Wild Monthly Moves

Talk about a wild year. Check out the monthly moves in the S&P 500 so far this year. You probably thought it was volatile in Q1 when the S&P 500 had two declines of 5.3% and 3.1% followed by a gain of 3.6%.Q2 saw even bigger swings with two declines of over 8% sandwiched between the month of May when the S&P 500 was up by the smallest amount possible (0.01%).In Q3, the S&P 500 rallied 9.1% in July, but then gave back all of those gains and more in the subsequent two months.Q4 started off on a positive note with a gain of nearly 8%, but there’s still two months left to give back all of those gains as well.

It’s not often that you see moves of such a large magnitude in the S&P 500, especially when they’re to both the downside and upside.Let’s start with the up moves. October was the second month this year that the S&P 500 rallied 7.5% or more, and while that may not sound like much, it is enough to be tied (with several other years) with the most in the post-WWII period.While there were three years with a higher frequency of 7.5%+ monthly gains in the 1930s (1933, 1935, and 1938), the only other years with as many 7.5%+ monthly moves in the post-WWII period were in 1948, 1954, 1982, 2001, 2009, and 2020.

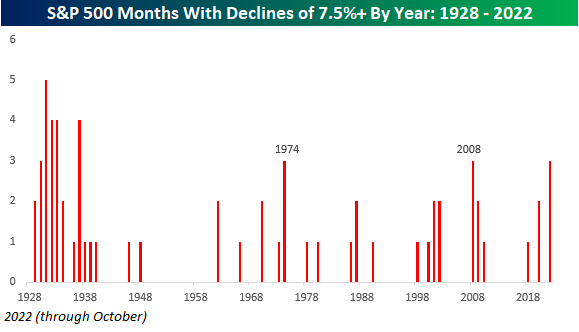

In terms of downside 7.5%+ months, this year has been even more extreme. With three monthly declines of 7.5%+, 2022 is tied with only 1974 and 2008 for the most in any post-WWII year. The only years with more were all in the 1930s (1932, 1933, 1934, and 1938).

Combining the two series together is where things really start to get interesting. With five monthly moves of at least 7.5% in either direction, there hasn’t been a single year in the post-WWII period with more- and there are still two months left to go. The only years with a higher number of 7.5% monthly moves were 1931, 1932, and 1932. While market-makers (are there any of those anymore) may be loving the volatile trading environment of 2022, most investors probably can’t wait to wipe the slate clean in 2023.

More By This Author: