What We'd Pay For Hershey

The Hershey Company (HSY) stock continues to be stuck. With the market having been volatile we recently discussed at length with a member of BAD BEAT Investing this name and you will recall we discussed more broadly that we might see a rotation into dividend-paying consumer staples. Hershey stock performed pretty well during the volatility that the market experienced in the last quarter of calendar 2018. In the last few months, solid dividend paying names have continued to perform rather well. Hershey, however, is a name we have long been sour on. Sure, we have acknowledged that money can be made trading it, but as an investment, the stock has been essentially dead-money. As the name looks to drop below $100, can traders and possible long-term investors consider a position here? It is our opinion that the stock is a better value closer to $90, and both traders and investors should wait until the stock is well under $100 to do some buying. In this column, we discuss recent price action, performance, and discuss our 2019 projections. We also describe where we would be compelled to buy shares.

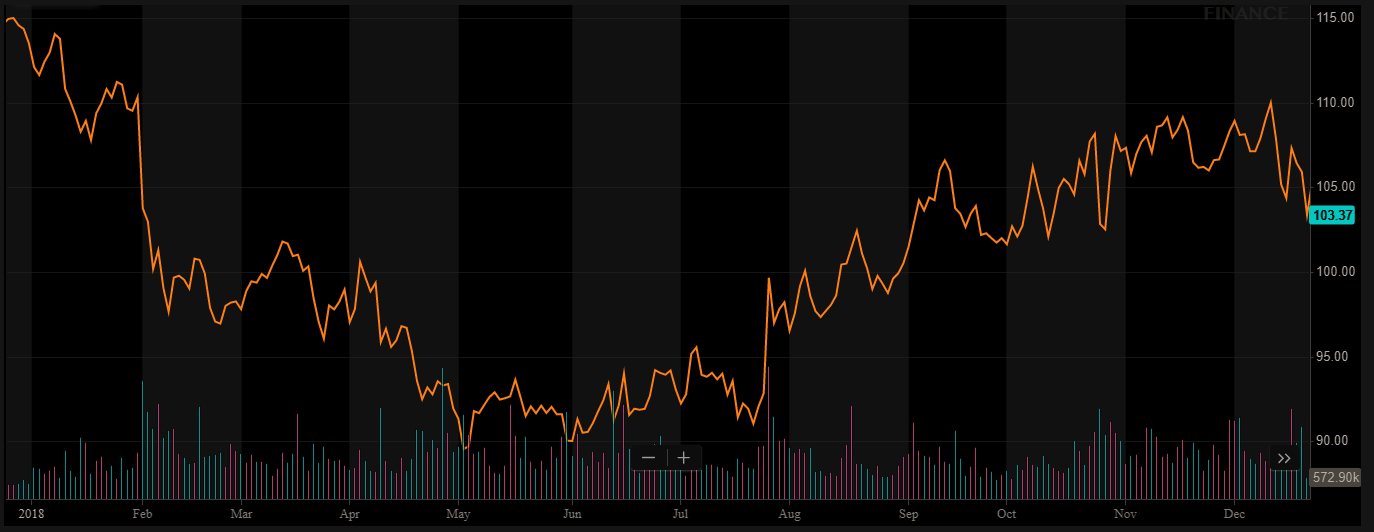

Stock held its own in calendar Q4 2018

We have been bearish on the name, calling it dead-money/overvalued in the past. While we still would love to own the name if it were ever cheap enough to yield 3.5%, we would have no problem owning it if it offered growth. But it isn't offering much growth, so we take a dividend investor/value oriented look longer-term. Frankly, we are a trading firm, and the name really has best been traded. With shares dropping following a mixed Q4, our member asked about the name. As such we wanted to talk about the name. The stock is still down tremendously in a year, though it rebounded some as investor's looked for safety in the last few months:

Source: BAD BEAT Investing

While share prices dove in 2018, they slowly gained steam to end the year. Here in 2018 the stock has pulled back and is now down to $103 following the Q4 report. The fall has us questioning whether a rally is likely after this drop, and whether it can be bought here. One thing we do feel confident about is that we just don't see the stock getting to a 3.5% yield, but it would be a golden opportunity to buy shares. The lowest the yield has been was just over 3%.

A nice yield, but wait for at least 3%

As we know, when a stock falls, the dividend yield improves. We have stated we would like to buy shares if they ever fell enough to yield 3.5%. One way in which a stock can offer a higher yield is if the company increases the dividend. Right now it is $0.722 quarterly, which translates to 2.8% at $103. To get to 3%, the price needs to hit $96 per share. To get to our 3.5% goal, shares need to hit $82-$83. That is asking a lot and would require a 20% drop. This is unlikely but a level we would buy hand over fist. From a trading and investing perspective, we believe that below $96 offers traders a solid risk-return level, whereas true value hunters should be eyeing the $80's. This is especially true if the company raises its dividend at some point, which is likely this year. Does performance justify a buy?

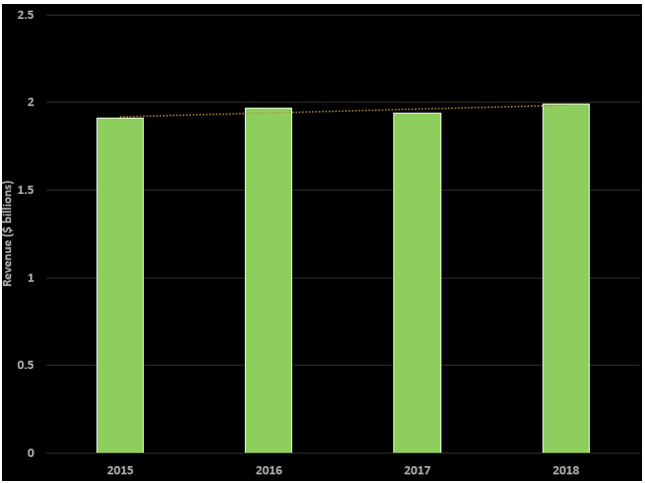

Let's talk sales

We will discuss valuation in a moment but the stock is priced for (moderate) growth. As such we would expect sales and earnings to be moving nicely higher each year. However, the growth is minimal. Let's start with sales. Net sales in the Q4 report were $1.99 billion and rose a slight 2.6% year-over-year:

Source: SEC filings, graphics by BAD BEAT Investing

While this growth is welcomed, we think it is critical to keep in mind that this growth stems from acquisitions. Overall, it is inarguable that this is slow growth during an economically strong period. We have to keep in mind organic sales pressures are real. These sales were about in line with Street expectations for $2.0 billion, but digging into the sales numbers we get more color.

First know that due to international sales, currency is still a risk, but it has subsided over the last year or so. This is evidenced by a reduced currency impact each quarter. In fact, currency constant currency sales increased 3.1%, so there was still some impact. But what we think is key is that sales overall were up thanks to acquisitions, contributing a 3 point benefit, while there was some volume increases of 0.9 points. There were some timing of shipment issues, and the company attributed some of the strength a year ago to new product launches. To bolster revenues, the company has pricing power, this quarter pricing was a 0.8 point headwind, thanks in part due to promotional pricing.

The moral of the story here? For the most part sales growth was nearly entirely inorganic, and this is not a strength in our opinion.

Looking ahead on sales

As we look to 2019, we think there is an opportunity to raise some pricing to generate organic growth. The continued lack of organic growth is a risk to investing in the stock. We see North America as a key to growth, and suspect acquisitions to have a strong impact on 2019 numbers, while pricing can be adjusted to offset past headwinds. Overall, however, if it was not for acquisitions, we would expect sales to be mostly flat in 2019. Thanks to acquisitions, we are looking for sales to be up 1-2% on the year, with any organic growth driven by volumes, but the higher side of our target can be hit if pricing is adjusted. What about margins?

Margins

Because revenues were up investors should be on the lookout for increases in expenditures. When reviewing expenses a few things stand out. Advertising and related consumer marketing expenses decreased in North America by 13.3%. This stemmed from optimization of emerging brand spending, reductions in agency and production fees, and media efficiency gains. Selling, marketing and administrative expenses, excluding advertising and related consumer marketing was flat year-over-year. Factoring in the slight rise in sales with the controlled spending, margins improved. This was a key positive to be aware of. This spending led to gross margins widening to 47.5% from 43.2% last year.

While this was welcomed news, when we look to adjusted gross margin, we are met with disappointment. Controlling for items margins contracted to 42.5% from 42.7%. On the year they fell from 45.6% to 44.0%. However, factoring in spending lower on the balance sheet adjusted operating profit rose to $421.2 million from $368.9 million. This helped overall earnings

Looking ahead on margins

As we look to 2019, margins will be key in earnings growth. We believe margins will stabilize in the year so long as selling and marketing expenses remain flat. This is the line we will watch most in 2019, and are targeting 46% for reported gross margins and 44.5%-45.5% for adjusted margins.

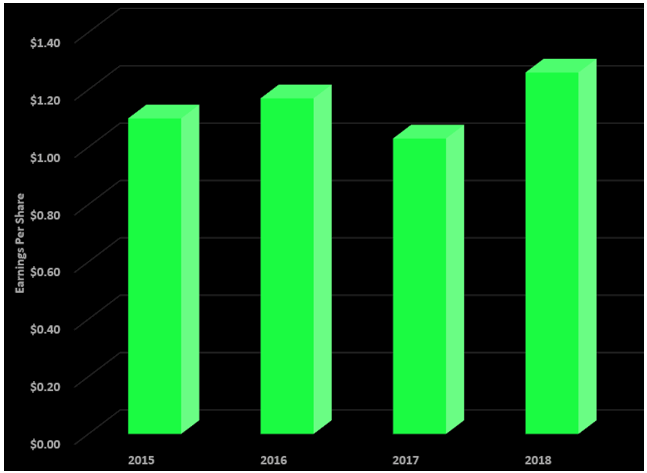

Earnings

When we consider the rise in both revenues and the well-controlled expenses, widening operating profit was the natural result. Operating margins widened. In addition, thanks to tax reform, the effective tax rate declined to 9.5% in the quarter from 15.1%. For the year, the effective rate declined to 19.2% from 26.7%. The tax rate was a major contributor to growth in earnings per share. The Q4 net income figure on an adjusted basis per share was $1.26 per share:

Source: SEC filings, graphics by BAD BEAT Investing

This is most definitely growth and was stellar growth of 23% from last year. However, growth would be much lower if it was not for taxation rate declines. This growth is going to mitigate big time in 2019.

Looking ahead on earnings

In our opinion, this performance simply does not justify the stock's valuation which we will discuss in a moment, especially when we consider that the tax rate will now stabilize to all of the growth in earnings will need to be organic (provided no further acquisitions). Since some acquisitions were made in early 2018 (i.e. Amplify) some growth is expected. The rest will need to be driven by growing sales and controlling expenses. As we are looking for sales to rise 1-2% with margins stabilizing, or improving, we are targeting earnings per share growth of 4%-6%, or to $5.58 to $5.69.

Valuation considerations

So with 2018 earnings per share of $5.36, and our top end expectation of 6% growth to $5.69, we have to discuss whether the name is properly valued. We think it is overvalued at $103. Now, even though we think $96 or below justifies a buy thanks to dividend growth, that is another 8% lower, or 20% lower if it got to a 3.5% yield.

With the recent move in share price, we firmly believe that Hershey is priced at a premium valuation for the slow growth that it offers. For 6% growth in earnings, you are paying at $103 a premium 18 times forward earnings. That is not good enough. If the stock peels back to $96, not only is the yield 3%, but the valuation would be a bit more attractive at 16.8 times forward earnings. That is still expensive, but any risk is offset by the dividend there in our estimation. Finally, if the market completely turned sour on this stock and drove shares to $82, to offer a 3.5% yield, the stock in our opinion would be attractively valued at 14.4 times forward earnings. This would be the level we would come in and buy heavily. It is a decent buy under $96, but a great buy at $82, even if it is unlikely to get there.

Our view

We still would love to get the stock at a 3.5% yield, but this would require a decline into the mid-$80s for the stock. Should the market tank, this could happen, and a defensive stock like Hershey would be much more attractive. $82 is the price we would pay for this stock.

Disclosure: Quad 7 Capital nor BAD BEAT Investing hold any positions in this ticker