Airliner Earnings: Should You Buy?

Image Source: Unsplash

We’ve got a heavy slate of earnings reports this week, as many different pockets of the economy are being represented. So far, we’ve seen Q2 results from a fair number of S&P 500 companies, with earnings for these index members up 8.7% on 5.2% higher revenues.

The overall earnings landscape is expected to remain positive, aided by another strong showing from technology.

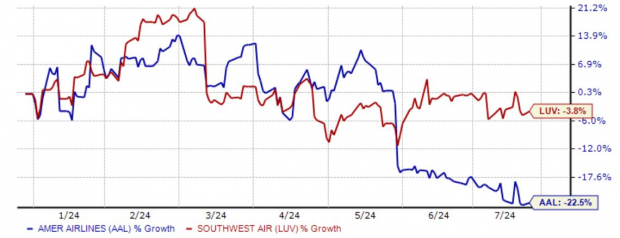

This week, several airliners, namely American Airlines (AAL - Free Report) and Southwest Airlines (LUV - Free Report) are on the docket. Both stocks reside in the red YTD, with American Airlines’ decline much more pronounced.

Image Source: Zacks Investment Research

We can use recent results from a peer, United Airlines (UAL - Free Report), as a small guide. Let’s take a closer look at what investors can expect from the pair.

United Airlines Beats EPS Expectations

United Airlines exceeded the Zacks Consensus EPS estimate but modestly fell short of sales expectations, with shares seeing a slightly positive reaction post-earnings. Earnings fell 18% year-over-year, whereas sales showed nearly 6% growth.

The results overall reflected consumers’ continued travel demands, with UAL flying the most customers in its history for Q2. Capacity was also up 8.3% from the year-ago period, and the company also posted a record for customers carried in a single day at 565k.

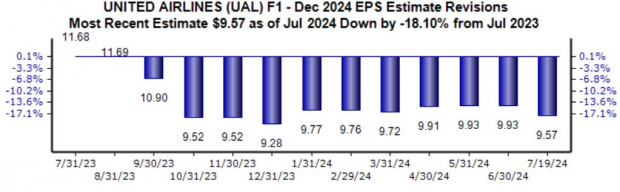

It was a decent quarter for the company, and shares have enjoyed positive price action since. Still, analysts lowered their earnings expectations for UAL’s current fiscal year following the release, as illustrated below.

Image Source: Zacks Investment Research

While recent share performance has been favorable, analysts’ revisions post-earnings certainly raise questions about the sustainability of the trend.

Southwest & American Airlines

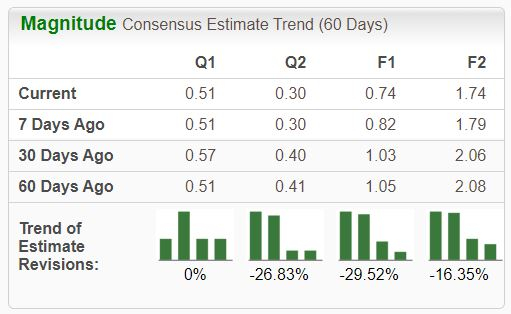

Both Southwest and American Airlines have seen negative earnings estimate revisions for their respective releases, with both expected to have lower earnings relative to the year-ago periods. In fact, Southwest is currently a Zacks Rank #4 (Sell), whereas American Airlines is currently a Zacks Rank #5 (Strong Sell).

Southwest Airlines Revisions Snapshot –

Image Source: Zacks Investment Research

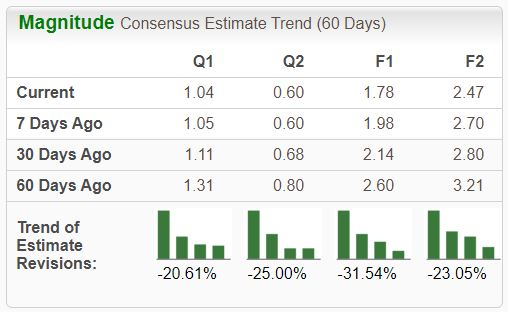

American Airlines Revisions Snapshot –

Image Source: Zacks Investment Research

The negative revisions pictures paint a cloudy near-term picture for each’s share performance, partly explaining their weak YTD action. However, it’s worth noting that favorable guidance could usher in positive earnings estimate revisions, which would support post-earnings positivity.

Should You Buy?

While United Airlines has seen a bit of post-earnings positivity following its quarterly release, the negative revisions that have followed warrant some scrutiny. United’s results reflected continued consumer strength regarding travel, though the company’s profitability was crunched significantly.

Both Southwest Airlines and American Airlines saw negative earnings estimate revisions following United’s release, not a positive development. Due to their cloudy earnings pictures, investors would be better off staying on the sidelines and should instead focus on stocks enjoying positive earnings estimate revisions.

More By This Author:

Mag 7 Earnings: 2 Reports Coming This WeekThese 3 Small Caps Boast Big Growth Profiles

Ride Bullish Momentum With These 3 Stocks