Will Alibaba Ever Pay A Dividend?

Alibaba Group (BABA) had strongly rewarded its shareholders in the years after its 2014 IPO. But things have changed dramatically in the past two years, with shares of the tech giant down 39% in the past 12 months.

Alibaba does not currently pay a dividend to shareholders. However, in contrast to other high-growth tech stocks that do not pay dividends and might never, such as Netflix (NFLX), Uber (UBER), and Lyft (LYFT), Alibaba is highly profitable and generates positive free cash flow.

As a result, the company has the capacity to initiate and sustain a dividend. Therefore, the big question for income investors is whether the company will ever decide to pay a dividend.

Business Overview

Alibaba is a gigantic e-commerce company, which provides online and mobile commerce businesses in China and in many other international markets.

It operates in four segments: Core commerce, cloud computing, digital media, and innovation initiatives. While the company expects meaningful growth from all its segments, its core commerce business is by far its most important, as it generates essentially all the earnings of the company.

The primary concern for Alibaba is the regulatory crackdown in China, which has exposed investors to geopolitical risk. While Alibaba remains a highly profitable company, displaying net income margins that often surpass the 25%+ levels, its shares have been lagging due to the ongoing concerns surrounding Chinese equities.

Further, the Chinese government’s involvement in steering the company’s direction, combined with the ongoing crackdown on Big Tech, has also been raising questions among investors.

These issues have significantly impacted investor sentiment, which is why Alibaba’s shares continue to fall.

Growth Prospects

Fiscal 2021 was a challenging year for Alibaba, and it continues so far into fiscal 2022. Still, there are reasons behind Alibaba’s sustained business momentum amid the prevailing macro challenges. First of all, the company benefits from the strong growth of the Chinese economy.

However, China’s economy grew by just 0.4% over the second quarter of 2022, compared with the same period last year.

As it is impossible for any country to continue growing at a high single-digit rate indefinitely, the Chinese economy has decelerated in recent years. Nevertheless, it is still growing at a much faster pace than the developed nations such as the U.S., meaning China remains a key emerging market.

Moreover, the middle class of China in large cities has exceeded 300 million people and thus it has become almost equal to the entire U.S. population. These consumers seek to upgrade the quality of products they purchase and thus they pursue a great variety of foreign brands. Alibaba, which connects all these people to well-known foreign brands, greatly benefits from this behavior of consumers.

It is also important to note that China’s middle class is expected to double in size within the next 10 years, with most of the growth driven by the less-developed cities. Apart from the major metropolitan areas of China, such as Shanghai, Beijing, and Shenzhen, China has more than 150 cities with a population of more than 1 million people.

All these cities have more than 500 million people in aggregate and a consumption economy above $2 trillion. The economies of these cities grow much faster than the economies of the major metropolitan areas. As a result, consumption from this category of Chinese cities is expected to grow significantly through 2029.

This secular trend will provide a strong tailwind to Alibaba, which relies to a great extent on domestic consumption.

Moreover, Alibaba greatly benefits from the fast pace of digitization of the Chinese economy. During the last decade, digitization has been driven primarily by smartphones, which have made it possible for consumers to remain connected to the internet for most of the day.

Digitization of the Chinese economy will accelerate even further in the upcoming years thanks to the advent of 5G technology and the fast propagation of IoT (Internet of Things) devices. Alibaba is ideally positioned to benefit from the increasing penetration of Internet in the lives of consumers.

Alibaba’s growth was flat in the first quarter of fiscal 2022, despite the broader challenges the company is facing. In the most recent quarter ending June 30th, 2022, the online retailer generated revenue of US$30.7 billion, mostly thanks to 10% revenue growth in its Cloud segment.

After achieving a user base consisting of more than 1.2 billion annual active consumers, the company is shifting its focus from growing its user base to better serving these customers. This should lead to higher efficiency and improved margins.

A decrease in China commerce adjusted EBITDA due to a decrease in customer management revenue led to a 19% year-over-year (YoY) decrease in income from operations. This also led to a 48% YoY decrease in diluted EPS, and a 29% decrease in adjusted EPS.

Will Alibaba Ever Pay A Dividend?

Tech companies need to spend large amounts of money to grow their businesses and stay ahead of the competition, and Alibaba is no different.

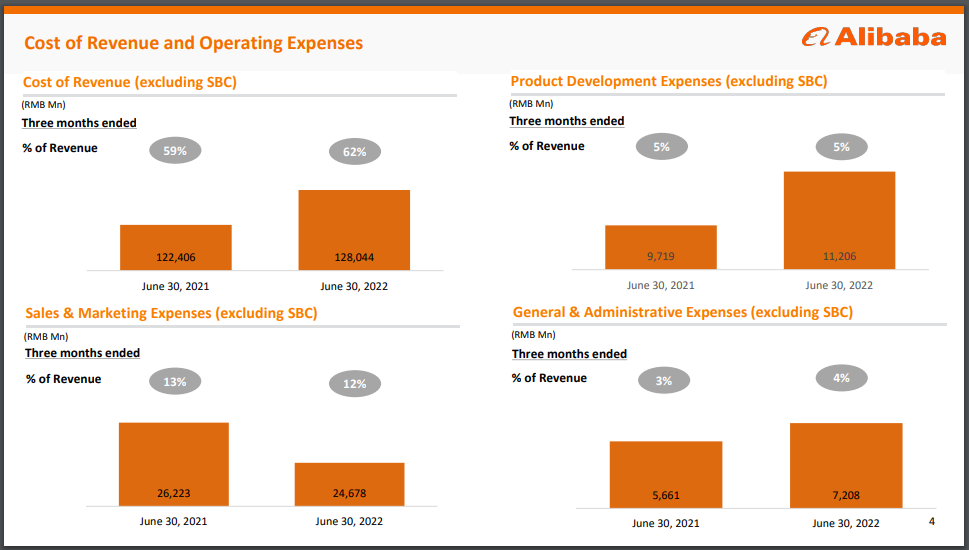

As Alibaba is trying to grow its customer base at a relentless pace, it is investing heavily in its business. More precisely, it spends significant amounts on product development, marketing, and general & administrative expenses.

Source: Investor Presentation

All these expenses consume a significant portion of the operating cash flows of the company, and therefore somewhat limit its free cash flow. However, Alibaba generates consistent free cash flow, even during the challenging environment over the course of 2021 and so far in 2022.

In the most recent quarter, non-GAAP free cash flow came to US$3.31 billion, thus the company is highly free cash flow positive.

This performance greatly differentiates Alibaba from other high-growth tech stocks, many of which have been growing their revenues at tremendous rates but are still far from achieving positive free cash flows.

Thanks to its positive free cash flows, Alibaba has the financial capacity to initiate a dividend. In addition, the company has a remarkably strong balance sheet. As of June 30th, 2022, cash, cash equivalents, and short-term investments totaled US$67.7 billion. For context, this equates to roughly 27% of the current market cap of the stock.

However, while Alibaba seems to have the financial strength to initiate a dividend, it is not likely to do so for the foreseeable future. The company continues to have elevated capital expenditure needs to grow its current businesses and expand into new areas.

Final Thoughts

Alibaba greatly benefits from the sustained growth of the Chinese economy and the secular growth of digitization. The e-commerce giant has been growing its revenues, earnings, and free cash flows at an impressive rate for many years.

While 2021 saw declining free cash flow, this metric improved in the first quarter of 2022. The long-term prospects of Alibaba remain quite positive due to the overall growth of the Chinese economy, and in particular the tech sector.

However, Alibaba is still in its high-growth phase, with ample room to continue growing for several more years. As a result, it makes much more sense to continue invest in its business than to return cash to its shareholders right now.

Free cash flow is also under pressure due to China’s ongoing regulatory crackdown on big tech companies.

For all these reasons, investors should not expect a dividend from the online retail giant for the next several years at least.

More By This Author:

Dividend Aristocrats In Focus: Coca-Cola

3 Oil Refiners To Hold For Dividends

3 Dividend Paying Energy Stocks Benefiting From High Oil Prices