Sustainability Investments Exceed All Expectations

![]()

In 2022, climate-related private market investment significantly exceeded the overall market in terms of deal activity, cash deployed, and capital flows into specialized funds.

Unprecedented government initiatives in the United States and Europe that will unleash a flood of cash to meet the task of achieving net-zero emission obligations by 2050 are giving climate technology an additional boost. While the EU Green Deal could potentially commit more than €1 trillion in public and private cash to the fight, the US Inflation Reduction Act (IRA), passed last year, allocates more than $370 billion in funding for climate change mitigation. Together, these steps could provide investors with more chances in a market that McKinsey predicts will reach $9 trillion to $12 trillion in 2030.

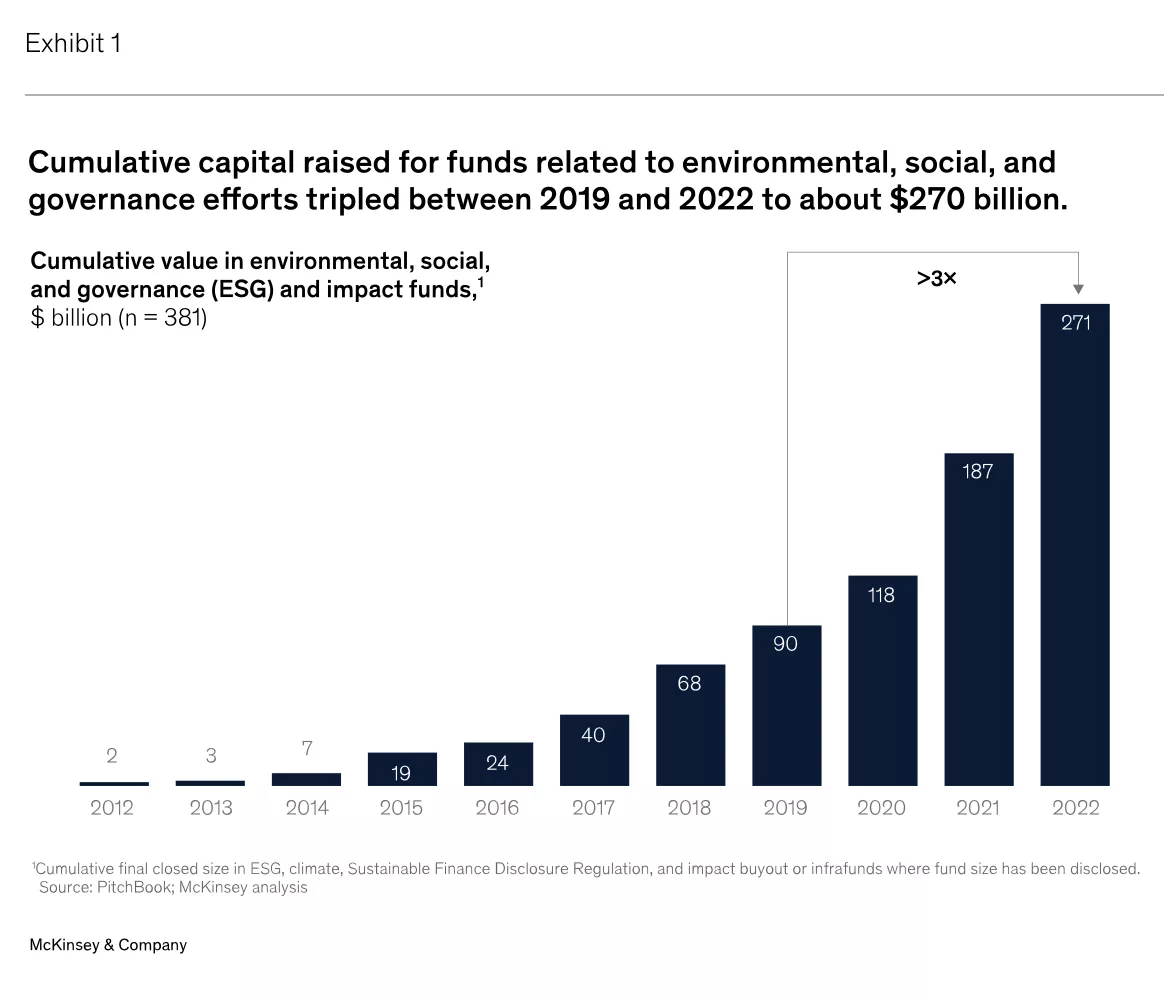

Over the past four years, capital formation in the climate investing sector has witnessed a breakthrough growth phase. Private-market equity investors introduced more than 330 new sustainability, environmental, social, and governance (ESG), and impact funds between 2019 and the end of 2022. From $90 billion to more than $270 billion, these funds' total assets under administration increased by three times (Exhibit 1). Additionally, the large sum of money allocated for climate possibilities in business capital budgets, public equity investment vehicles, and credit funds is not included in those calculations.

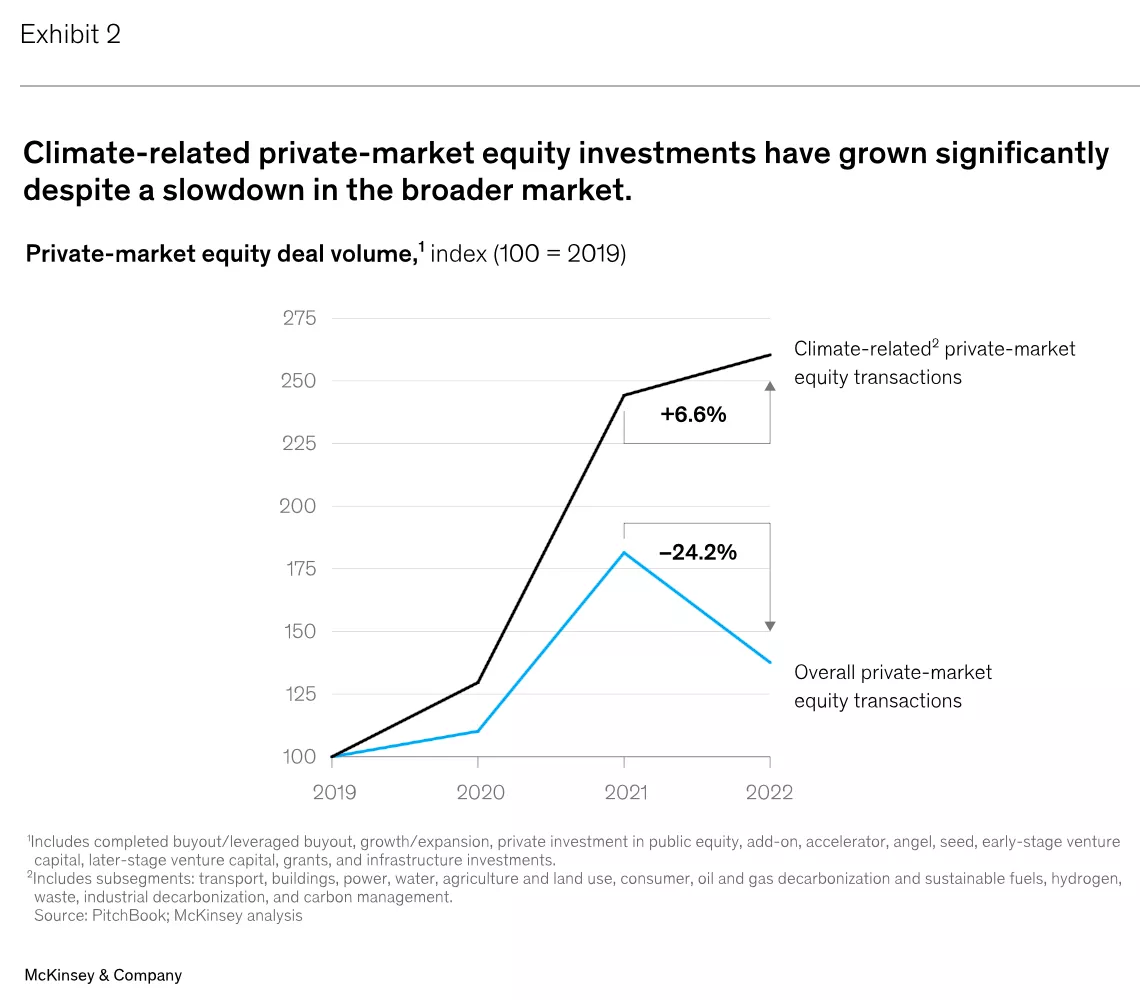

Capital with a focus on climate change has been utilized quickly. According to PitchBook, a database of private-market deals, the global volume of climate-oriented equity transactions in private markets—equity investments, from pre-seed to buyout, in energy transition technologies and other climate solutions—increased more than 2.5 times, from approximately $75 billion in 2019 to approximately $196 billion in 2022 (Exhibit 2).3 This amounts to an average annual growth of around 40%. Investment increased by about 90% from the prior year in 2021, reaching $183 billion. The level of investments increased by over 7% between 2021 and 2022. This sort of achievement stands in stark contrast to the total volume of private-market equity deals, which fell by about 24% from levels reached in 2021.

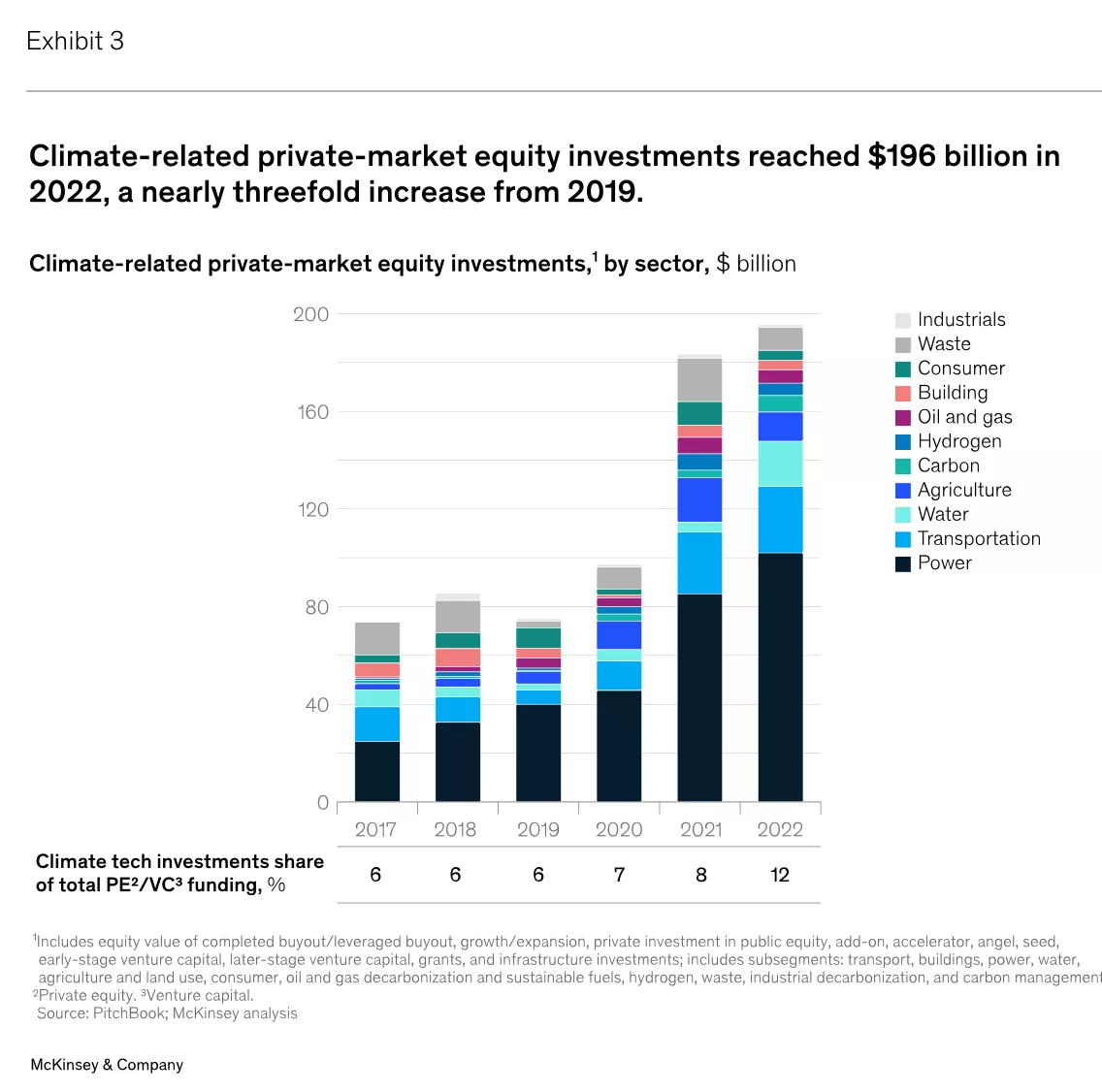

Private equity investments with a focus on climate change have been made in a variety of subsectors (Exhibit 3). The largest beneficiary was power, which received almost 50% of the deployed capital between 2019 and 2022 as an investment more than quadrupled, from $40 billion to $100 billion, thanks to the sustained growth of large-scale renewables. The adoption of electric vehicles (EVs) raised investment in the transportation sector by 370 percent, from $6 billion to $30 billion, over that time. In 2022, investments in the total amount of climate-focused private-market equity were just 3 percent each for hydrogen and carbon management, two significant developing industries. But they also had the biggest increase in investment inflows since 2019: 460 percent (from less than $1 billion to $5 billion) and 1,400 percent for hydrogen.

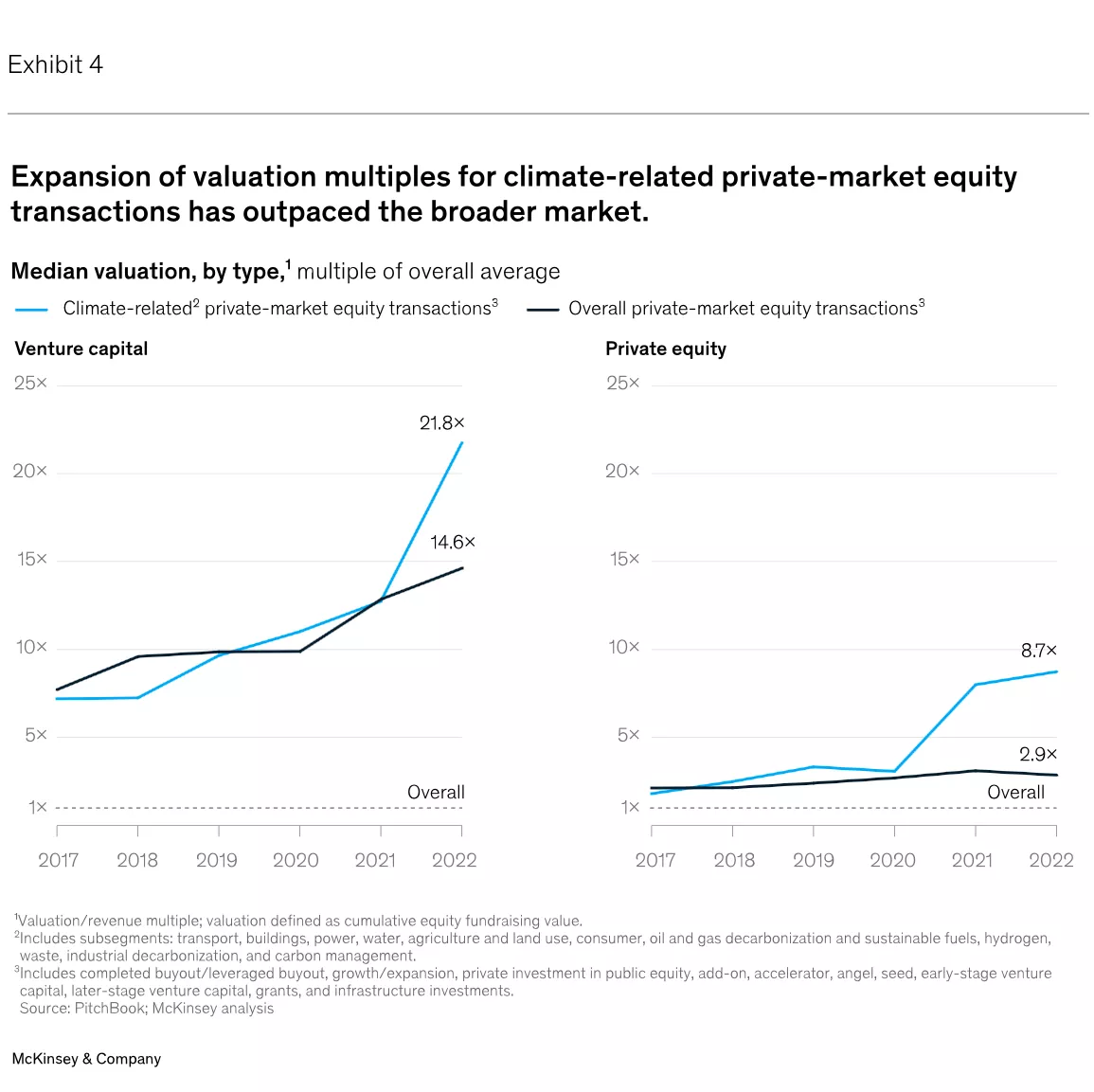

The valuations have risen quickly as a result of this capital infusion (Exhibit 4). For private equity acquisitions, the median valuation-to-revenue multiple grew from about three in 2019 to about nine in 2022, while for venture capital deals, it increased from about ten to about 22. Corporate capital competition for climate-focused assets has increased valuation pressure. Some energy companies are using their sizable cash reserves to buy growth assets in the field of climate solutions.

More By This Author:

Capitalization, Style - Wave-Trend Summary, Week Ending April 21

The Three Companies That Are Driving Performance For An Interest Rate Cut

Volatility Is Bottoming

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF.