What You Missed, And What's Coming In The Week Ahead

Image Source: Pixabay

The election is in the rear-view mirror faster than expected. The House is still up in the air. But what matters now is how the market will take the Fed's recent policy decision as earnings continue. Let’s get to the week ahead.

Monday, Nov. 11, 2024

- Event: Bond market holiday & Rivian IPO anniversary

- Why it matters: The Fed cut rates last week, and the 10-year bond is still at 4.3%. We have to be very watchful right now. We won’t get any answers on fiscal expectations from the Trump administration until Tuesday. Meanwhile, we reflect on one of the most over-hyped IPOs in recent memory.

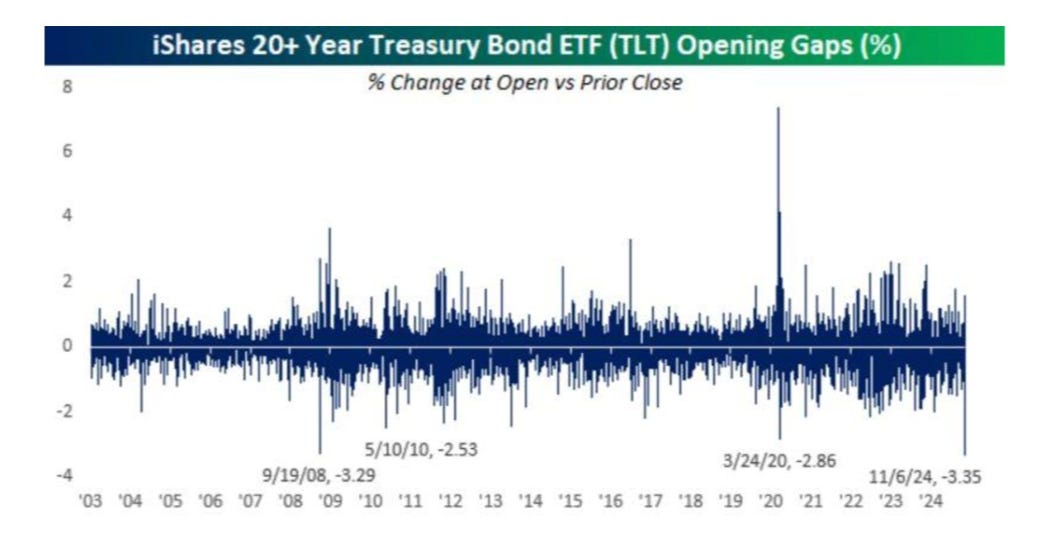

Long-duration bonds will remain under stress. We just witnessed the largest gap down on the most important long-term bond ETF on record.

Bonds with more than 10 years' duration will likely see much higher yields, as bond vigilantes demand more yield to justify the higher inflation and the prospect of borrowing to afford the interest payments.

(Click on image to enlarge)

Since we’re not getting any information on Monday, let’s pour a drink for Rivian (RIVN) and the third year since its IPO. There was a time when this company was worth more than Volkswagen. Shares are now down 91% since that IPO in November 2021, right near the peak of the last liquidity cycle.

They’re just trying to get through the next liquidity market bottom. It worked for Carvana (CVNA). I doubt they’ll be able to survive this round.

Tuesday, Nov. 12, 2024

- Event: Home Depot earnings (HD) & OPEC monthly report incoming

- Why it matters: The housing market's canary in the coal mine is set to reports earnings, while OPEC will tell us why we should pay more or less for gas.

Home Depot earnings day is the day when we find out if Americans are still willing to spend $500 on a fancy grill while their mortgage rate is north of 6%. With this story, recall that every "challenging environment" or "headwind" mentioned is code for "nobody's buying houses anymore."

If you’re trading Home Depot stock, look to suppliers like Masco, Scotts Miracle-Gro, and American Woodmark. When Home Depot sneezes, these guys catch pneumonia.

Meanwhile, OPEC's monthly report is to be released in the coming week. Expect the usual mix of "robust demand outlook" (we want higher prices) and "market stability concerns" (we want higher prices). However, weakness in China will likely keep oil suppressed for some time.

Wednesday, Nov. 13, 2024

- Event: CNBC Delivering Alpha Summit & CPI report

- Why it matters: Wall Street's wealthiest investors will gather, while inflation numbers will likely keep the Fed up at night.

The Delivering Alpha summit is an odd event. We’ll listen to Wall Street billionaires tell millionaire CNBC anchors how to make money—even though most audience members don’t have the access or capital to do what they’re discussing.

The real show arrives at 8:30 AM. We’ll get the latest Consumer Price Index (CPI) data. Investors expect another uptick on a month-by-month basis. That "2% target" is starting to look more like a suggestion than a goal. As I recently noted, the Fed is probably fine just letting core services inflation rise.

Thursday, Nov. 14, 2024

- Event: 13F filing deadline & PPI report

- Why it matters: We will get to see what hedge funds were buying three months ago, and another inflation report will be released.

With 13Fs and other reports, hedge funds will tell us what they bought approximately 45 days ago. This is like reading last week’s newspaper for yesterday’s weather.

As for the PPI report, it's like CPI's less famous cousin. Everyone is interested, but we're mostly killing time until the next Fed meeting.

Friday, Nov. 15, 2024

- Event: Alibaba (BABA) earnings

- Why it matters: It will be time to check if the company commonly referred to as "China's Amazon" has been surviving the nation’s economic problems.

Remember when Alibaba was going to be the next big thing? Well, now we’re watching analysts try to pretend that Chinese tech stocks aren't radioactive. Wait until John and Jane at Goldman Sachs try to reconcile the earnings report with China's official GDP figures.

More By This Author:

An Overtime Thriller And The Week AheadHere's How to Play the Election

A Sneaky Way to Own The Best Energy Stocks

Disclosure: None.