Not A Bull Market, Next Week: Long WMT/Short HD

(Click on image to enlarge)

(Click on image to enlarge)

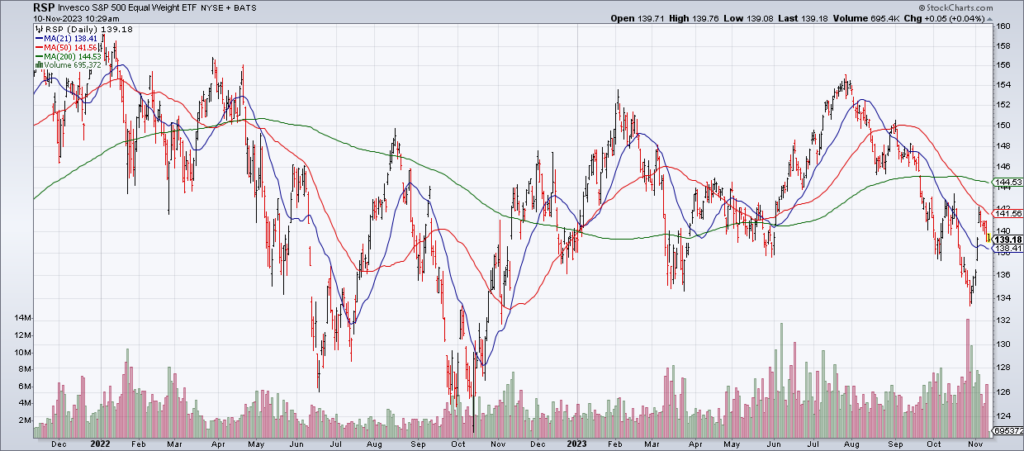

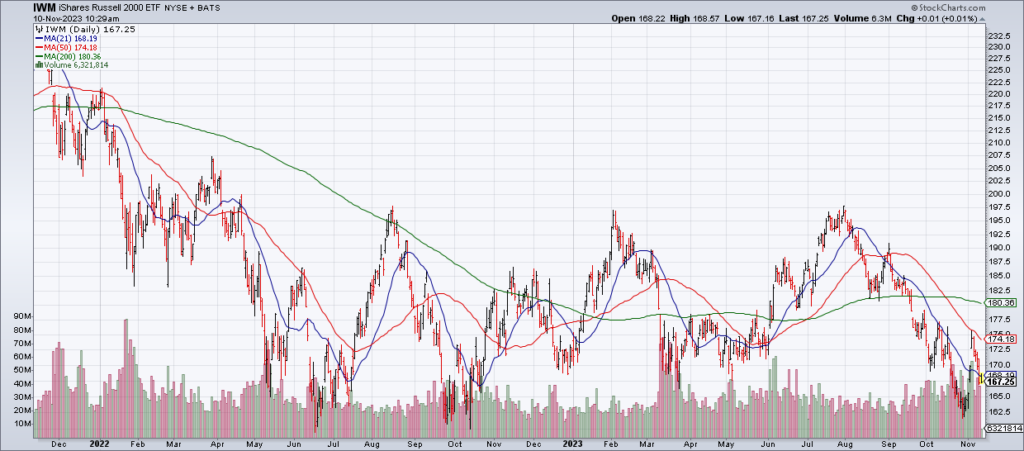

Despite the huge bounce last week I continue to believe that we’re still in the bear market that began in November 2021. That’s because the Magnificent 7 – the mega cap tech stocks – are the only stocks really performing well while beneath the surface most stocks continue to lag. You can see this in the charts above of the S&P Equal Weight ETF (RSP) and the Russell 2000 ETF (IWM). While both of those ETFs bounced hard last week, both remain well below their 200 DMAs and they’ve given back a good amount this week. I continue to think that it’s only a matter of time before mega cap tech – which is overvalued and lacks growth – rolls over and takes the market cap weighted indexes with them.

(Click on image to enlarge)

Next week Home Depot (HD) reports on Tuesday morning and Walmart (WMT) on Thursday morning. My “Long WMT, Short HD” trade is working well and I expect that to continue. In a tough economy with consumers squeezed, you want to own WMT which sells necessities and not HD which sells discretionary home improvement merchandise. My bet is that this continues to show up in the comp numbers each of them reports.

(Click on image to enlarge)

More By This Author:

DIS And The Bifurcated Market ThesisUBER Is Superior To LYFT On Every Metric

Looking For Love In All The Wrong Places