What's Going On With The Mag 7?

Image Source: Pixabay

The Mag 7 group has been at the forefront of many market headlines over the last year, with their robust performance and quarterly results consistently exciting the market.

And over the last several weeks, three members of the club – Nvidia (NVDA - Free Report), Apple (AAPL - Free Report), and Amazon (AMZN - Free Report) – have seen increased search activity, with investors clamoring to know more. Given their current popularity, let’s take a quick look at how each company currently stacks up.

Nvidia

Investor-favorite Nvidia has faced some pressure recently amid a broader cooldown in the AI trade. Still, shares are up a staggering 130% year-to-date, and its earnings outlook remains positive across the board.

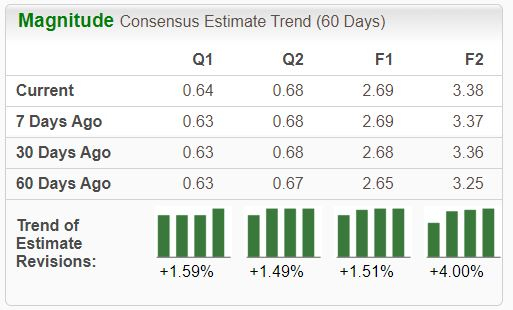

Image Source: Zacks Investment Research

The $2.69 per share expected for its current year suggests a 100% year-over-year pop in earnings, with sales also expected to see a 90% increase. The company’s sales growth has been remarkable thanks to unrelenting demand for chips needed for AI applications.

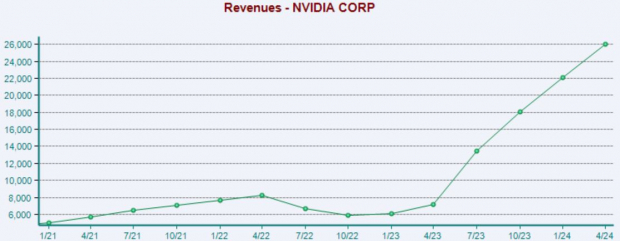

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Apple

Apple shares were scrutinized for their slow start to 2024 but have picked up considerable steam lately, up 14% overall YTD. Worries surrounding China and falling behind in AI weighed on performance, though its recent set of quarterly results brought post-earnings positivity.

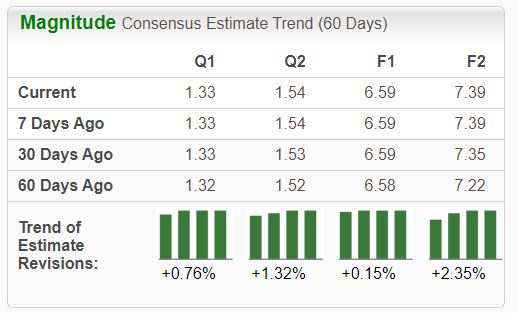

The stock is a Zacks Rank #2 (Buy), with earnings expectations ticking higher across the board.

Image Source: Zacks Investment Research

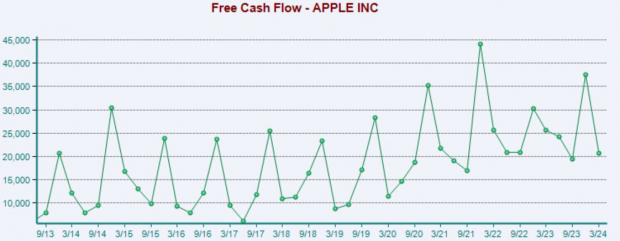

Strong cash-generating abilities have allowed consistent dividend growth, with Apple recently delivering its 12th consecutive year of higher payouts. Shares yield a modest 0.5% annually, though the company’s 4.9% five-year annualized dividend growth shows a commitment to increasingly rewarding shareholders.

Free cash flow totaled $20.7 billion throughout its latest period.

Image Source: Zacks Investment Research

Amazon

Favorable quarterly results that have recently revealed a reacceleration in AWS has sparked positivity for Amazon shares in 2024, with the stock currently holding a favorable Zacks Rank #2 (Buy).

AMZN was firing on all cylinders throughout its latest period, with operating income of $15.3 billion 220% higher than the $4.8 billion mark in the same period last year. As mentioned above, AWS delivered great results, with net sales of $25 billion showing 17% year-over-year growth and snapping a recent streak of negative surprises on the metric.

The outlook for Amazon’s current fiscal year has remained bright, with the $4.59 Zacks Consensus EPS estimate for its current fiscal year suggesting 60% year-over-year earnings growth.

Image Source: Zacks Investment Research

Bottom Line

All three stocks above – Nvidia, Apple, and Amazon – have remained at the forefront of investors’ minds, all holding a spot in the beloved Mag 7 group.

While the stocks have faced pressure as of late, their fundamentals remain strong beneath the hood, with outlooks also remaining positive. The recent pressure is likely a reflection of profit-taking after remarkable runs, with recent small-cap strength also weighing on their performances.

More By This Author:

Airliner Earnings: Should You Buy?

Mag 7 Earnings: 2 Reports Coming This Week

These 3 Small Caps Boast Big Growth Profiles