Which AI Stocks Are Actually Profitable?

Image Source: Unsplash

On the drive home from our day-cation in Helen Georgia this past weekend, my wife and I started talking about AI and the various ways technology is affecting the world we live in.

(By the way, you should check out Angela’s newsletter on AI’s role in education — It has challenged the way I think about many of the issues we grapple with today!)

Angela’s question brings up an important point when it comes to the AI stocks we’re tracking in today’s market.

Investors have been very excited to buy just about ANY stock with ties to artificial intelligence. In fact, the AI expansion reminds me of the early days of my career, when a stock could add many multiples to its valuation simply by adding “dot com” to its name or launching an e-commerce site.

But while AI stocks have had a tremendous year so far, we’re starting to see some key divergences in how different names in this area are trading. And one of the key differentiators is whether a company actually turns a profit (or has a near-term plan for profits)… versus AI companies that are investing heavily without a prospect of earnings in the foreseeable future.

Now that investors are being more picky about which AI stocks they drive higher, it’s time for you to to zero in on the stocks with the best probability of giving you a positive return heading into the end of the year.

Infrastructure versus Implementation

Bespoke Investment Group has created two helpful groups of AI stocks.

Infrastructure AI companies provide the necessary hardware and resources to enable AI processes to work and to allow the technology to continue to evolve. I like to think of these companies as the “outfitters” of the AI goldrush — selling picks and shovels to the speculators who are setting out to mine the gold.

You’re probably familiar with many of these stocks which include computer chip designers and manufacturers, data center companies, companies that make networking equipment, and other adjacent businesses.

Implementation AI companies are in the process of creating new technologies that use AI technologies. These are the cutting edge large language models, the chatbots, the virtual and augmented reality systems and other high-tech innovators.

By nature, many of these companies are investing heavily in development, without seeing returns yet. So naturally many of the companies in this area are not yet profitable and for some, profitability isn’t even on the near-term radar.

For investors and traders, profitability isn’t always necessary to generate returns (at first). Stocks can have tremendous runs even before companies generate a profit as investors start to account for the value being built.

But unprofitable companies often carry more risk because of the high expectations built into their stock prices. Any disappointment can cause a crisis of confidence, driving share prices sharply lower. And without true earnings to solidify some concrete source of value, it’s difficult for investors to determine a “fair” price to start buying again.

So today, as investors start looking more carefully at fundamental valuations and profit projections, it’s important to do more qualitative work with each investment rather than simply looking at the exciting technology a certain company may be bringing to market.

With that in mind, let’s quickly look at these baskets of AI stocks as organized by Bespoke…

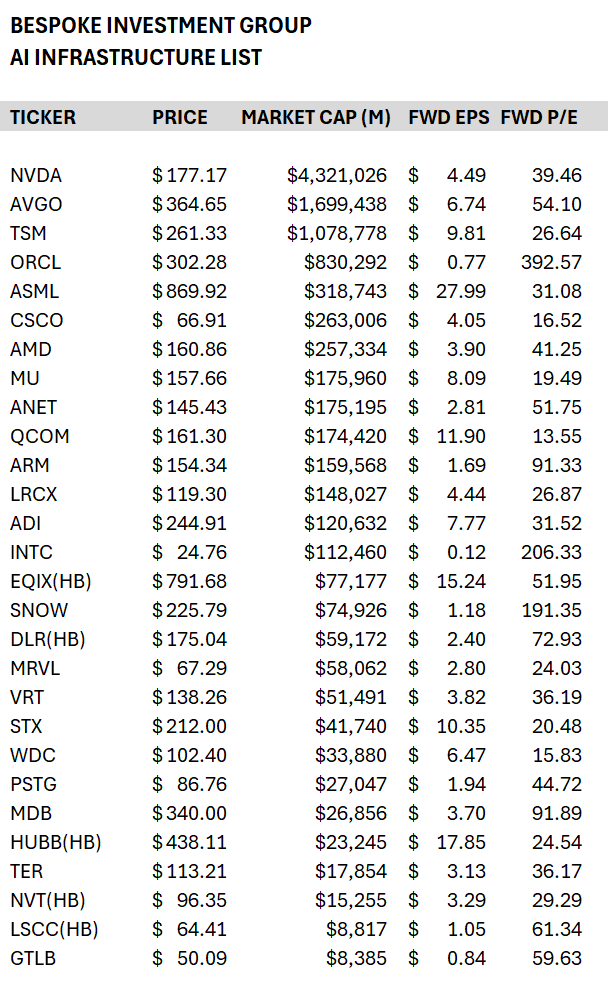

First, I’ve taken the AI Infrastructure List and sorted by market cap. I’ve included the forward earnings expectation for each company, and a forward price / earnings (or P/E) figure. This essentially tells us how much we’re paying for every dollar of profit each company is earning.

Please note, there are many different variables to consider. For example, some companies are growing more quickly than others. Some are undergoing a turnaround process. Some have fiscal year ends at a different time of year. So not every stock is an apples-to-apples comparison. But this table can be a good start for your AI investing watch list.

Next, we have the implementation basket…

You’ll notice that many of these stocks have much higher valuations. That’s because investors are paying rich prices because they have high expectations for future growth. And while these expectations may pay off, it’s important to reiterate that high valuations come with substantially more risk — especially during periods when investors are paying closer attention to fundamentals and valuation metrics.

One of the biggest concerns I hear across multiple research sources is whether the billions invested in rolling out AI computing capacity will ultimately pay off in higher profits for the corporations making the investments.

As is usually the case with developing industries, there will be a handful of huge winners that will leave investors with large profits. And there will be a playing field littered with “also-rans” — companies that were part of the AI landscape for a time, but didn’t have the innovation, the capital, or the influence to sustain their business.

We’ll do our best to find the winners and to lock in our share of profits along the way!

More By This Author:

The Worst Investment Advice

Get Ready, Inflation Is About To Get Worse

The AI Cannibal Trade