Beware The Summer Squall

Image Source: Pixabay

I’m flying home from Baltimore and received the following notice from Delta this morning:

“Our meteorology team is forecasting inclement weather in the Northeastern U.S. area that could impact your upcoming flight…”

Good thing I’m not afraid of a little turbulence! (Although I DO hope I don’t get stranded in an airport somewhere waiting for the weather to clear.)

As we wrap up another positive month in the market, forecasters are also predicting some turbulence for investors! You see, the months of August and September have historically been the weakest months in the markets, which means there is an elevated risk of a late-summer pullback.

If you’ve been keeping your capital at work and profiting from this bull market, congratulations! Sitting on your hands and sticking with a bullish market is actually harder than you might think. It’s so tempting to take profits too early and wind up missing a big part of the move higher.

Which brings up a conundrum as we head into this seasonally turbulent period.

Should you lighten up on your positions to protect your capital (and potentially miss out on what has become a very strong bull market)?

Or should you “stay the course” and keep your investments intact (knowing that you’ve got an elevated risk of giving some of your profits back if things get dicey in August and September)?

Today, I want to share the strategy I’m using to protect my own investment capital, while still participating in the market’s bullish run.

Buying Insurance For Your Portfolio

If you drive a car, you should always have auto insurance… If you live in Florida, it’s wise to have hurricane insurance. And if you’re an investor, I think you should own some “portfolio insurance!”

Option contracts give investors many different ways to accelerate profits and to protect capital in all different market environments. You just have to understand how these tools work and how they match with YOUR investment approach.

One of the simplest ways to protect your investment wealth is to buy a put contracts on stocks that could be vulnerable if the market trades lower.

When you buy a put contract, you’re buying the right to sell shares of stock at a specific price. For example, you might have the right to sell 100 shares of Wal-Mart (WMT) at $100.

If the stock trades sharply lower, your right becomes more valuable. Think of it this way… If WMT fell to $70 but you had the right to sell them at $100, that right would be worth $30! (After all, you could buy the stock in the open market at $70 and then sell shares at $100 — for a net profit of $30.)

If you own a put contract, the price of that put contract will rise as the stock trades lower. So if the broad market weakens in August and September, owning these put contracts could generate profits that would help offset potential losses from your traditional investments.

See why these put contracts act like an insurance policy for your investments?

The big question is… which stocks should you use for these put contracts?

Picking Stocks that are Likely to Fall

One of the most important characteristics I look for when selecting stocks for portfolio insurance is “relative strength.”

I want to buy put contracts on stocks that are not holding up as well as the market… Or put another way, stocks that are weak “relative” to the rest of the market.

The logic is this… If these stocks can’t manage to perform well during a bull market, imagine what will happen when the broad market turns lower. Often, these “relatively weak” stocks wind up trading sharply lower once the market turns. And that gives us significant profits from owning put contracts on these stocks.

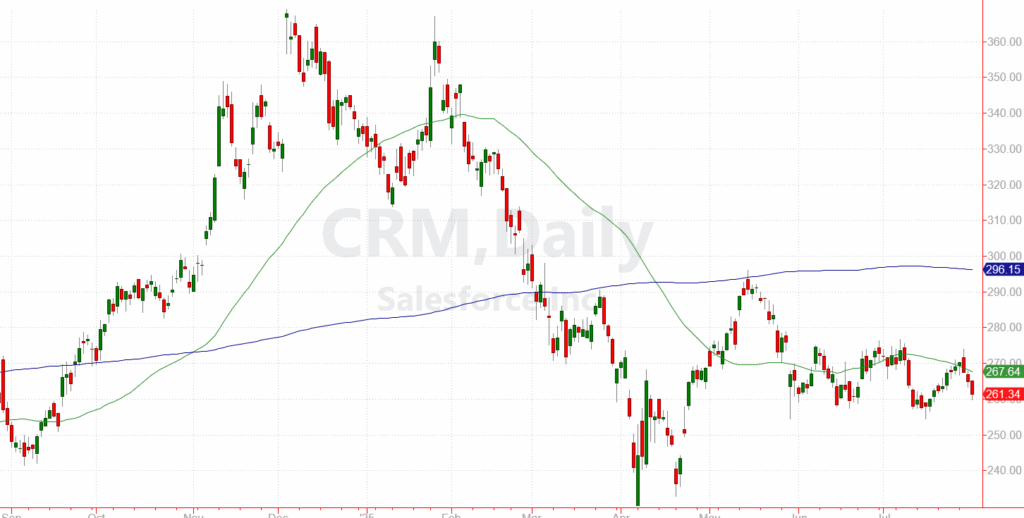

Here’s an example… Shares of Salesforce Inc. (CRM) have been under pressure this year. While the company theoretically should benefit from a strong economy and business investment, something is keeping investors from buying shares and pushing the stock to new highs.

(Click on image to enlarge)

The relative weakness is what drew my attention to CRM. And as I did more research, I realized that customers implementing AI won’t need as many licenses from CRM — which means demand for the company’s software is weaker than expected.

Buying put contracts on relatively weak stocks like this can go far in helping you protect the value of your investment account during turbulent market periods.

Meanwhile, if you own some insurance via put contracts, it can give you more confidence to continue to hold profitable positions that keep moving higher over the long run. So you’ll be able to continue to ride the bullish trend that I continue to have a lot of confidence in.

More By This Author:

The Best Option Strategy To Maximize Profits

An Investor’s Primer On Quantum Computing Stocks

An Investor's Primer On Quantum Computing Stocks

Disclosure: I have a personal position in CRM. I purchased put contracts as part of my Speculative Trading Program.