingly financialized world where deflationary pressures are actually growing instead of diminishing.

Plenty to take in here, and there is more in the rest of Barrow's article.

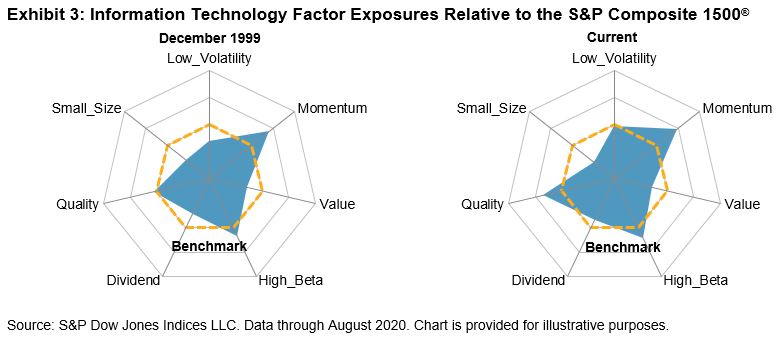

Anu Ganti in Not Your Father's Tech Sector compares the current rise in technology stocks to the late 1990's technology bubble and subsequent burst in 2000. Anu writes, "One notable resemblance to the late 1990s is Information Technology’s weight in the S&P 500. Information Technology makes up 28.7% of the S&P 500 today, and its weight hasn’t been this high since August 2000, when IT was 33.6% of the index."

But the author says similarities end there and provides background information as to why the current rally in tech stocks is better grounded than in the 1990's and argues that such stocks are more profitable and less volatile than 20 or so years ago. Included is this chart which does a good bit of explaining. Ganti want us to note in particular that "one of the main differences between now and then is that IT currently has much stronger tilts toward quality and low volatility than it did in 1999."

The author concludes that "No one can know in advance what the future relative returns of the IT sector will be and whether its outperformance will continue, but history tells us that the Tech sector of today is not your father’s Tech sector."

I'll close out today's column with a nod to overseas equities. Todd Campbell in Best & Worst ADRs - Monday, Sept. 14, says currently "The top-rated sectors are services, industrial goods and healthcare, and the best countries are Switzerland, Canada, and Belgium. Consumer goods, technology, basic materials, and financials score average. Utilities scores below average."

Here's the table:

.jpg)

Detailed rankings by country and best and worst performing equities are also, included.

That's a TalkMarkets wrap for today. Have a good week.

Evidently I define inflation a bit differently. I see inflation as the price of the things that I NEED TO BUY, such as food and power, rising much faster than the actual value. That is different than rising prices on durable assets. That inflation constitutes a direct attack on my savings and wealth. That is the inflation that the fed is constantly pushing so as to benefit those who are not me, at the expense of those who are in a similar position to mine. That includes most folks who are not actively in the stock market or banking business. I was still in high school when this reality became clear to me, and so it is not like the fed has just come up with something new.

Discovering that a given course of action does not work should not take 60 years, unless one is attempting to train Banyon trees. Thus the only possible conclusion is that the fed has never had the benefit to the majority of the population as any part of it's goals.