Get Ready, Inflation Is About To Get Worse

Image Source: Pixabay

This morning’s data sealed the deal… The Federal Reserve MUST steadily cut interest rates heading into the end of the year.

Here’s my favorite tool for projecting Fed rate cuts.

In case you missed it, the Consumer Price Index (CPI) rose 0.4% for the month of August. And for the past 12 months, prices are up 2.9%.

Looking at just the core CPI (which excludes food and energy), inflation is up 3.1%. Both are well above the Fed’s 2% inflation target.

Meanwhile, weekly jobless claims came in hot with 263,000 workers filing for unemployment benefits. This was well above the 235,000 estimate and up 27,000 from last week’s reading.

The jobs report is particularly sobering after learning that the BLS overreported the number of jobs created last year (ending March 2025) by 911,000. In other words, the data is pointing to significant deterioration in the job market which is a very sobering challenge for our economy.

Given the magnitude of job losses (or phantom jobs that weren’t actually created), the Fed must now shift course and do its best to stimulate the economy. If it doesn’t, businesses could lose confidence, start laying off employees, and the end result would be a challenging recession.

With this backdrop in mind, let’s look at what will happen as the Fed restarts its rate-cutting campaign.

Rate Cuts = A New Wave of Inflation

Lower interest rates are designed to stimulate economic activity.

With lower rates, prospective home buyers will sign contracts… Small businesses will be able to borrow at cheaper prices… (They can then expand and hire more workers)… Consumers pay less on credit card balances or personal loans… There is less of an incentive to save (because yields are lower)…

Essentially, lower rates give consumers and businesses an incentive to spend cash!

But what happens when more cash is spent??

Well, unless the supply of goods and services increases, Economics 101 tells us that prices must go up! In other words, inflation will pick up.

CNBC posted this inflation chart which shows that inflation has started to increase in recent months. It’s important to note that inflation has already started to rise without the Fed cutting rates.

So once the Fed starts to cut interest rates, these inflation numbers are likely to move even higher.

We may not see inflation back in the 7% to 9% range from 2022. But even a 1% or 2% increase would have a dramatic effect on financial markets.

Here’s How to Profit…

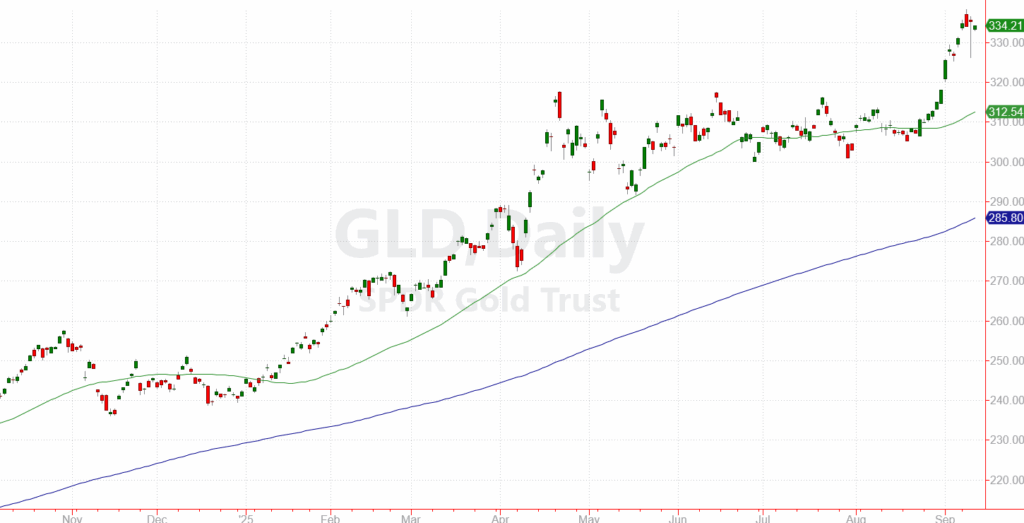

The first and most obvious way to profit from rising inflation is with an investment in gold. And while the price of gold has already advanced quite a bit over the past few years, we could have a long way to go!

(Click on image to enlarge)

At this point, most investment advisors still aren’t including a meaningful precious metal allocation in client accounts. So as inflation picks up and gold continues its run, customers will start asking for more exposure — which could drive significantly more buying pressure.

Meanwhile geopolitical concerns and trade challenges creates more of an incentive for central banks around the world to buy gold — and this represents a tremendous amount of demand that could push gold prices substantially higher.

I would use any pullback in gold to add to positions. And I’ve personally been using option contracts on the SPDR Gold Trust (GLD) to aggressively trade this move.

Silver is another great way to play this trend, especially because silver is both an industrial metal used in many healthcare and technology processes — as well as a precious metal that can hedge against inflation. Consider the iShares Silver Trust (SLV) as a great proxy for your silver investment.

Dividend stocks also perform well during periods of lower interest rates and higher inflation. That’s because the yields on these stocks become more attractive when treasury yields and savings account rates are lower. And many stocks in this category also have businesses that grow profits when prices increase.

I’ll continue to search for the best ways to protect your savings from inflation.

Please don’t sit on your hands and allow rising inflation to erode the value of your wealth. It’s dangerous to hold cash in today’s environment. But putting that cash to work can help you preserve the value of your hard-earned savings.

More By This Author:

The AI Cannibal Trade

Finally, Credit Card Companies Feel The Pain…

Beware The Summer Squall