With Big Gains In Stocks, Major Tech Companies On Schedule To Report 4Q 23 Earnings, FOMC Likely To Disappoint Equity Bulls

It is an FOMC week. The meeting is taking place at a time when markets are demanding aggressive cuts this year and the Fed is saying ‘no way’. Financial conditions have eased tremendously, and the central bank probably does not like that. Amidst this, the Nasdaq 100, which has rallied massively the past three months and is awaiting earnings from the leading tech outfits, showed early signs of fatigue last week. It is going to be volatile this week.

(Click on image to enlarge)

The Federal Open Market Committee (FOMC) meets this week. It is the first meeting this year and seven more are on schedule after this. Rates are expected to be left unchanged at a range of 525 basis points to 550 basis points.

The fed funds rate has gone up materially in a relatively short period of time, as it languished between zero and 25 basis points for two whole years before the Federal Reserve began to tighten in March 2022. By last July, the benchmark rates were higher by 525 basis points.

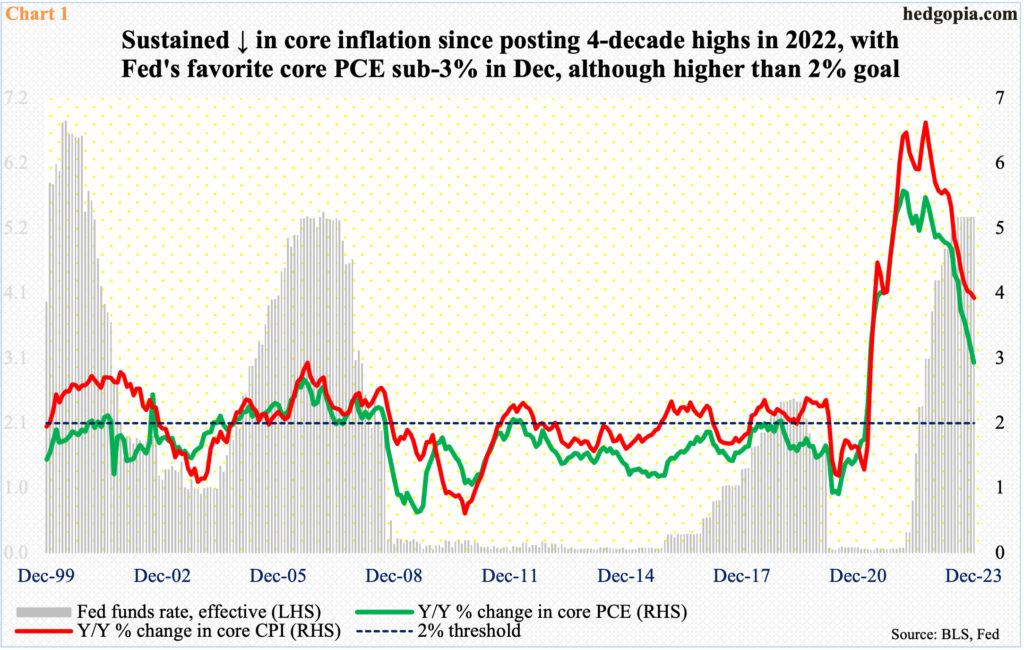

The central bank was trying to get inflation under control. Both the consumer price index (CPI) and the personal consumption expenditures (PCE) had jumped to four-decade highs in 2022, with core CPI rising at an annual rate of 6.6 percent in September and core PCE at 5.6 percent in February (Chart 1); as a matter of fact, headline CPI and PCE peaked at a rate of 9.1 percent and 7.1 percent respectively in June that year. Last month, core CPI and PCE respectively increased 3.9 percent and 2.9 percent. The Fed prefers core PCE and has a two-percent goal on that metric.

(Click on image to enlarge)

The decelerating trend in inflation has lit a fire under equities. After peaking between November 2021 and January 2022, the major indices first bottomed in October 2022, as inflation was showing signs of cresting, and again in October last year. From October 2022 through last Friday’s intraday high of 4907, the S&P 500 jumped 40.5 percent, and 19.6 percent from last October’s low.

This concurrently has been met by a persistent revision lower in earnings estimates. In October 2022, S&P 500 companies were expected to ring up $204.31 in operating earnings for 2022 and $231.78 for 2023; they ended up bringing home $196.95 and $212.35, with the latter blended as 4Q23 results are still coming in. For 2024, the sell-side expects $240.08, which again was as high as $246.31 last March, and $244.24 last October.

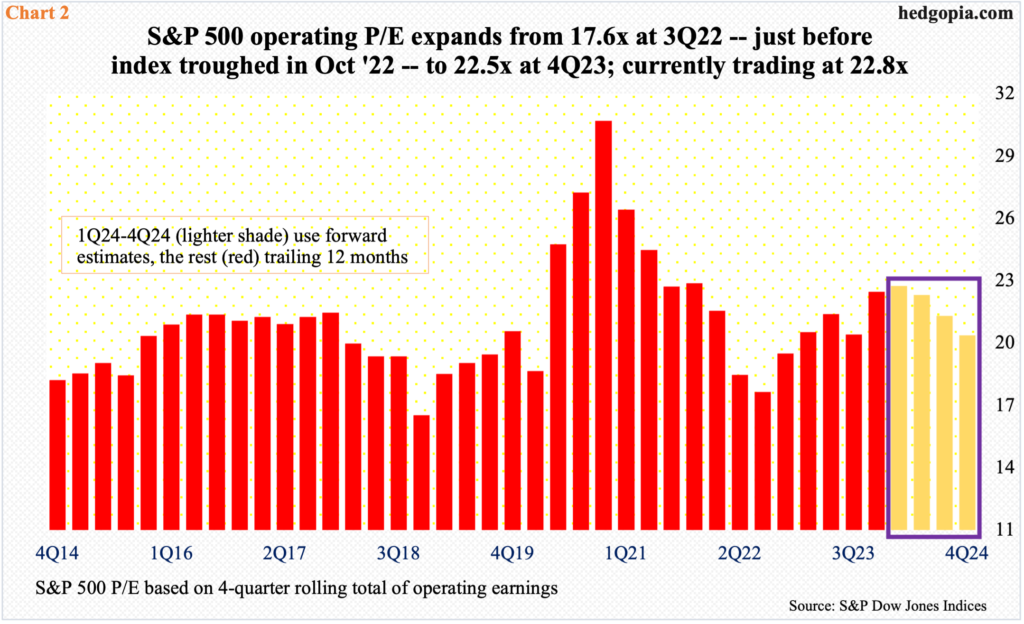

Rising prices and falling earnings to not constitute a good combination from the perspective of valuations. At the end of 3Q22, the operating price-to-earnings ratio for S&P 500 companies was 17.6x, which gradually rose to 22.5 last quarter. As things stand, the multiple has expanded a tad further to 22.8 so far in the March quarter (Chart 2).

This is expensive. The ratio is expected to drop to 20.4 by the fourth quarter this year, but that assumes the sell-side’s estimates come through, which is hardly a certainty given the prevailing downward revision trend. This year, earnings are expected to jump 13.1 percent, versus the expected 7.8 percent last year.

(Click on image to enlarge)

Extended valuations are bound to remain on the minds of investors this week as they are sitting on tons of paper gains. From last October’s low, the Nasdaq 100 is up 25.7 percent, and an astounding 69.2 percent from the October 2022 low.

The tech-heavy index holds particular importance this week as we will hear fourth-quarter results from the leading ones, including Apple (AAPL), Microsoft (MSFT), Google owner Alphabet (GOOG), Amazon (AMZN) and Facebook owner Meta (META).

Last week, Netflix (NFLX)’s numbers drew applause, while those from Tesla (TSLA) and Intel (INTC) were pooh-poohed. One thing is certain. All these stocks have enjoyed massive rallies the past three months. A ‘buy the rumor, sell the news’ phenomenon is always possible, not to mention the fact that a hawkish message from the FOMC will probably not help.

Ahead of this, the Nasdaq 100 last week rose 0.6 percent – its 12th up week in 13 – but also formed a weekly spinning top, with an intraday high of 17665 on Wednesday and a Friday close of 17421 (Chart 3). Shorts could be smelling blood here.

(Click on image to enlarge)

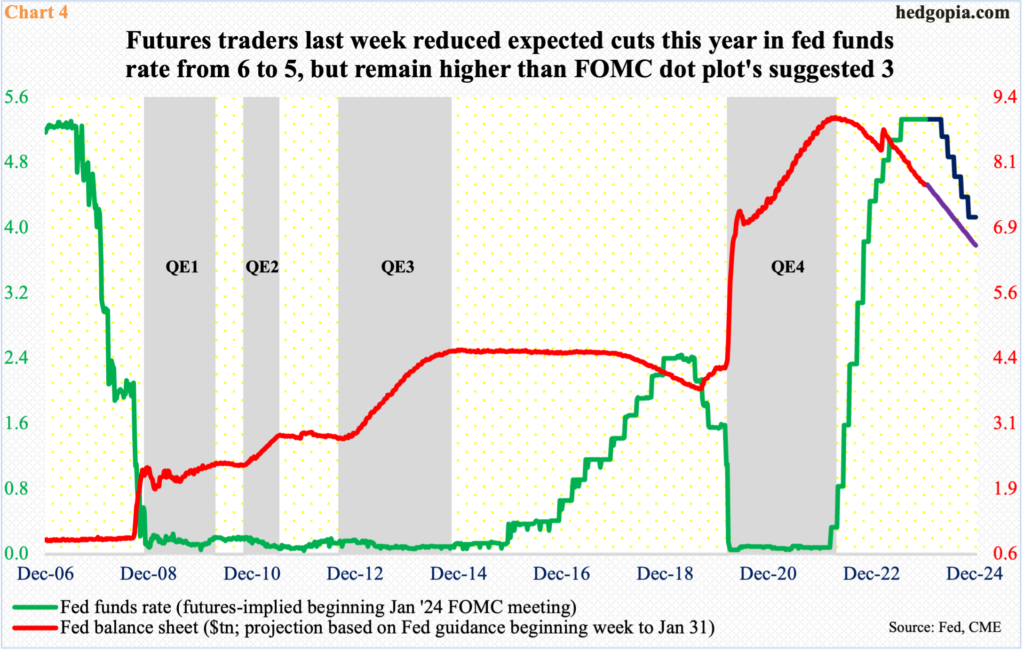

On December 13th, when the FOMC concluded its last meeting, the policy-making body made the now-famous dovish pivot, as the dot plot indicated three 25-basis-point cuts this year, up from two suggested at the September meeting. In reaction, futures traders, who going into the meeting were penciling in four cuts this year, immediately jacked up their expectations to six. One after another FOMC official since has warned the markets not to get ahead of themselves and to ratchet down their expectations. This until recently has fallen on deaf ears, with the futures market pricing in as many as seven cuts.

Last week, this changed a bit. In the face of the economy continuing to churn out stronger-than-expected numbers, including the fourth-quarter GDP figures that were released last week, the futures traders no longer view a March cut as probable, with odds having dropped to below 48 percent. Nevertheless, they still expect five cuts, ending the year between 400 basis points and 425 basis points (Chart 4). This is still way more than what the Fed officials are telegraphing what they are willing to give. (Concurrently, the central bank continues to reduce its balance sheet.)

With this as a background, and particularly considering the continued easing in the financial conditions thanks to massive gains in equities – and the associated risk relating to the wealth effect that comes with it – the FOMC message come Wednesday likely will not please the equity bulls. Ironically, they are pricing in a soft-landing in the economy, even as the futures traders have their money on five to six cuts, which the Fed is unlikely to deliver unless the economy tanks.

More By This Author:

Analyzing The Latest CoT: The Future Through Futures, How Hedge Funds Are PositionedWith Huge Gains In Share Prices Past 3 Months, Leading Tech Heavyweights Report Next Week

S&P 500 Posts New High, More Gains Likely Near Term

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more