What Volatility?

Image Source: Pixabay

October came to a close, and while investors had braced for volatility throughout the month, they got off relatively easy.

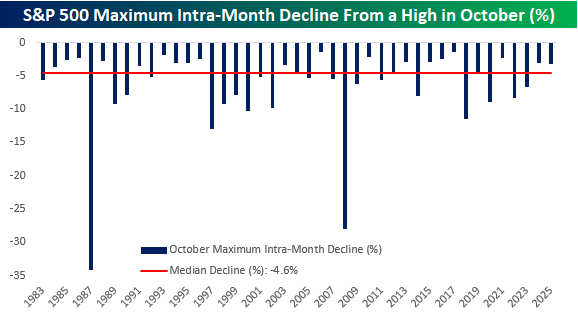

From its MTD high (at the time) on Oct. 9 to its intraday low on the following day, the S&P 500’s maximum drawdown from a high was 3.16%. While last October’s maximum drawdown of 2.99% was smaller, this past month’s max decline was 1.44 percentage points less than the median maximum drawdown of 4.60% seen during the month dating back to 1983, which is as far back as we have intraday price history for the S&P 500.

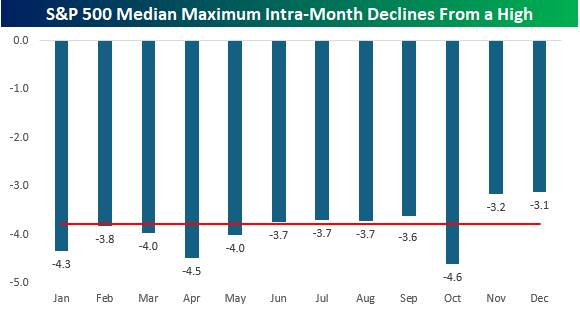

October is often known as the most volatile month, and history backs that up. As shown in the chart below, no other month has experienced a larger median maximum drawdown. Somewhat surprisingly, though, April at -4.5% and January at -4.3% aren’t far behind.

What makes the month seem even more volatile than it is, though, is that for anyone who has been around a while, two of the three largest intra-month drawdowns from a high have both occurred in October. In 1987, the S&P 500 declined by more than 34% from peak to trough, while in 2008, it plunged by 28%.

The only other months with an intra-month decline of more than 25% were March 2020 (-30.12%) when Covid shut down the economy and November 2008 (-26.45%) during the Financial Crisis. It isn’t always a crazy month, but when it is, October sure knows how to disappoint.

More By This Author:

Anticipation BuildsStrong Run Of Earnings Continues

Small Business Hesitation

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more