Why One Institution Just Bet $2.3 Million On Bitcoin Miners

Image Source: Pexels

Bitcoin crashed through $100,000 this week. Michael Saylor's Strategy Inc dumped billions in bitcoin holdings. The value of MSTR's bitcoin stash now sits below what they borrowed to buy it.

Every headline screamed bearish. Every technical analyst drew support lines that didn't hold. Every crypto trader watched their portfolio bleed red.

Then on Friday, while bitcoin stayed pinned near its lows, an institution quietly deployed $2.3 million on a single options trade.

The target? Riot Platforms (RIOT), a bitcoin mining stock that tracks crypto prices tick for tick.

The bet? RIOT pushes above $17 by January 16th.

The signal? This wasn't speculation. This was calculated positioning on a stock with elevated short interest, declining volatility, and a technical setup primed for a squeeze.

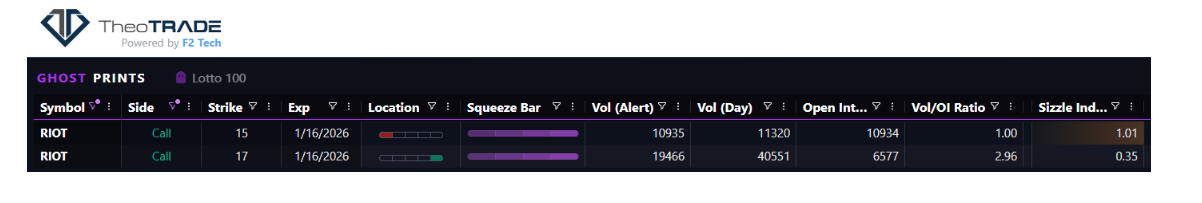

The Ghost Prints Surveillance Console caught it in real-time. And if you know how to read institutional order flow, this trade tells you everything about where smart money sees opportunity right now.

The $2.3 Million Signal

(Click on image to enlarge)

19,300 January 16th $17 calls bought in a single print at $1.18. Nearly $2.3 million in premium deployed in one block trade.

RIOT is a bitcoin mining company. Its stock price tracks bitcoin almost tick for tick. When bitcoin falls, RIOT gets crushed. When bitcoin rallies, RIOT explodes.

But here's what matters: While bitcoin stayed near its lows on Friday, RIOT followed the broader market and rallied hard off $13.

Someone with serious capital saw that divergence and positioned for upside. Not a moonshot bet on new bitcoin highs. Just a calculated wager that RIOT can push above $17 over the next month.

Why This Trade Works

RIOT carries elevated short interest. That creates structural buying pressure when the stock moves higher. Shorts covering adds fuel to any rally.

The institution buying these calls knows this. They're not speculating on bitcoin sentiment. They're positioning for a technical squeeze in a stock with compressed short interest.

The timing also matters. The VIX spiked above 23 on Friday before collapsing into the close. Declining volatility after a spike creates opportunity for defined-risk strategies that capture both directional movement and volatility compression.

When implied volatility is elevated, you can structure spreads that put pricing in your favor. You buy the lower IV, more expensive option and sell the higher IV, less expensive option for a net debit.

That debit becomes your maximum risk. Everything else becomes profit potential with no additional exposure.

The Trade Structure

Here's how to capture the same setup that the institution is targeting:

- Trade Type: Long Call Vertical Spread

- Expiration: January 16th, 2026

- Buy: RIOT $17 Call

- Sell: RIOT $19 Call

- Net Debit: $0.40

This creates a $2-wide spread with defined risk and clear profit potential.

- Max Risk: $0.40

- Max Profit: $1.60

- Breakeven: $17.40

- Target Exit: 50-70% return on risk

The short $19 call reduces your premium cost and caps your upside. But it also defines your maximum loss at $40 per contract. No overnight surprises. No margin calls. Just a clean risk-reward setup that profits if RIOT rallies toward $19.

The Bigger Picture

This trade isn't about predicting bitcoin's next move. It's about recognizing when institutional capital positions against consensus.

The headlines said sell everything crypto-related. The chart patterns said breakdown imminent. The sentiment said stay away.

But the options flow said something different. It said someone with $2.3 million sees value here. They see a technical setup with asymmetric risk-reward. They see a stock ready to squeeze higher if the broader market stabilizes.

That's the edge Ghost Prints provides. It shows you what institutions actually do with their capital, not what they say on CNBC or write in quarterly letters.

When a massive block trade appears on a stock with elevated short interest and declining volatility, you're seeing convergence. Technical setup meets professional positioning. Both pointing the same direction.

More By This Author:

Why Today's Bounce Changes Nothing

Volatility Is Breaking. Trust Nothing.

How To Collect 5% Yields While Tech Bleeds

Neither TheoTrade nor any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered ...

more