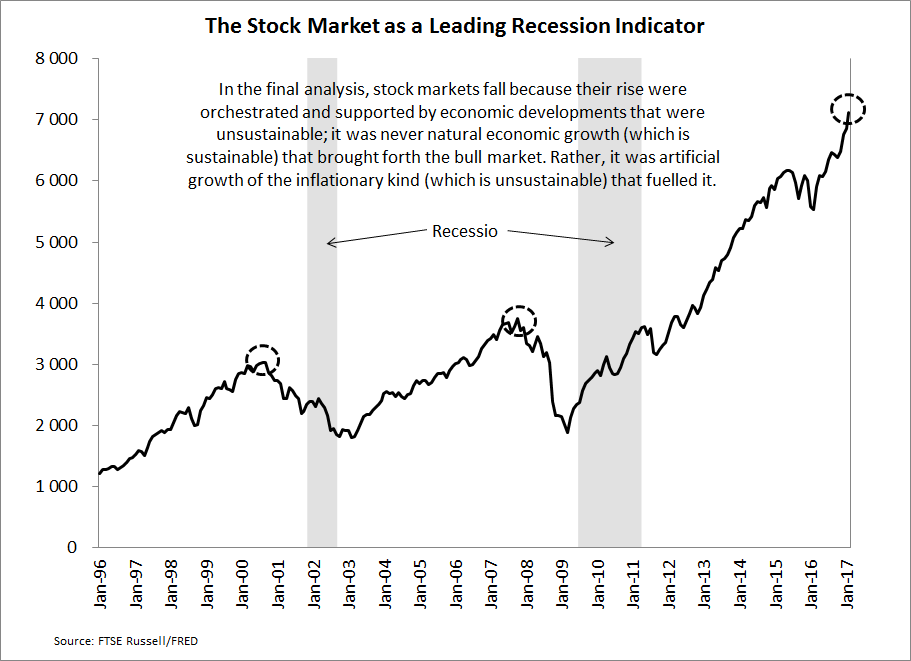

Why Does The Stock Market Peak Prior To A Recession?

Is not a rising stock market an indication that the economy is doing well? Contrary to popular opinion, an ever rising stock market is not an indicator of a prospering economy. If anything, it is a sign of a sick one. A surging stock market does not create real wealth for an economy. All it ever accomplishes is to shift the distribution of wealth and facilitate yet more money creation. As a continuously rising stock market over longer periods can only be brought about by inflationary policies (i.e. an increase in the quantity of money) and as inflationary policies can only serve to inflict damage on economic progress, a rising stock market over extended periods is a symptom of a regressing economy rather than a progressing one.

Therefore, the real damage to the economy has in fact already been inflicted during the bull market as the many living on Real Street only know too well. A recession as defined by mainstream economists (two consecutive quarter of declining GDP growth) is fast approaching in my opinion. From a non-mainstream perspective, there never truly was a rebound, just the appearance of one driven mostly by monetary expansion.

Disclosure: None

Good insight! I agree that inflationary policy is more damaging than beneficial. Nonetheless, increasing stock prices and record high indices indicates that blue-chip companies have been becoming more profitable, thus more lucrative to investors. Sustainable growth is the corner stone of any stable economy. In order to achieve sustainable growth the market must operate independent of interest rates and curb credit expansion in order to have a "REAL" economy.