Will Delta Air Lines Stock Keep Flying After Beating Q1 Expectations?

Image Source: Pixabay

Able to exceed its Q1 expectations on Wednesday, Delta Air Lines (DAL - Free Report) stock got a further boost as President Trump’s decision to temporarily rescind reciprocal tariffs on most countries (Outside of China) sent markets soaring.

With the 90-day tariff recension serving as a further catalyst following Delta’s favorable Q1 report, DAL shares skyrocketed +23% in today’s trading session. That said, Delta’s stock is still down 26% year to date and investors are surely wondering if the sharp rebound can continue.

Image Source: Zacks Investment Research

Delta’s Q1 Results

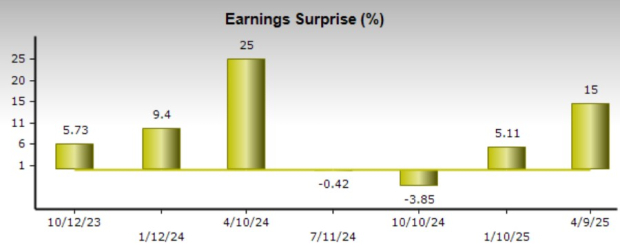

Providing one of the first glimpses of the Q1 earnings season, Delta reported first-quarter sales of $14.04 billion, topping estimates of $13.8 billion and rising from $13.74 billion a year ago. On the bottom line, Q1 net income came in at $240 million, or adjusted earnings of $0.46 per share which topped estimates of $0.40 by 15% and was slightly up from EPS of $0.45 in the comparative quarter.

Notably, Q1 operating cash flow was at $2.4 billion with Delta's operating income at $569 million, on an operating margin of 4%.

Image Source: Zacks Investment Research

Delta’s Cautious Guidance

Due to broader economic uncertainty around global trade, Delta CEO Ed Bastian stated the company plans to protect margins and cash flow by reducing planned capacity growth in the second half of the year while actively managing costs and capital expenditures.

Given the lack of economic clarity, Delta did not provide a full-year outlook but expects Q2 probability between $1.5 billion-$2 billion and EPS in the range of $1.70-$2.30 which came in below the current Zacks Consensus of $2.62 per share or 11% growth. Delta expects Q2 sales at $16.3 billion-$17 billion, and in range of the Zacks Consensus of $16.71 billion or 0.3% growth.

Delta’s Cheap Valuation

Following the YTD drop in DAL shares, what certainly attracts long-term investors to Delta’s stock is the company’s cheap valuation. Trading at $44, Delta’s stock is at a 5.2X forward earnings multiple which is below its Zacks Transportation-Airline Industry average of 7.5X and is roughly on par with American Airlines (AAL - Free Report) and United Airlines (UAL - Free Report).

Furthermore, DAL trades at just 0.3X sales and well below the optimum level of less than 2X with the industry average at 0.5X.

Image Source: Zacks Investment Research

Bottom Line

For now, Delta’s stock lands a Zacks Rank #3 (Hold). While it wouldn’t be surprising if the rally in DAL were to continue, more upside may largely depend on the trend of earnings estimate revisions in the coming weeks as analysts digest the company’s cautious guidance and the temporary rescission of Trump’s reciprocal tariffs.

More By This Author:

Still Time To Buy Coca-Cola Stock As A Defensive Hedge?3 International E&P Stocks To Watch In An Undervalued Industry

2 Furniture Stocks To Watch Defying The Industry Downturn

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more