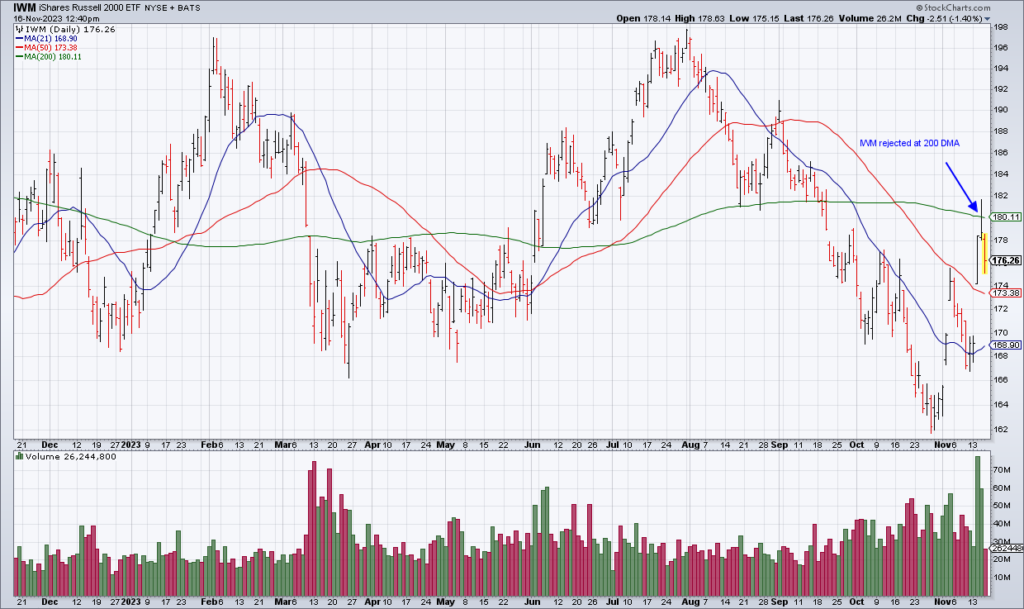

WMT: Buy The Dip, IWM Rejected At 200 DMA

(Click on image to enlarge)

In my weekly preview, I wrote about my “Long WMT/Short HD” position and I continue to like that trade despite the action in the stocks post earnings. HD bounced after reporting earnings on Tuesday mornings but only because the stock was beaten up. US comps were -3.5% as customers continued to do smaller home improvement projects but put off larger ones. On the other hand, WMT stock is getting hit today but only because the stock was overbought. Walmart US comps excluding fuel were +4.9%.

(Click on image to enlarge)

Also worth noting is that the Russell 2000 index of small cap stocks – which stole the show on Tuesday – was rejected Wednesday at its 200 DMA and has continued to sell off today. As I wrote on Tuesday, the main bearish technical argument has been lack of breadth. Until small caps – and stocks beside the Magnificent 7 in the S&P – can show some real strength, this continues to be a very thin market.

More By This Author:

CSCO PANW: Weak GuidanceIn Search Of Deep Value: AAP & TGT

Not A Bull Market, Next Week: Long WMT/Short HD