Window For A Bottom Opens – VIX Needs To Spike

After being off for Yom Kippur yesterday, it feels like a Monday today. Markets behaved poorly to the end of last week but hung in okay on Monday against another spike in long-term interest rates. Stocks were under pressure in the pre-market today. They need to close in the upper half of their range today to indicate at least a very short-term rally has begun.

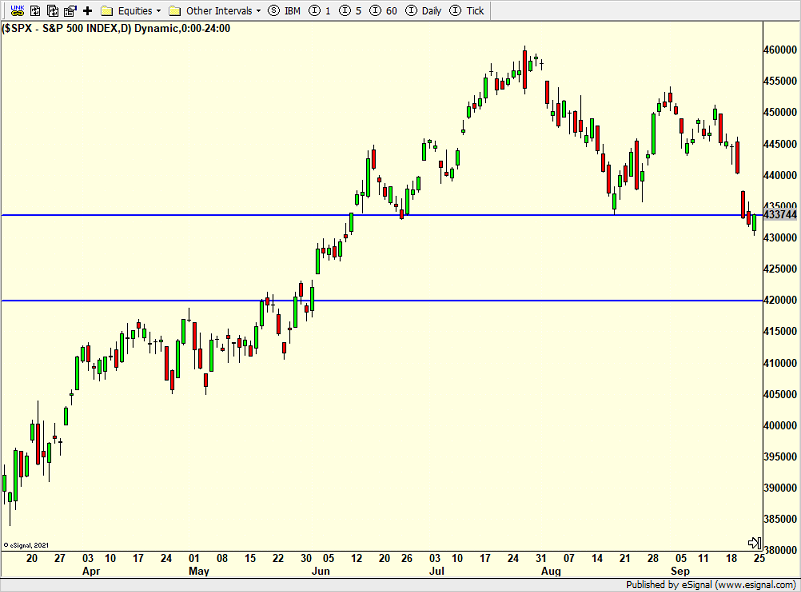

As I discussed last week, the window for a stock market low is now open as the bare minimum in time and price has been met. Time-wise, it looks like the window will be open for a few weeks. Price-wise, looking for a bottom between right here and the 4200 area on the S&P 500. It could come quickly or we could see a few days or rally, decline to new lows and bottom.

I have received lots of questions about why this decline can’t become something larger and more painful. It can. It always can. I can be wrong. I hope that goes without saying. However, it’s still a pre-election year where deeper declines are more rare. And yes, I do know that the 1987 crash was in Q4 of a pre-election year.

The landscape for a low continues to build. And we all know that the end of declines can sometimes be scary. They are supposed to in order get enough investors to sell and believe the rally is over and more pain is coming. I don’t sense that there is enough fear in the market.

Look at the Volatility Index (VIX) below which goes up when stocks go down. In March when stocks went down 9%, the VIX spiked to 31. I would think that we will see a VIX spike above 20 in the coming few weeks, perhaps higher, to shake the nerves of some investors. It’s too early to say if that will be enough.

On Monday we bought BALT, FMAT and XLV. We sold levered S&P 500.

More By This Author:

Pullback AcceleratesFed Stands Pat – Stocks Should Rally

The Weakest Week Of The Weakest Month Already In Pullback Mode

Please see HC's full disclosure here.