Dividend Aristocrats In Focus: Coca-Cola

For superior long-term returns, investors should focus on high-quality dividend growth stocks. This comes to mind when reviewing the Dividend Aristocrats, a select group of 65 companies in the S&P 500 Index with at least 25 consecutive years of dividend increases.

We review all 66 Dividend Aristocrats each year. The 2022 Dividend Aristocrats In Focus series continues with a review of beverage giant The Coca-Cola Company (KO).

Not only is Coca-Cola a Dividend Aristocrat, it is a Dividend King as well. The Dividend Kings have increased their dividends for 50+ consecutive years. You can see all the Dividend Kings here.

Coca-Cola has a dividend yield of 2.8%, which is considerably higher than the S&P 500 Index average yield of 1.5%. In addition, Coca-Cola is likely to continue raising its dividend each year.

But this is a difficult time for Coca-Cola given consumer preferences have been changing for years away from traditional sparkling beverages. Indeed, soda consumption continues to wane in the U.S, where the company’s market share is dominant. Because Coca-Cola’s earnings growth has slowed, the stock continues to appear overvalued. However, it remains a high-quality business with strong brands, and an attractive, growing dividend, and a market-beating yield.

Related: Dogs of the Dow: the highest yielding Dow Jones 30 stocks.

In addition, it has been diversifying away from sparkling beverages in recent years and those efforts have paid off. This article will examine Coca-Cola’s investment prospects in detail.

Business Overview

Coca–Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands and 200 master brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide. It currently has a market capitalization of more than $270 billion, making it a mega-cap stock.

Related: See detailed analysis on the top beverage stocks.

Its brands account for more than 2 billion servings of beverages worldwide every day, producing roughly $42 billion in annual revenue. It also has 20 brands that each generate $1 billion or more in annual sales.

The sparkling beverage portfolio includes the flagship Coca-Cola brand, as well as other soda brands like Diet Coke, Sprite, Fanta, and more. The still beverage portfolio includes water, juices, coffee drinks, and ready-to-drink teas, such as Dasani, Minute Maid, Vitamin Water, and Honest Tea.

Source: Investor Relations

Coca-Cola dominates sparkling soft drinks. The company is attempting to maintain and even improve this dominant position with product extensions of existing popular brands, including reduced and zero-sugar versions of brands like Sprite and Fanta.

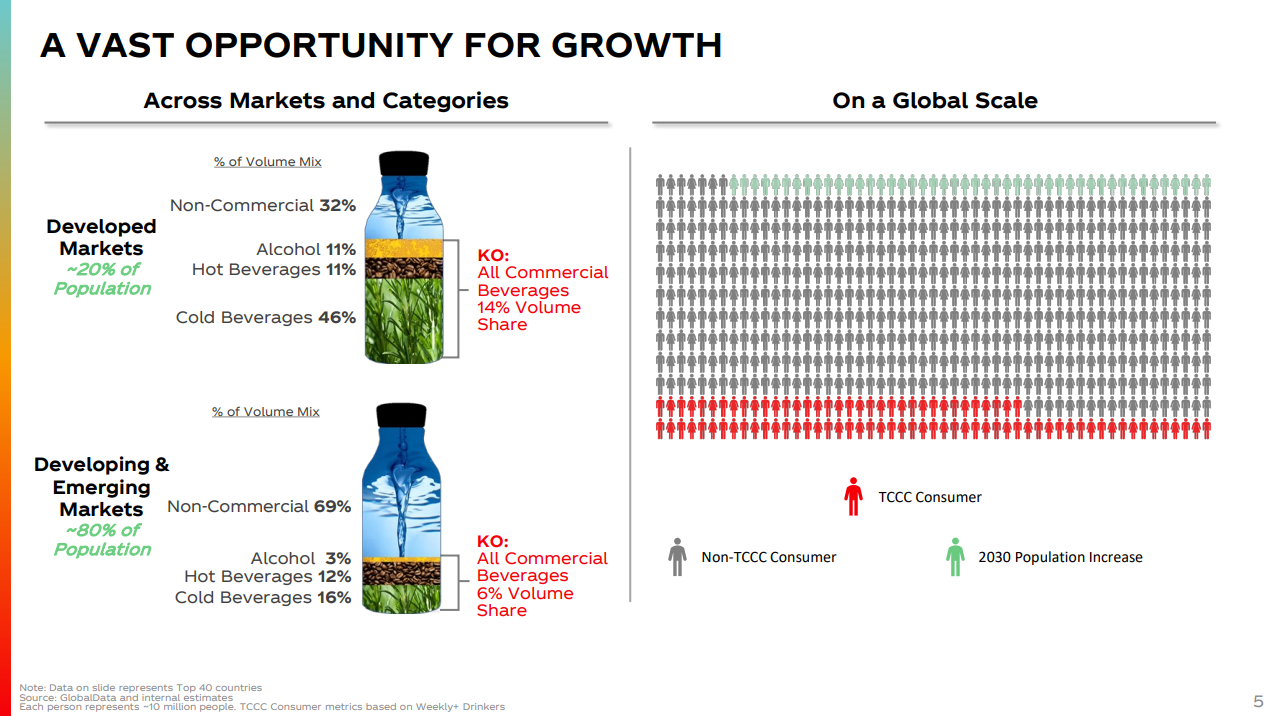

This is a challenging time for Coca-Cola. Sales of soda are slowing down in developed markets like the U.S., where soda consumption has steadily declined for years.

Declining soda consumption is a significant threat for the company. While Coca-Cola’s total volumes certainly still rely upon sparkling beverages such as soda, the company has gone to great lengths in recent years to diversify away from its core products, understanding that the long-term growth prospect for sparkling beverages isn’t particularly inspiring. Coca-Cola has acquired multiple still beverage brands in recent years.

Coca-Cola reported second-quarter earnings on July 26th, 2022, and results were ahead of estimates on both revenue and profits. Adjusted earnings-per-share were 70 cents, three cents better than expected. Revenue was up 12% year-over-year, hitting $11.3 billion, and $730 better than expectations.

Organic revenue was up 16%, including 12% growth from price and mix, and 4% growth in concentrate sales.

Operating margin was 30.7% of revenue, down 100 bps year-over-year. Margin compression was due to higher operating costs, an increase in marketing investments, and the impact of the BODYARMOR purchase.

The company expects organic revenue growth of 12% to 13% for this year, and adjusted earnings-per-share growth of 5% to 6%. We now estimate $2.45 in earnings-per-share for this year.

Growth Prospects

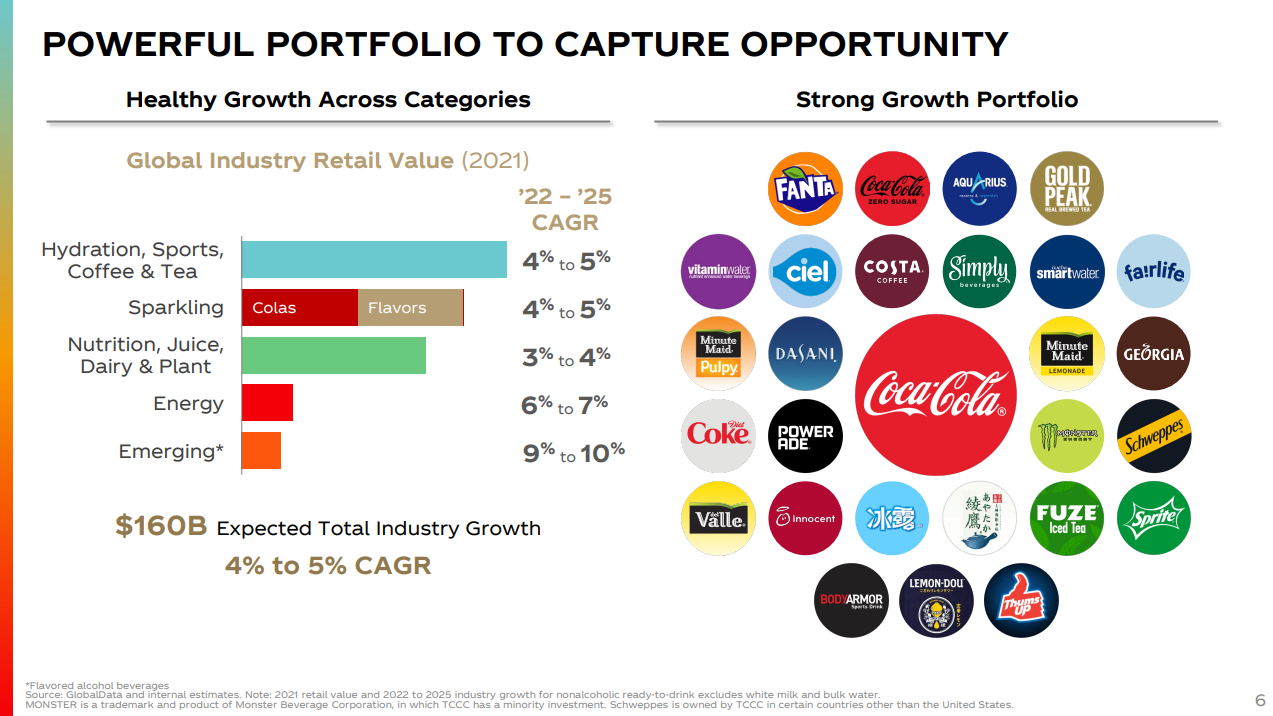

In an effort to return to growth, Coca-Cola has invested heavily outside of soda, in areas like juices, coffee, teas, dairy, and water, to appeal to changing consumer preferences. Due to the success of its growth initiatives, we continue to see Coca-Cola as having a favorable long-term growth outlook.

One reason we like the stock is because it competes in an industry that continues to grow globally in excess of the rate of broad economic growth. This leads to strong levels of overall growth in the industry, which Coca-Cola has certainly been capitalizing on in recent years.

In addition, the ready-to-drink category is sold through highly-diversified channels and continues to have mid-single digit projected growth rates, both for Coca-Cola and the industry. This is particularly true for still beverages like tea, coffee, and water. Coca-Cola’s years-old strategy to diversify away from sparkling beverages is due to this and it is undoubtedly bearing fruit.

Coca-Cola also continues to acquire brands in order to grow, including its acquisition of Costa, a coffee brand based in the UK.

Source: Investor Relations

This is certainly an out-of-the-box buy for a sparkling beverage behemoth, but Coca-Cola is doing what it takes to secure its future. In the relatively short time Coca-Cola has owned the coffee brand, it has expanded its offerings, including combining Coca-Cola and coffee in ready-to-drink packages.

Finally, we continue to like the divestiture of the company’s bottling operations. This has resulted in some pretty significant revenue declines over the years, but the end goal is much higher margins. Revenue turned higher during the pandemic, and margins are much higher than pre-divestiture.

Taking all of this into account, in addition to the company’s ample buyback program and productivity improvement efforts, we see total earnings-per-share growth of 6% annually over the next five years.

Competitive Advantages & Recession Performance

Coca-Cola enjoys two distinct competitive advantages, which are its strong brand and global scale. According to Forbes, Coca-Cola is the sixth-most valuable brand in the world, worth over $64 billion.

In addition, Coca-Cola has an unparalleled distribution network. It has the largest beverage distribution system in the world. A new entrant would be hard-pressed to recreate this distribution system, even with billions of dollars to invest.

These advantages allow Coca-Cola to remain highly profitable, even during recessions. The company held up very well during the Great Recession:

- 2007 earnings-per-share of $1.29

- 2008 earnings-per-share of $1.51 (17% increase)

- 2009 earnings-per-share of $1.47 (3% decline)

- 2010 earnings-per-share of $1.75 (19% increase)

Not only did Coca-Cola survive the Great Recession, it thrived. Coca-Cola grew earnings-per-share by 36% from 2007-2010. This shows the durability and strength of Coca-Cola’s business model. The company’s dividend also appears very safe, even after 60 years of consecutive increases.

Coca-Cola continued its impressive results last year when the company remained highly profitable even though the U.S. economy swung to recession. We would expect the company to thrive during any future recessions.

Valuation & Expected Returns

We expect Coca-Cola to generate adjusted EPS of $2.45 for 2022. Based on this, Coca-Cola stock trades for a price-to-earnings ratio of 25.6. This is above our fair value estimate of 23 times earnings, which means the stock is somewhat overvalued. A declining P/E multiple could reduce annual returns by -2.2% over the next five years.

The stock will generate positive returns through future earnings-per-share growth (estimated at 6%) plus the 2.8% dividend yield. Putting all of this together, we expect total annualized returns of 6.3% through 2027.

However the stock is currently overvalued, the corresponding contraction of the valuation multiple is expected to reduce total returns over the next five years. The overall result is that we expect Coca-Cola stock to generate decent, albeit unspectacular, shareholder returns at the current share price, and we rate it a hold.

Final Thoughts

Coca-Cola has made great strides repositioning its portfolio to meet changing consumer tastes. It has built a large portfolio of juices, coffees and teas, to cater to a more health-conscious consumer.

There is more work to be done to diversify away from sparkling beverages, and we see solid growth prospects looking ahead.

We rate the stock a hold since it is overvalued, but the stock remains a strong choice for income investors due to its above-average dividend yield and long history of annual dividend increases. These qualities make Coca-Cola a time-tested Dividend Aristocrat and a blue chip stock.

More By This Author:

3 Oil Refiners To Hold For Dividends

3 Dividend Paying Energy Stocks Benefiting From High Oil Prices

Blue Chip Stocks In Focus: Atmos Energy