Why Peabody Energy Corp Stock Is A Buy?

Image Source: Pixabay

As part of our ongoing series, each week we will focus on one of the stocks from our stock screeners, and take a look at why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our stock screeners is: Peabody Energy Corp.

Peabody Energy Corp (BTU)

Peabody Energy Corp is a producer of metallurgical and thermal coal. It also markets and brokers coal, both as principal and agent, and trades coal and freight-related contracts. The company operates in the following segment: Seaborne Thermal, Seaborne Metallurgical, Powder River Basin, Other U.S. Thermal and Corporate, and Other.

The Powder River Basin segment generates the majority of the revenue for the company. A substantial part of its overall revenue is generated from its customers in the United States, and rest from Japan, China, Australia, Taiwan, and other regions.

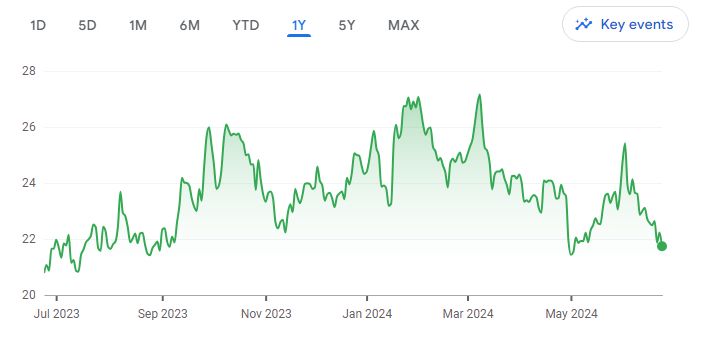

A quick look at the share price history (below) over the past twelve months shows that the price has moved up 4.62%. Here’s why the company is undervalued.

Image Source: Google Finance

Key Stats

- Market cap: $2.93 billion

- Enterprise value: $2.33 billion

Operating Earnings

- Operating earnings: $660 million

Acquirer’s Multiple

- Acquirer’s multiple: 3.50

Free Cash Flow (TTM)

- Free cash flow: $409 million

FCF/MC Yield Percentage:

- FCF/MC yield: 15%

Shareholder Yield Percentage:

- Shareholder yield: 17.20

Other Indicators

- Piotroski F score: 5.00

- Dividend yield percentage: 1.5

- ROA (five-year average percentage): 12

More By This Author:

Coca-Cola Co Valuation: Is The Stock Undervalued?

Mastercard Incorporated DCF Valuation: Is The Stock Undervalued?

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months - Sunday, June 23

Disclosure: None.