Which AI Stock, Nvidia Or Broadcom, Is The Better Bargain To Buy?

Image Source: Pexels

Advancements in artificial intelligence (AI) have made Nvidia Corporation (NVDA - Free Report) a Wall Street darling for some time. On the other hand, Broadcom Inc.’s (AVGO - Free Report) recent share repurchase plan, along with its planned moves to capitalize on the growing AI field, has delighted income-oriented investors.

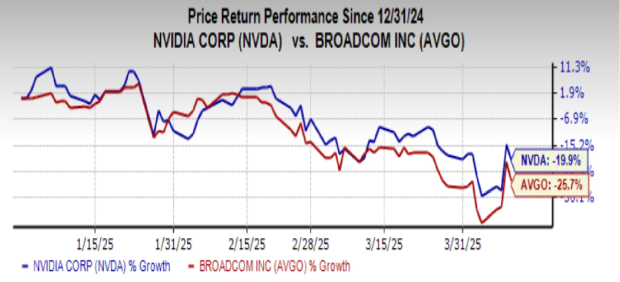

However, the latest trade war between the United States and several other countries has caused market turmoil, with shares of Nvidia and Broadcom declining 19.9% and 25.7% year to date. This presents an opportunity to buy these quality stocks at a discounted price for long-term gains. But which stock is the better bargain? Let’s explore –

Image Source: Zacks Investment Research

Reasons to be Bullish on Nvidia Stock

Nvidia leads the growing graphics processing unit (GPU) market with over 80% share, giving the Jensen Huang-led company a competitive edge over its peers. More than Advanced Micro Devices, Inc.’s (AMD - Free Report) ROCm software platform, Nvidia’s CUDA software platform is in demand among developers.

At the same time, there is an insane demand for Nvidia’s new Blackwell chips among notable tech firms due to their energy efficiency and faster AI interfaces. The older Hopper chips also maintain steady demand due to their higher quality compared to rival Intel Corporation’s (INT - Free Report) chips.

Nvidia, meanwhile, is well-poised to make the most of the increase in AI data center spending. Top cloud computing stocks are fulfilling the increase in demand for AI workloads by acquiring GPUs and are spending $250 billion on AI data center infrastructure. One of Nvidia’s prominent customers, Microsoft Corporation (MSFT - Free Report) , may have reduced data center spending, but Alphabet Inc. (GOOGL - Free Report) and Amazon.com, Inc. (AMZN - Free Report) are now supporting Nvidia in this aspect.

Reasons to be Bullish on Broadcom Stock

Broadcom expects the demand for its custom AI accelerator to increase in the near future and the market size for its execution processing units (XPUs) to touch $60-90 billion by fiscal 2027, way higher than last year’s $12.2 billion.

Broadcom’s XPUs can work on a particular workload and even outdo Nvidia’s GPUs. Moreover, they have the competence to perform tasks more affordably than GPUs. Thus, banking on the rise in demand for accelerator chips, Broadcom is now developing a 2-nanometer AI XPU, which is unique. The company’s application-specific integrated chips (ASICs), known to support AI and machine learning, are witnessing strong demand as well.

NVDA or AVGO: Which Stock is a Better Bargain Buy?

No doubt, with GPUs and XPUs gaining popularity in the coming years, and AI infrastructure spending increasing, the future does look bright for both Nvidia and Broadcom. However, from a long-term perspective, Nvidia is a better choice than Broadcom.

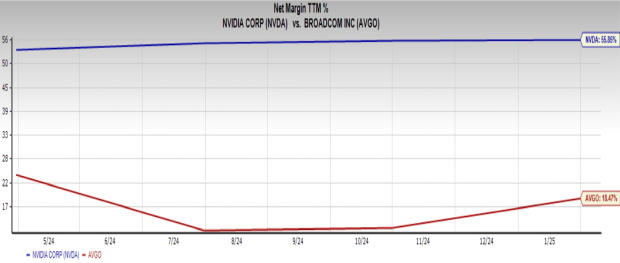

This is because Nvidia has been able to generate profits more proficiently than Broadcom, with its net profit margin coming in at 55.9%, more than AVGO’s 18.5%.

Image Source: Zacks Investment Research

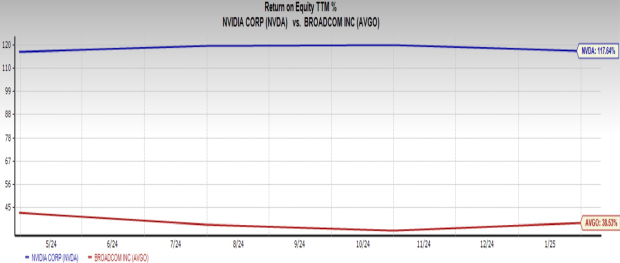

Nvidia has also been able to control its expenditures and generate profits in a much better way than Broadcom since its return on equity (ROE) of 117.6% outshined AVGO’s 38.5%.

Image Source: Zacks Investment Research

But from a short-term viewpoint, Broadcom has an upper hand over Nvidia. After all, Broadcom is a solid dividend payer, which is indicative of a better-quality business that can keep the company immune to the current market vagaries.

Broadcom has increased its dividends 6 times over the past five years, and its payout ratio sits at a healthy 52% of earnings. Broadcom also has sufficient cash balance to pay off its dividends.

On the contrary, Nvidia’s payout ratio sits at a paltry 1% of earnings and the company increased dividends only once in the past five years.

Nvidia presently has a Zacks Rank #2 (Buy), whereas Broadcom carries a Zacks Rank #1 (Strong Buy).

More By This Author:

4 Agriculture Operations Stocks To Watch Amid Positive Industry Trends

These Construction & Industrial Products Stocks Are Poised To Soar: EME, MTH, STRL

Will Delta Air Lines Stock Keep Flying After Beating Q1 Expectations?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more