Coca-Cola Co Valuation: Is The Stock Undervalued?

Image Source: Pexels

Each week, we conduct a brief analysis on one of the companies in our screens. This week, we thought we’d take a look at a stock that is not currently in our screens, Coca-Cola Co (KO).

Profile

Founded in 1886, Atlanta-headquartered Coca-Cola is the world’s largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee.

Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenue overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

Recent Performance

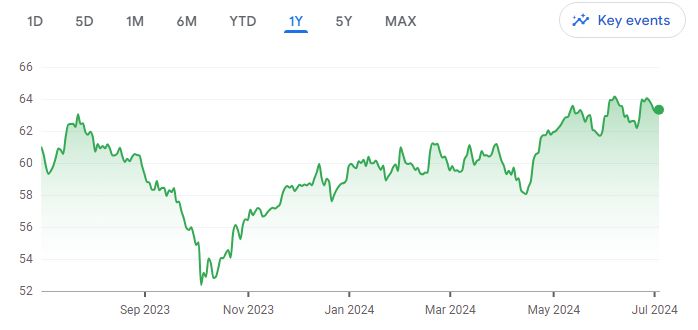

Over the past twelve months, the share price has moved up 3.77%.

Source: Google Finance

Inputs

- Discount Rate: 6%

- Terminal Growth Rate: 2%

- WACC: 6%

Forecasted Free Cash Flows (FCFs)

Terminal Value

- Terminal Value = FCF * (1 + g) / (r – g) = 376.13 billion

Present Value of Terminal Value

- PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 281.06 billion

Present Value of Free Cash Flows

- Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 55.30 billion

Enterprise Value

- Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 336.36 billion

Net Debt

- Net Debt = Total Debt – Total Cash = 25.63 billion

Equity Value

- Equity Value = Enterprise Value – Net Debt = 310.73 billion

Per-Share DCF Value

- Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $72.26

Conclusion

Based on our metrics, the stock is undervalued. The DCF value of $72.26 per share is higher than the recent market price of $63.33. The Margin of Safety is 12.36%.

More By This Author:

Mastercard Incorporated DCF Valuation: Is The Stock Undervalued?

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months - Sunday, June 23

Visa Inc DCF Valuation: Is The Stock Undervalued?

Disclosure: None.