“World’s Smallest Violin” Stock Market (And Sentiment Results)

Boeing

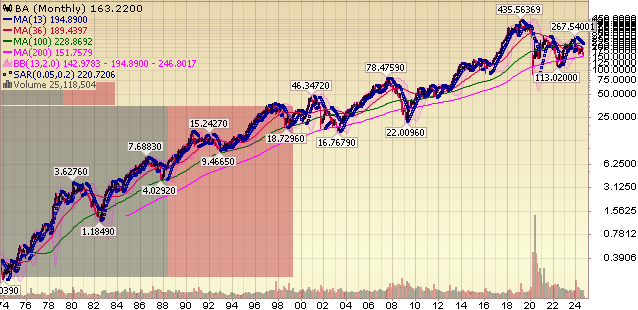

(Click on image to enlarge)

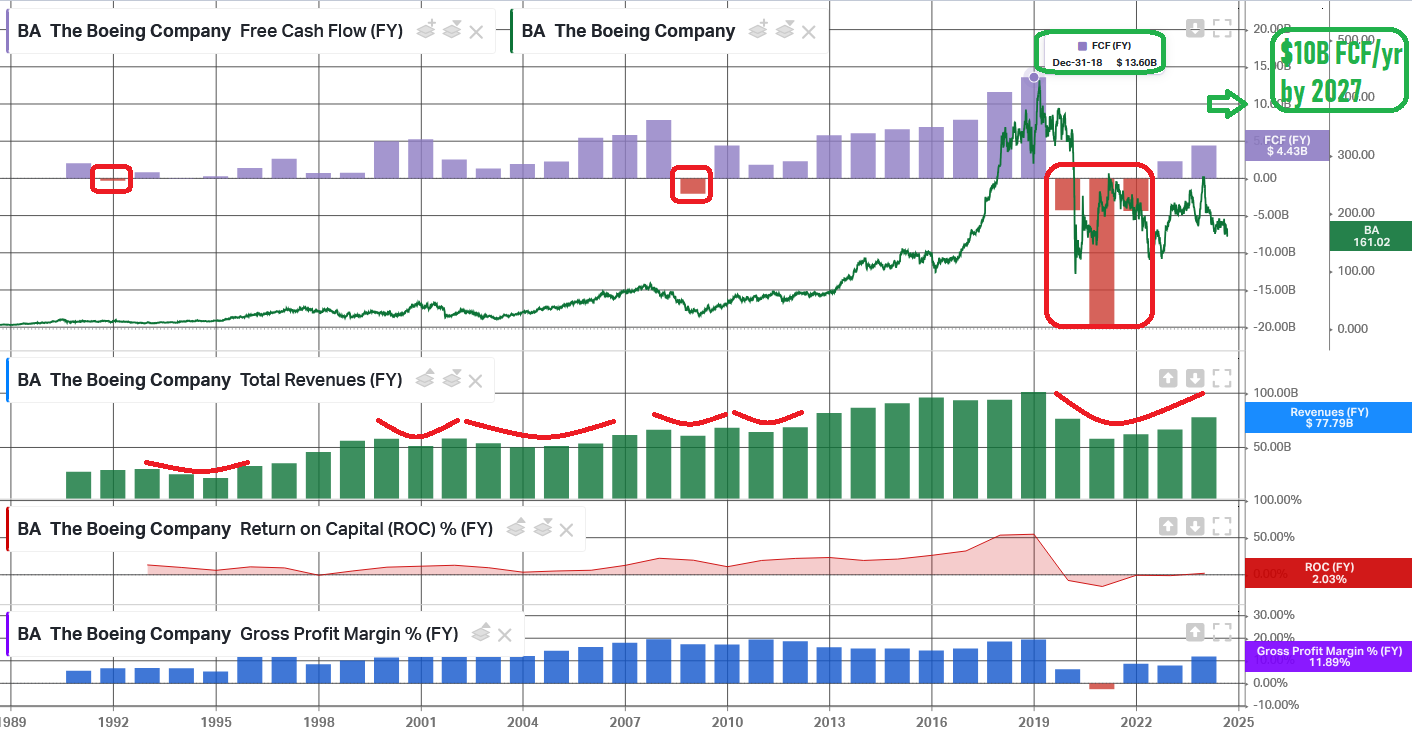

(Click on image to enlarge)

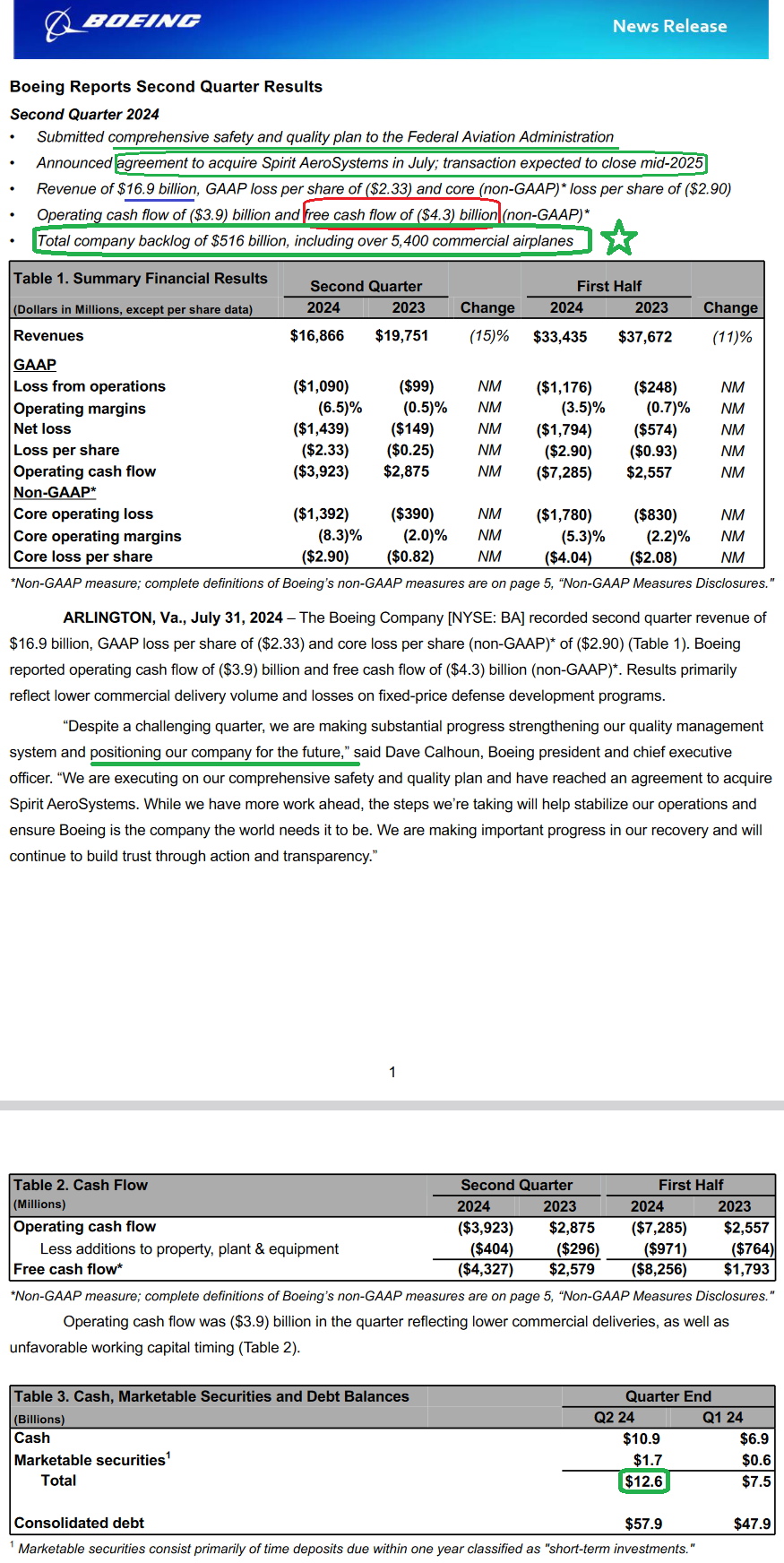

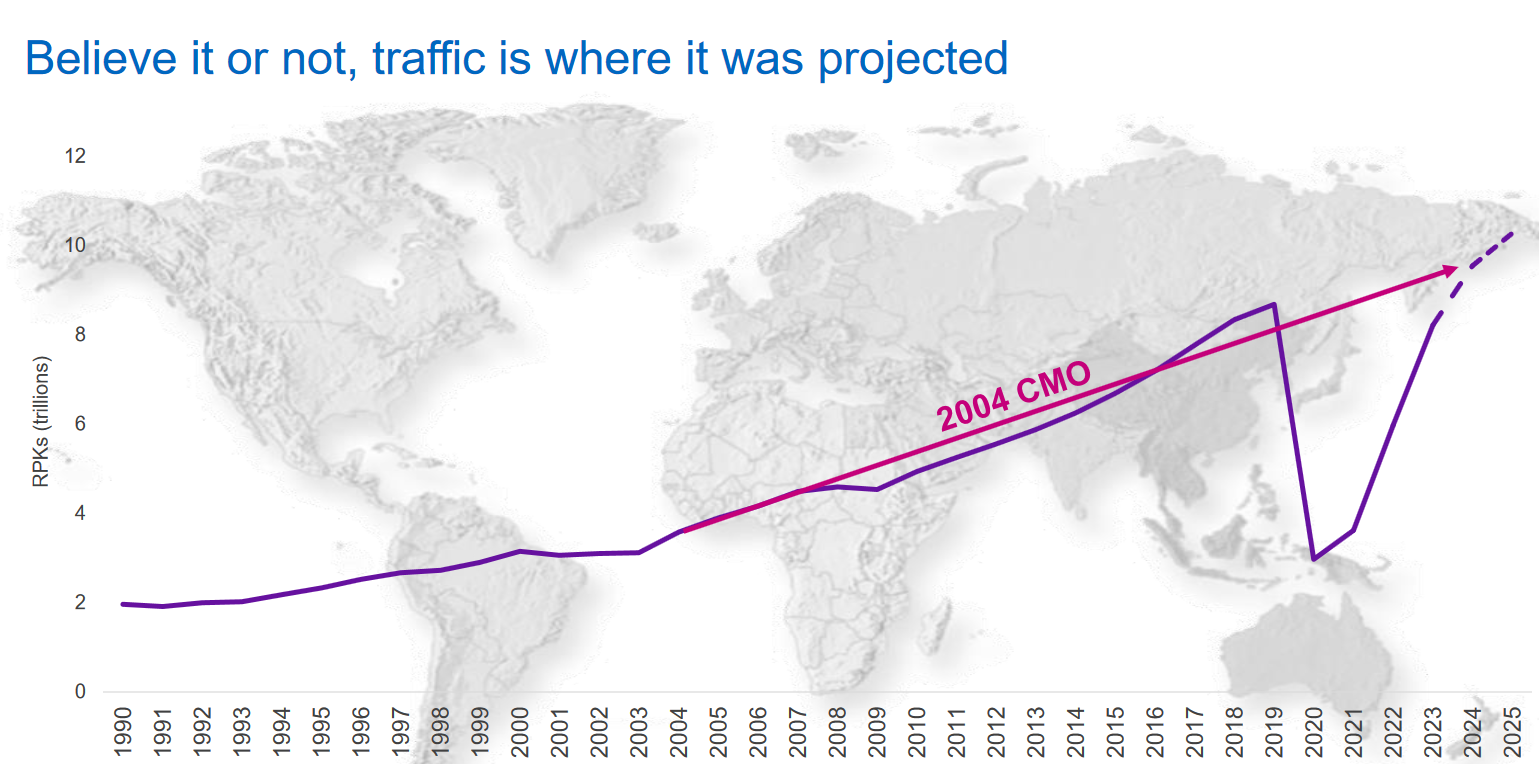

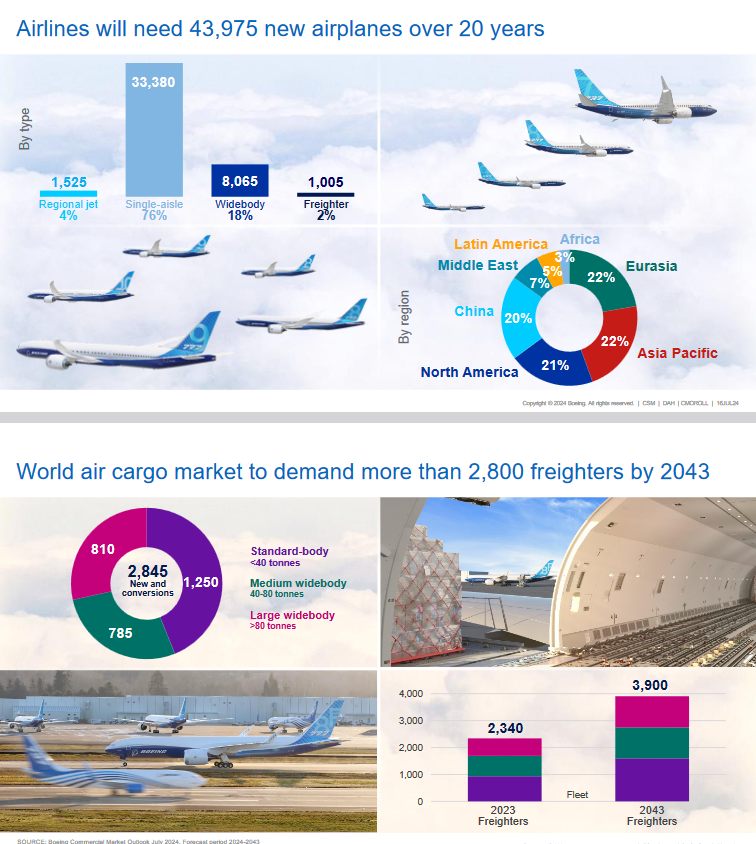

The table and chart above are all you need to know about duopolistic Boeing. For decades it has had periods of negative Free Cash Flow followed by Free Cash Flow recoveries. It has had periods of dips in revenues followed by recoveries to new highs in revenues. It has had periods of dips in stock price followed by recoveries to new highs in stock price. This time will be no different.

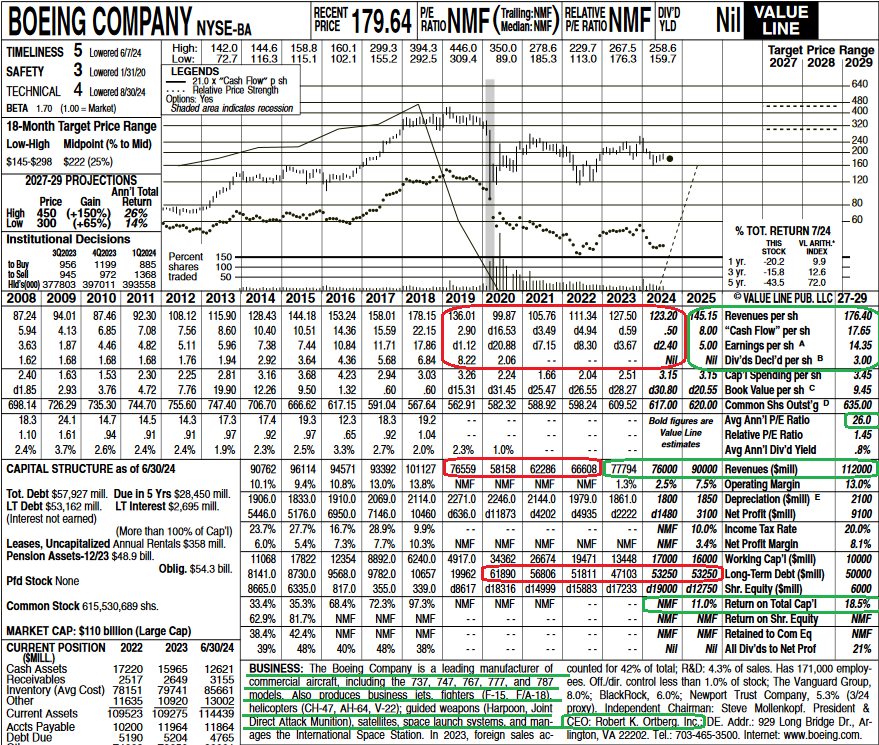

(Click on image to enlarge)

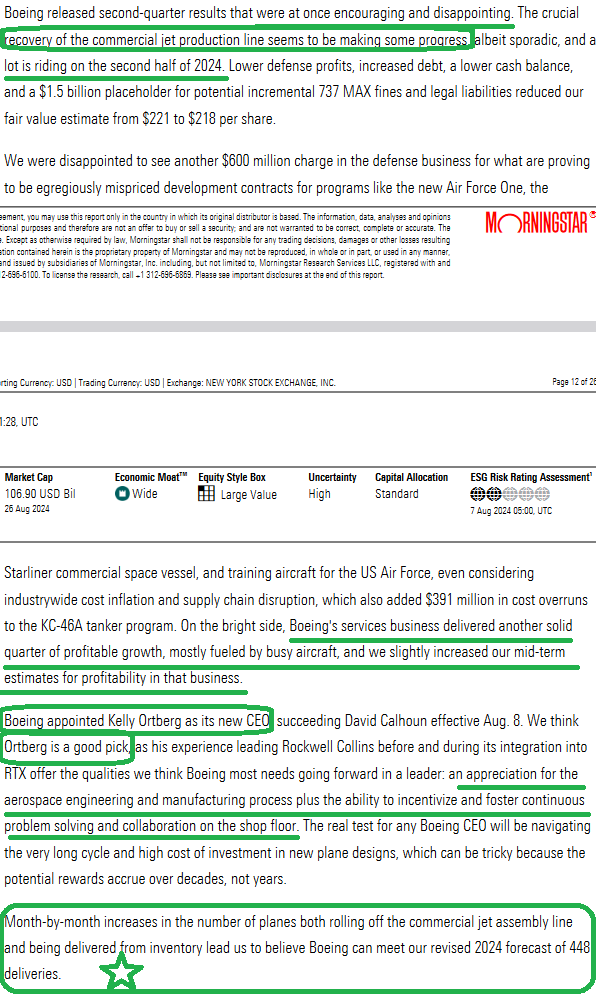

Tuesday’s downgrade by a short-termist sell side analyst was comical. “Boeing delays its $10B/yr Free Cash Flow target by 1 year – from 2026 to 2027.” For those slow with math, the market cap is just ~$100B right now or 10x 2 years out Free Cash Flow ~ 10% FCF yield.

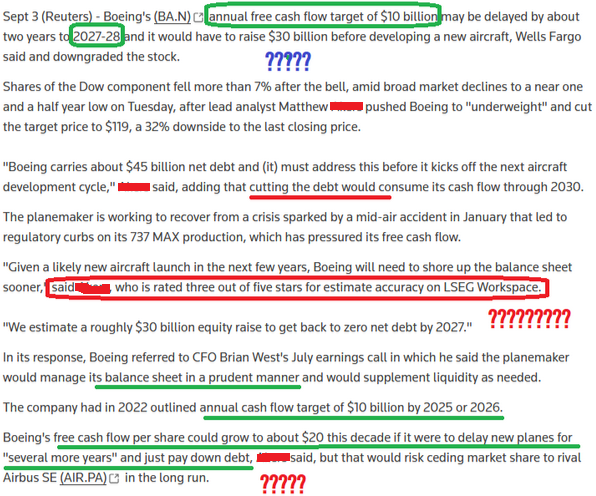

Here was the Reuters article citing one of the most ridiculous analyst reports I have seen in my years in the business:

(Click on image to enlarge)

1) This is the silliest statement I’ve ever seen an analyst put in writing, “We estimate a roughly $30 billion equity raise to get back to zero net debt by 2027.” Why would they ever go to zero net debt? When did Dave Ramsey become Boeing’s new financial advisor?

2) Why is Reuters quoting an analyst who is ranked “3 out of 5 stars for accuracy?”

3) Why would they start a new plane in fears of losing share when their competitor already has a backlog as large as theirs – spanning a decade out for plane models they already produce?

4) Even the analysts cedes their free cash flow could spike to $20B/yr if they delay their next airplane development cycle. Duh…I wonder what we should do…

5) I will be sending this analyst a Christmas card for allowing us to expand our position in the high $150’s. We are grateful for your service. Please write several more notes so we can add more size at lower prices.

6) Total company backlog is $516 billion, including over 5,400 commercial airplanes. For those worried about the “health” of Boeing, may I offer you the World’s Smallest Violin (see image above). They’ll be just fine…only a matter of when, not if.

Key Catalyst – New CEO – Kelly Ortberg (started August 8).

As CEO of Rockwell Collins, he doubled sales in 6 years and quadrupled (4x) the value of the company for shareholders before selling it at a nice premium to United Technologies in 2019.

(Click on image to enlarge)

Morningstar Overview Key Points:

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Earnings Results:

(Click on image to enlarge)

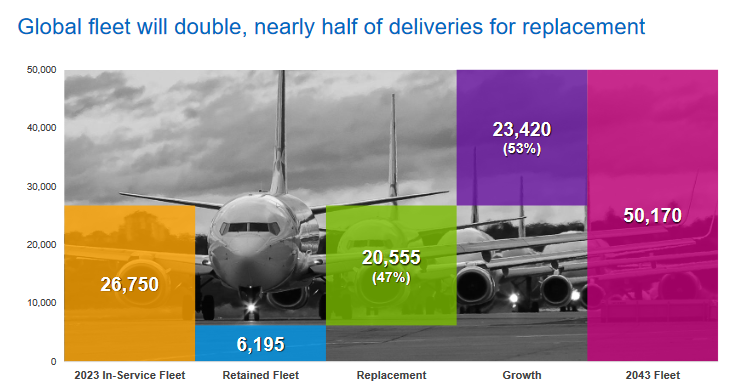

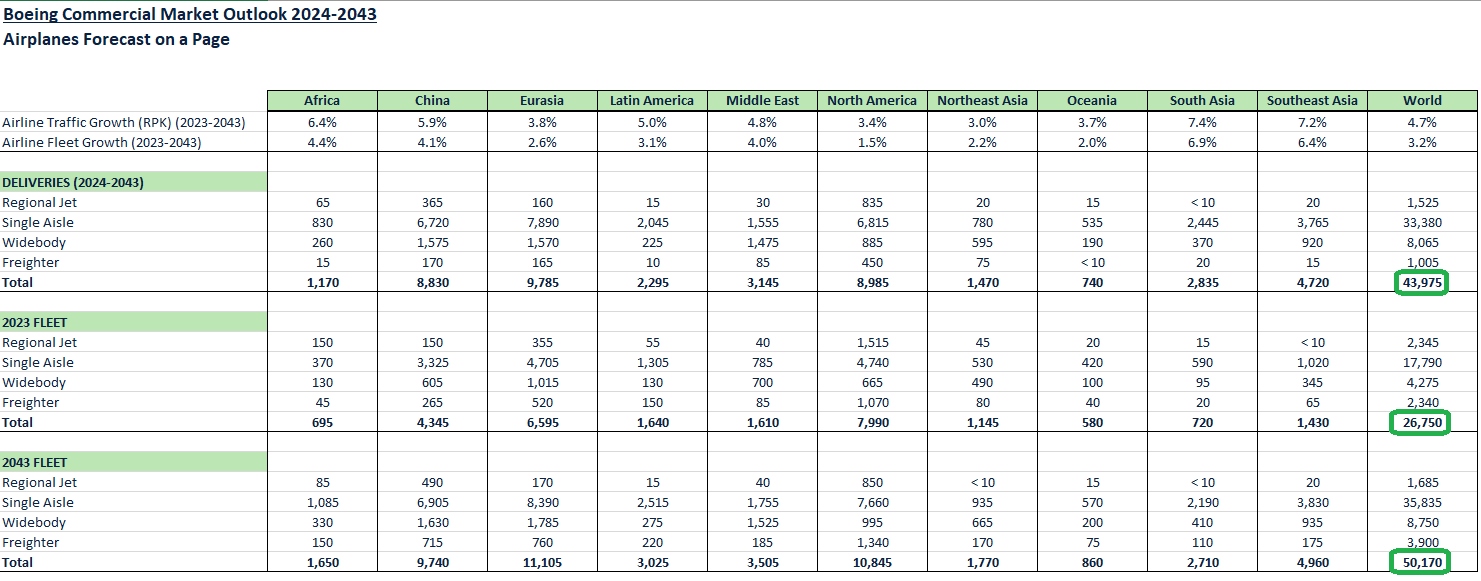

THE FUTURE IS BRIGHT:

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Now onto the shorter term view for the General Market:

The CNN “Fear and Greed” ticked up from 52 last week to 53 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

(Click on image to enlarge)

(Click on image to enlarge)

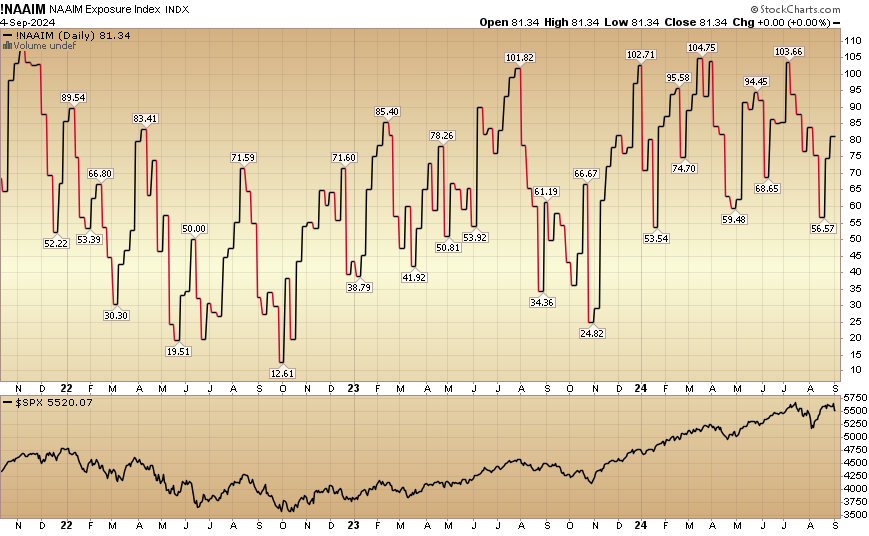

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 81.34% this week from 74.68% equity exposure last week.

(Click on image to enlarge)

Our podcast|videocast will be out tonight or tomorrow. We’ll have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1, Q2 and Q3 raises so far this year. We successfully closed out our Q3 raise for smaller ($1M-$5M) accounts in July.

Larger ($5-10M+) accounts can access “open enrollment” here.

*Opinion, Not Advice. See Terms

More By This Author:

“Oil Cans And Vans” Stock Market (And Sentiment Results)

Babalicious Stock Market (And Sentiment Results)

“Re-Stock Cycle” Stock Market (And Sentiment Results)

Disclosure: Long all mentioned tickers

Disclaimer: Not investment advice. For educational purposes only: Learn more at more