Why Today's Bounce Changes Nothing

Image Source: Unsplash

You'll get one day to exit when this breaks.

One massive down day where everyone tries to sell at once.

No bounce after...No recovery...No second chance.

Just a straight drop through every support level while you watch your positions bleed out with no bid.

That's not fear mongering. That's mechanical market behavior that plays out in every major correction.

The market doesn't fall the same way it rises. It climbs methodically. Then it falls through windows.

Right now we're at the edge.

Yesterday's 80-point drop followed by a 70-point bounce?

That's the trap working exactly as designed.

Retail sees a buying opportunity.

I see the final setup before the trapdoor opens.

Here's why this distinction matters more than any market call you'll hear this week.

How Markets Actually Move

Think about the old Milton Bradley board game Chutes and Ladders.

You roll the dice. Land on certain squares and you climb a ladder, jumping ahead multiple spaces.

Land on others and you slide down a chute, losing all your progress.

The market works exactly this way.

The climb up happens methodically. Algorithms defend support levels. Buyers step in on dips. Each pullback gets purchased.

You move from square to square, occasionally hitting a ladder that accelerates the move higher. This can last for months.

But the descent works differently.

When the market breaks, you don't get the luxury of methodical declines. There are no defended levels on the way down. No ladders to climb back up. Just chutes. You

get one massive down day where everyone tries to exit at once. Then another. No bounces. No reprieves.

The asymmetry is brutal.

Markets take the stairs up and the elevator down. This isn't a cliché. It's mechanical behavior driven by how algorithms are programmed and how human psychology responds to fear versus greed.

Why the Asymmetry Exists

Fear moves faster than greed.

Greed accumulates slowly. Buyers add positions gradually. Risk builds methodically. Algorithms walk prices higher in measured increments because that's what keeps the buying program active without triggering velocity stops.

Fear liquidates instantly.

When support breaks, algorithms flip from buy programs to sell programs. Not gradually. Instantaneously. Margin calls hit simultaneously. Stop losses trigger in clusters. The selling pressure becomes self-reinforcing. There's no bid support because the machines pulled it.

This creates the chute.

You drop from 6,000 to 5,700 in two sessions. No bounce. No ladder to climb back up. Just gravity. And by the time you realize what's happening, you're already down 300 points with no clear exit.

The VIX weekly is setting up exactly like it did in April before the last correction. Not predicting anything. Just showing you what happens when volatility breaks out. When fear takes control. When the chute opens up underneath the market.

The Critical Distinction Most Traders Miss

Here's what kills accounts.

Traders treat every dip the same. They buy pullbacks indiscriminately because buying dips has worked for six months straight. The pattern gets reinforced. Algorithms condition retail to buy weakness. Then the structure breaks.

That's when buying the dip becomes financial suicide.

The difference between a ladder and a chute isn't obvious until you're already sliding. But there are signals:

Ladder phase signals:

- Dips get bought within hours, not days

- Volume surges on up moves, dries up on pullbacks

- Support levels hold consistently

- Algorithms defend key price zones

- Bounces return to prior highs quickly

Chute phase signals:

- Bounces fail at resistance immediately

- Volume expands on down moves

- Support levels break without defense

- Algorithms step aside completely

- Lower highs and lower lows persist

The transition from one to the other happens faster than most people react. You think you're in a standard pullback. You're actually in the opening phase of a major unwind.

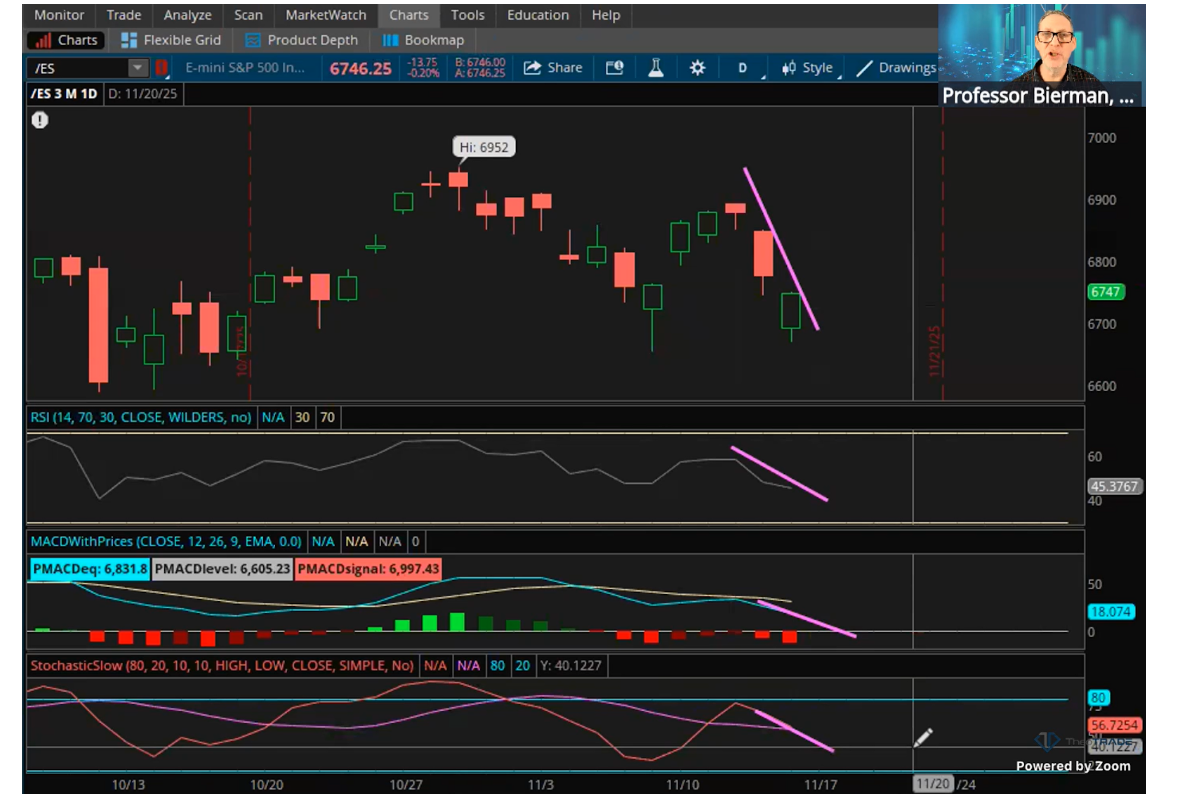

Right now, we're breaking support levels. Making lower lows and lower highs. The bounce today recovered some losses, but the damage is already done. This is what the transition looks like. The market tries to climb back up the ladder, but the rungs keep breaking.

Where We Are Right Now

The market is fighting to stay in ladder mode.

Wall Street is desperate to defend this through year end. Window dressing. Performance bonuses. Fourth Ferrari payments. They need the market higher. So they keep buying the dips. Keep defending the levels. Keep running the same program that's worked all year.

But the structure is weakening.

We're breaking through support levels more frequently. Bearish divergences are building. The RSI on the daily is rolling over. We're threatening the signal line. Once momentum and trend both flip bearish, the algorithmic support disappears.

That's when the chute opens.

You'll get one day where it drops 300 points. No bounce. No ladder. Just down. And everyone who bought the dip at the top is stuck holding positions with no exit. The algorithms won't save you. They'll be the ones selling.

This is why I'm building short positions on every rally. Not because I know exactly when this breaks. Because I know what happens once it does. And I'd rather be positioned early than caught in the chute trying to find an exit that doesn't exist.

The Positioning Edge

You don't need to predict the exact moment the chute opens.

You need to recognize when ladder mode is ending. When the structure is breaking. When algorithmic support is weakening.

Right now, those conditions are building. The market can prolong this through December. Maybe. But every day we stay elevated increases the severity of the eventual drop. The higher you are on the board when you hit the chute, the farther you fall.

Most traders will wait for confirmation. They'll want to see the break happen first. By then, it's too late. You're already sliding. No exit available. That's how chutes work.

I'm positioning now. Building shorts methodically. Taking profits on longs. Not because I'm bearish on everything. Because I understand how markets fall. And they don't give you time to react once the chute opens.

The game is different on the way down. No ladders. Just slides.

More By This Author:

Volatility Is Breaking. Trust Nothing.How To Collect 5% Yields While Tech Bleeds

Expected Move Predicts Every Market Turn

Neither TheoTrade nor any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered ...

more