Williams Companies: Strong Results, Forward Growth, Possible Opportunity

On Wednesday, February 19, 2020, midstream giant The Williams Companies, Inc. (WMB) announced its fourth quarter 2019 earnings results. At first glance, these results appeared to be mixed as the company managed to beat the expectations of its analysts in terms of top-line revenues but it did miss their expectations in terms of bottom-line earnings. A closer look at the actual earnings report meanwhile does show a slightly different different story, however, as the company delivered very impressive performance compared to the equivalent quarter of last year, which is largely what we have come to expect from midstream companies lately. Unfortunately though, the stock market has absolutely pummeled the company's stock price in response to the steep decline in oil prices that we have seen recently despite the fact that this company is somewhat insulated from energy prices. This may create an opportunity for investors.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company's earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Williams Companies' fourth quarter 2019 earnings results:

- The Williams Companies reported total revenues of $2.107 billion in the fourth quarter of 2019. This represents a 4.40% decline over the $2.204 billion that the company brought in during the prior year quarter.

- The company reported an operating income of $624 million in the most recent period. This compares very favorably to the $506 million that the firm had in the year-ago quarter.

- The Williams Companies had a reserved transportation capacity of 21.3 billion cubic feet of natural gas per day at the end of the year. This was a record level for the company and represents an 8% increase over the prior year quarter.

- The company gathered an average of 13.3 billion cubic feet of natural gas per day in the fourth quarter. This was also a record level for the company and represents a 10% increase over the equivalent period of last year.

- The Williams Companies reported a net income of $124 million during the fourth quarter of 2019. This represents a substantial improvement over the $571 million net loss that the company reported in the fourth quarter of 2018.

When we review the highlights, we see that, with the exception of revenues, every measure of financial performance showed a marked increase over the prior year quarter. This is in-line with what most other midstream companies reported. The biggest reason for the decline in revenues was the fact that commodity prices, particularly natural gas, were lower in this quarter than they were a year ago. This should be no surprise to anyone as gas prices gradually declined over the last year due to the United States being oversupplied with natural gas. This can be clearly seen here:

(Click on image to enlarge)

Source: Business Insider

The reason why this would have an impact on Williams' revenues is that some of the company's contracts are what are known as take-or-pay contracts. A take-or-pay contract is a contract that requires the receiving party to either take delivery of the goods or pay a penalty. The way the company operates with these contracts is that it purchases the natural gas or liquids products at one end of the pipeline and then sells them to its customers at the other end with a markup. As both the buying and selling price are based on the market prices for the resources, both the revenues and the cost of goods sold will be lower when resource prices are lower. The important thing is the spread between the purchase and sale price as this is what dictates the company's cash flow. This is a direct function of volumes, which is why we still saw the company's cash flow increase even though its revenues went down.

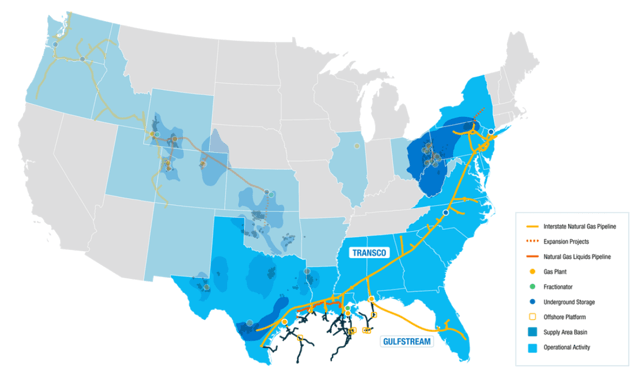

As was the case with most other midstream companies, The Williams Companies saw its transported volumes increase compared to the prior year quarter. This is a direct result of the rising levels of natural gas production that we have seen over the past year. This alone would not result in higher volumes however as the company would still need to have the infrastructure available to transport these higher volumes. Fortunately, this is indeed the case. As I pointed out in past articles on the company (such as this one), one of the company's biggest growth projects recently has been the expansion of the Transco pipeline system. The Transco system consists of more than 10,000 miles of pipelines that stretch from the Permian basin in Texas to New York City:

Source: The Williams Companies

This system is a major supplier of natural gas to the highly populated Northeast and New York City and as such it is one of the largest and most important pipeline systems in the United States. One thing that we have been seeing over the past few years is a rising demand for natural gas in the Northeast as a result of both population growth and a desire to move away from oil and coal as sources of heat and power. In response to this rising demand, The Williams Companies has been working to expand the capacity of the Transco system and we saw its efforts pay off over the past year as this system delivered higher volumes in the latest quarter than it did a year ago. In the fourth quarter alone, the company brought online the Gateway and Rivervale South to Market expansions to the system that should increase the supply of gas to the region. This is something that could have a positive impact on the company's first quarter results as these expansions will be operating for the entire quarter instead of only part of it.

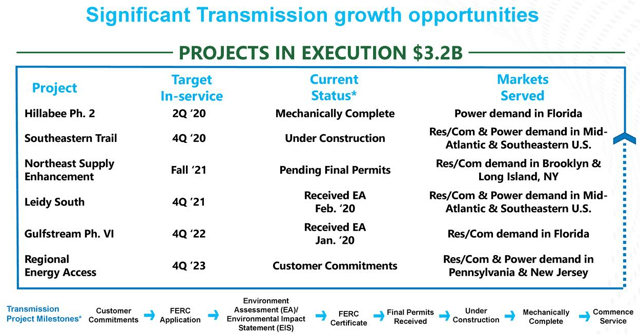

The Williams Companies does not expect this to be the end of its growth story. In fact, the company currently has $3.2 billion worth of growth projects in development. We can see this here:

Source: The Williams Companies

As we can see, these projects are scheduled to come online between now and 2023 with the first one coming online in the second quarter. The nice thing about all of these projects is that the company has already secured contracts from its customers for the use of the new infrastructure. This has two benefits for the company. The first of these is that it ensures that the company is not spending a great deal of money to construct infrastructure that nobody wants to use. It also effectively guarantees that the company will generate a positive return on its investment. Thus, we should expect the company to produce growth as they come online, with the first boost starting in the second quarter of 2020.

Despite the strength that we saw in the company's business during this quarter and the promise of future growth, the market has greatly punished the stock. Over the past six months, the stock has gone from $24.81 per share to $13.39 today. This is a 46.03% decline:

(Click on image to enlarge)

This decline has given the stock a very appealing 12.38% yield. Of course, it is critical that we ensure that the company can actually afford the dividend that it pays out. In the case of a midstream company like The Williams Companies, this is typically done by looking at a metric known as the distributable cash flow. Distributable cash flow is a non-GAAP figure that theoretically tells us the amount of cash that was generated by the company's ordinary operations that is theoretically available to be paid out to the company's owners. In the fourth quarter of 2019, The Williams Companies had a distributable cash flow of $828 million, which is an 11% increase over the year-ago quarter. This is enough for the company to cover its dividend 1.80 times over. Analysts typically consider anything over 1.20x to be sustainable but I typically like to see it closer to 1.30x for a margin of safety. Regardless, we can see that the company is easily generating more than enough cash to afford the dividend that it pays out and the long-term contracts that it has with its customers should allow it to continue to do so. There may therefore be an opportunity here.

In conclusion, The Williams Companies joined many of its midstream peers at announcing a very strong quarter in which it was able to deliver a solid amount of growth. This growth story has not ended yet though as the company plans to bring a few new projects online over the next few years that have already secured contracts from its customers for their use. Despite this, the market has been severely punishing the stock, which may create an opportunity for an investor with the fortitude to ride out the current market.

Disclosure: Neither Powerhedge nor any of its affiliated entities or officers has any positions in any stock mentioned in this article. We will not be acquiring a position within 72 hours of ...

more

$WMB looks good to me.