Worst Start To A Presidency Ever For U.S. Stocks

Image Source: Unsplash

Trump 2.0 Wealth Destruction

Today is the 63rd trading day since Inauguration Day back on 1/20, and the S&P 500 is now down 14.5% since President Trump was sworn in for his second term. The 14.5% drop for the S&P is by far the biggest decline the index has seen three months into a Presidential term since 1928.The next closest was a 9% drop for the S&P in the first three months of FDR's third term back in 1941.

We're truly dealing with equity market destruction of epic proportions since the President re-took office.

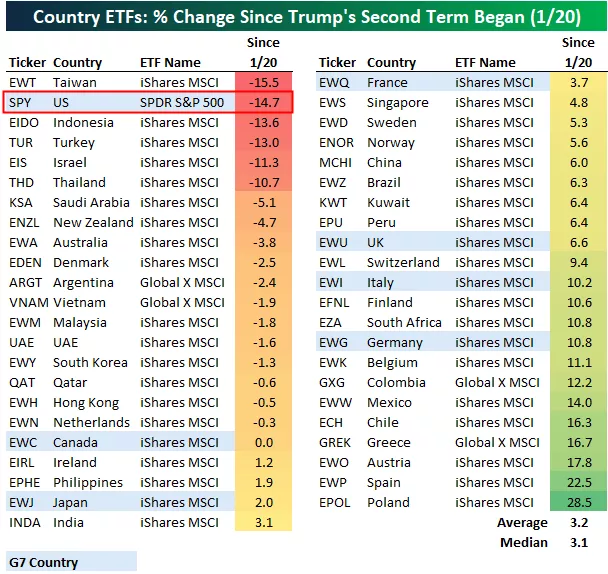

And what makes the decline in the US stock market even worse during Trump 2.0 is that it's nearly alone in the red. Equity markets around the world have generally held up well. Below we show the performance of 45 country ETFs traded on US exchanges since Trump's second term began.The US (SPY) ranks 2nd to last behind only Taiwan (EWT).The average country ETF is actually up 3.2%, so the US (SPY) is underperforming the average country by nearly 18 percentage points!

Germany (EWG) has been the best performing G7 country ETF since Trump re-took office with a gain of 10.8%.That means Germany has outperformed the US by more than 25 percentage points in the three months since Trump 2.0 began!As of this afternoon, the US (SPY) is the only G7 country ETF in the red since Inauguration Day.

More By This Author:

Picking Up Where Last Week Left OffNY Fed Shows Weak Demand And Flying Prices

Easter Seasonality

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more