Why September Could Offer Strategic Investment Opportunities Despite Historic Market Volatility

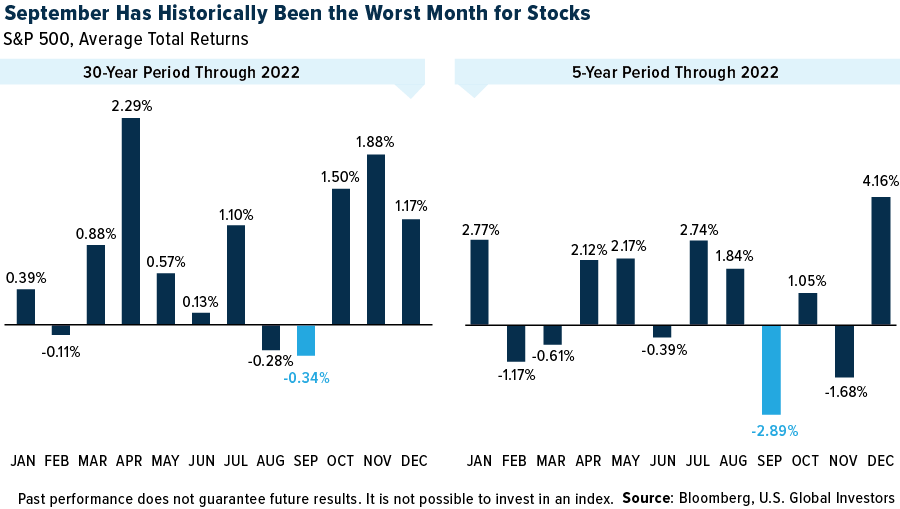

It’s common knowledge that September has historically been a challenging month for stocks, regardless of the timeframe. Since 1928, the S&P 500 has closed down 52 times in September, more than in any other month, according to Yardeni Research. Looking at monthly returns over the past 30 years and five years, equities have had the worst performance during September, dipping 0.34% and 2.89% on average, respectively.

(Click on image to enlarge)

Even though past performance doesn’t guarantee future results, investors should prepare for continued market volatility this month.

At the same time, a close examination of economic indicators and market trends suggests that this September could tee up some strategic investment opportunities.

The Recession Narrative Appears To Be Fading

As optimism cautiously returns to Wall Street, new data suggests that fears of an impending recession are receding among some S&P 500 companies.

FactSet reports that significantly fewer S&P 500 companies mentioned “recession” during their second-quarter earnings calls compared to previous quarters. Only 62 companies cited the term, marking a 45% decline from the March quarter and the lowest number since the final quarter of 2021.

A recent study of the economic impact of higher rates offers some context that may help explain companies’ newfound optimism. According to the findings of the Federal Reserve Bank of Chicago, most of the Fed’s rate-hiking policy has already been felt in the broader economy. The labor market will feel a slower impact, with more than half of the total effect on hours worked yet to materialize. However, the report’s authors predict that the existing policy measures should be sufficient to bring inflation close to the Fed’s 2% target by mid-2024—all without triggering a recession.

This could mean that the era of rate hikes is nearing its end, which would likely be a positive development for equities.

Indeed, betting markets seem to believe that the Fed is ready to pause. The probability of the Federal Open Market Committee (FOMC) keeping rates at current levels when its members meet later this month is 95%, according to 30-day Fed Funds futures pricing data. There’s a similarly overwhelming likelihood that rates will be lower one year from now.

Core inflation is reportedly cooling, and this could give the Fed some elbow room. Chair Jerome Powell’s speech at the Jackson Hole Symposium last month was mostly well-received by markets, indicating that the central bank’s policy will remain data-dependent with an aim to tighten only if necessary.

Signs Of Resilience In Manufacturing And Services

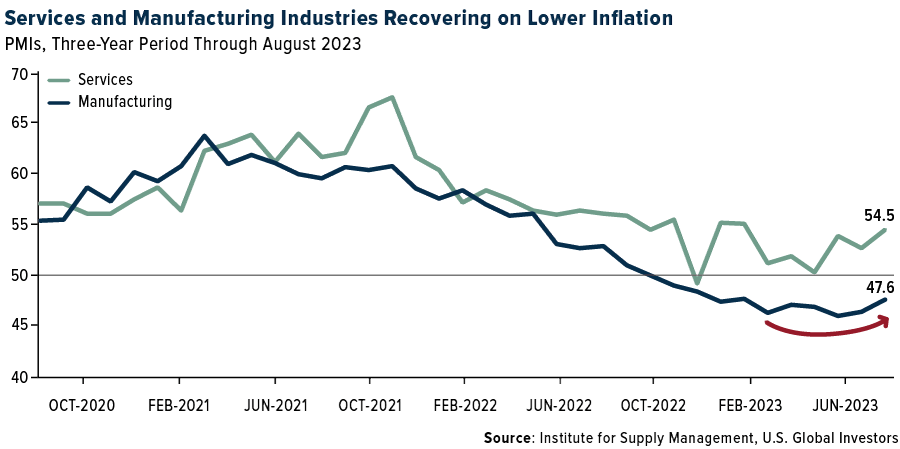

The health of the U.S. manufacturing and services sectors, even as it remains at historically low levels, is also moving in the right direction, suggesting now may be a good buying opportunity.

The Institute for Supply Management (ISM) reported that the Services Purchasing Managers’ Index (PMI) increased for the third consecutive month in August. A PMI above 50.0 indicates expansion, and the index rose from 52.7 in July to 54.5 in August.

(Click on image to enlarge)

On the manufacturing side, conditions remained below the 50.0 mark for the 10th consecutive month in August, despite showing slight signs of improvement. The PMI stood at 47.6, a small increase from July’s 46.4 and the highest reading since February, indicating a slower pace of contraction.

Overall, both sectors are showing signs of resilience and adaptability as prices gradually come under control. For investors eyeing long-term growth prospects, these subtle but positive shifts could mark a favorable entry point.

Investment Strategies For September… And Beyond

September has a reputation for being a tough month for stocks, but the current economic backdrop suggests that this year might be different. Reduced concerns about a recession, signs of a potential shift in Fed policy and positive sector trends all point to the possibility of strategic investment opportunities.

It’s crucial to approach this with a balanced perspective. Diversification remains key, and investors might consider a mix of asset classes, including equities, fixed income, commodities and, of course, gold to hedge against ongoing uncertainties.

As always, investors should remain vigilant, keeping an eye on inflationary pressures and geopolitical uncertainties that could increase volatility into the markets. A well-considered, data-driven investment strategy could be particularly rewarding in the current environment, offering a way to both manage risk and seize new opportunities.

More By This Author:

The Concentration Risk Lurking In Your 401(k)

How The U.S. And EU Are Tackling Airline Emissions Differently

The Top 10 Airlines Ranked By The Number Of Employees