Where We Go After Wednesday's Rally

AI-Generated Image

One Reason To Be Bullish

After Wednesday’s rally sparked by Fed Chairman Powell’s comments that December’s rate hike would likely be smaller than 75 basis points, the S&P 500 did something it hadn’t done in seven months: rise above its 200-day moving average, as market technician Ryan Detrick pointed out below.

S&P 500 closed above the 200-day MA for first time in more than 7 months.

— Ryan Detrick, CMT (@RyanDetrick) November 30, 2022

Looking at the previous 13 times (since '50) it was beneath this trendline for 6 mos or more and closed above showed only once did it move back to new lows.

Up avg 18.8% yr later and higher 12/13 times. pic.twitter.com/cqeOJahm1L

Detrick noted that 12 out of the 13 times the market was below that trendline for 6 months or more, the following year was bullish, with stocks finishing up an average of 18.8%.

A Reason To Be Bearish

In response, though, a pseudonymous Twitter user suggested today’s market environment most closely resembles the one time this pattern was followed by a steep loss: March of 2002, when the market was trading at a similarly high cyclically adjusted price/earnings ratio (CAPE) as it is now.

Aw heck, I can't wait...

— Pitfall Harry (@JKD_ff) November 30, 2022

The answer is just once, in March of 2002 when the CAPE was at an almost identical level to today

Shockingly (not), this was your "only once did it move back to new lows"

How much lower? Straight down 30%+, bounce, then low, down 33.9%

Another Reason To Be Bearish

Another reason to be bearish is Morgan Stanley CIO’s warning about downward earnings revisions hitting the market early next year. On CNBC this week, Wilson predicted stocks could drop to 3,000 on the S&P in the first third of next year, about a 25% drop from current levels.

Video Length: 00:08:01

Navigating The Uncertainty

Although Wilson predicts a correction in early 2023, he argues against going to cash now, as CNBC wrote in their write-up of the interview above:

“This is not a time to sell everything and run for the hills because that’s probably not until the earnings come down in January [and] February,” he said.

Wilson expects bullish tailwinds to push stocks higher over the next few weeks.

“It’s our job to call these tactical rallies. We’ve got this one right,” Wilson said. “I still think this tactical rally has legs into year end.”

CNBC

Our general approach to this sort of uncertainty is the hedged portfolio method: buy and hedge a handful of names that meet these two criteria:

- High potential returns over the next six months

- Cheap to hedge relative to those potential returns.

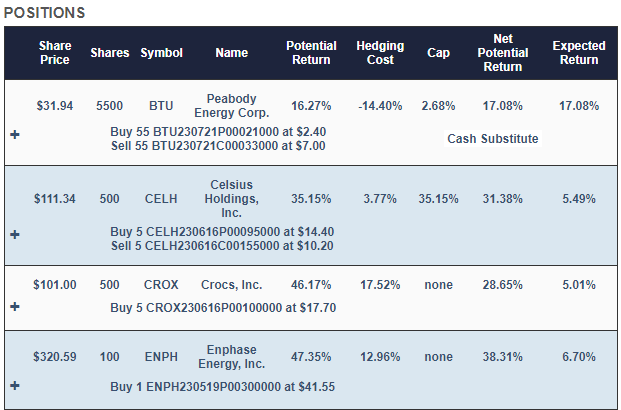

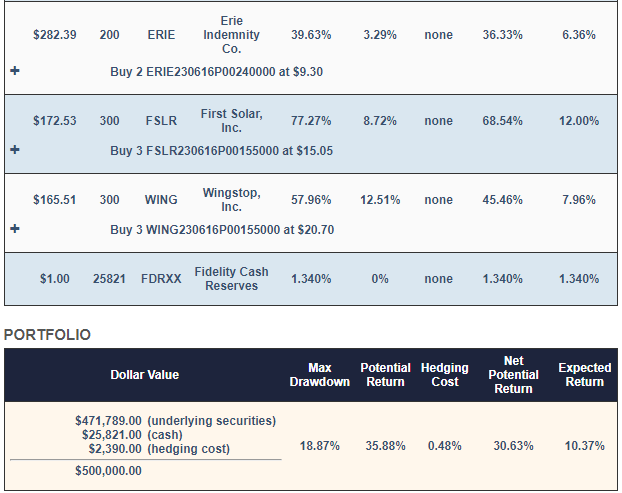

Using that approach as of Wednesday’s close, this is the portfolio our system presented to users who had $500,000 to invest and were unwilling to risk a drop of more than 20% over the next six months (you can use this approach for dollar amounts as low as $30,000, but the output would be a bit different).

Screen captures via Portfolio Armor on 11/30/2022

Our system started out by putting roughly equal dollar amounts into a handful of its current top names as ranked by its estimates of potential returns net of hedging cost: Celsius Holdings, Inc. (CELH), Crocs, Inc. (CROX), Enphase Energy, Inc. (ENPH), Erie Indemnity Co. (ERIE), First Solar, Inc. (FSLR), and Wingstop, Inc. (WING). Then, it rounded down those dollar amounts to round lots of shares (divisible by 100) to lower hedging costs and used a tightly collared position in Peabody Energy Corp (BTU) to absorb most of the cash leftover from the rounding-down process.

If each one of those stocks went to $0, that portfolio would be down less than 19%; if they all do as well as our high-end potential return estimates, it’ll be up about 30% in six months; a more likely return would be about 10%, depending on market conditions.

Smoothing Out Returns

The portfolio above is meant to last six months, so the simplest approach here would be to open that portfolio, go to cash in six months, and open another. But if you want to smooth out your returns a bit, you could put half of your money in a portfolio like that now, and then put the other half in three months. You’d still hold each portfolio for six months, but you’d get twice as many entries in a year.

More By This Author:

Theft At FTX

Fading The Post-CPI Rally

An Eventful Week For Sam Bankman-Fried

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more