What "Risk" Means During Earnings Season

Image Source: Pexels

Yesterday, we had some fun at Wall Street’s expense.

Today, we get serious.

A lot of people ask me about stocks.

What do I like? What should they buy? What’s the next big winner?

I understand why they ask. But that’s not really what I do.

I’m a risk person.

My job... and what I try to teach here... isn’t about finding the next highflier.

It’s about helping you limit downside so you can sleep at night.

And then applying those lessons to situations with real upside, especially if we get a regime shift at the Fed and a change in broader liquidity over the next two years.

That’s the game I’m playing.

So when earnings season rolls around, I’m not hunting for “beats” or chasing guidance raises. (A Post-Drift Momentum strategy I’ll use after earnings is a different conversation for a different time.)

I’m looking at something different… especially in negative conditions.

Who can survive on a day like today?

Balance Sheet Survival

On the micro side, I still believe fundamentals work.

I don’t trash them… I think they’ve told a reasonable amount of the story on the way up, but not as significant as the ongoing liquidity support since late 2022.

In this environment, it’s not about growth rates or TAM slides or “the story.”

It’s about one thing:

Can this company survive a liquidity contraction?

Can it handle the stress of everyone running for the same pile of cash to refinance existing debt like it’s the last Costco rotisserie chicken before a snowstorm?

These are serious questions… and they’re going to matter over the next 18 months.

With a risk-based focus, everything else is noise until you answer them.

I’m not going to bore you with equations.

Here’s what I look at and where to find it.

1. Net Cash and Maturity Walls

Wait what?

This is easy. Who has net cash on the balance sheet?

And who is sitting on a pile of maturities coming due in 2025, 2026, and 2027?

Who can refinance easily, and who is lying to themselves about capital access?

This isn’t about private credit or governments. This is about basic measurements that you can use to understand what the hell is going on with a company’s debt.

If they were borrowing at under 2% a few years ago, and now they have to refinance it all at over 6%, that’s a huge problem.

When money was really cheap, nobody cared about maturity walls.

When money was free, maturity walls looked like speed bumps.

Now they’re guardrails missing on a mountain road.

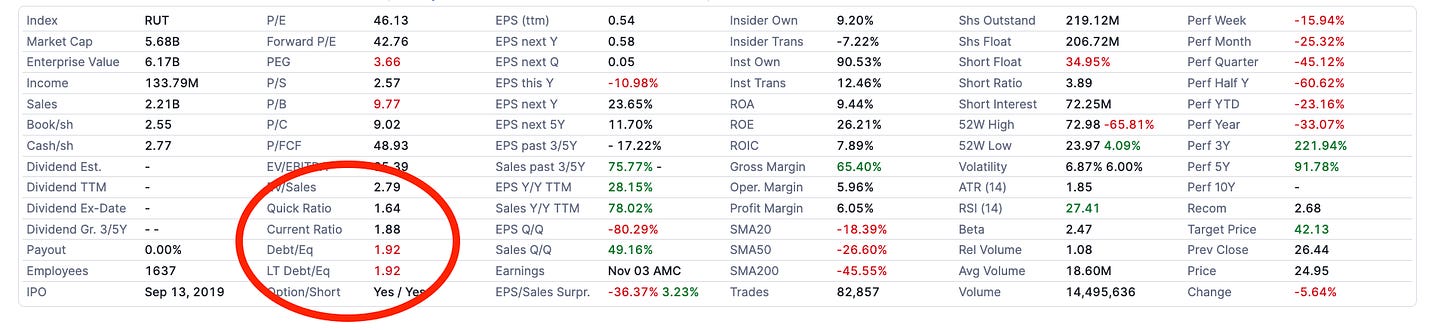

A pretty standard way to determine what problems they face is just to look at a few measurements. You can go to Finviz.

Then, pull up any ticker. Under the Financial tab, look at…

-

Debt/Equity.. How leveraged are they?

-

LT Debt/Equity ... How much of that is long-term?

-

Current Ratio ... Can they cover short-term obligations?

-

Quick Ratio ... Same thing, but a tad stricter

This is the financial sheet of Hims (HIMS)… the online pharmaceutical company. Those four metrics are right there…

Red is no good.

Now… if you’re a glutton for punishment, you can check when each specific debt will mature. You need to pull up the 10-K, parse through the debt footnotes, or the Contractual Obligations table.

But for a quick read on balance sheet health, Finviz gets to the basics in 10 seconds.

Companies with clean balance sheets and no near-term refinancing risk can play offense.

Everyone else is hoping the Fed bails them out before the bill comes due.

2. Free Cash Flow Durability

Margins are great.

But margins won’t pay a company’s bills.

They need cash.

I don’t mean cash that’s sitting in the bank right now. I mean that they’re prepared and versatile when the time comes. I want to see businesses that can self-fund in a tightening environment.

We aren’t going with companies that need to tap the debt markets every 18 months to keep the lights on.

Where to find it:

Uncle Stock and GuruFocus has the Piotroski F-Score built in.

That’s a 9-point scale measuring financial strength. Higher is better. It combines profitability, leverage, and operating efficiency into a single number.

I also pay attention to the Altman Z-Score for bankruptcy risk and the Beneish M-Score for earnings manipulation.

GuruFocus and other sites calculate these for you.

If the M-Score is flashing, it doesn’t mean fraud.

It means someone is getting very creative with a spreadsheet and a late-night vodka.

3. Insider Buying

This is one of the few signals that hasn’t been arbitraged away.

When insiders buy, especially cluster buying during periods of stress or drawdowns, it means something.

These are people with real information, putting real money on the line. I’m always interested in seeing big buys by executives after they report earnings.

Where to find it:

You need to go to EDGAR and find direct purchases… You don’t want to be parsing through 10% ownership and indirect buys. We do this daily right here.

Insiders collectively tend to call bottoms. Not because they’re geniuses. Because they hate losing their own money.

It’s not perfect, but it’s collectively better than most.

4. Simple Valuation, Anchored to Enterprise Value

I’ve learned to distrust story-driven multiples.

When liquidity is abundant, stories get bid up.

“It’s not about earnings, it’s about optionality.”

Or… “You’re paying for the platform.”

Sure. Until liquidity fades. Then stories get repriced. Brutally.

Where to find it:

Finviz shows EV/EBITDA right on the quote page. I prefer EV/EBIT when I can get it, but EV/EBITDA is close enough for a quick screen.

Combine that with a high F-Score, and you’ve got something interesting.

Quality and value in the same place. Here’s Tim Melvin… if you’re looking for more.

That’s where momentum can ignite when a trend finally arrives.

What I’ve Abandoned

I don’t care about P/E when liquidity is the oxygen. A cheap stock without financing is just a slow suffocation.

And I’ve mostly given up on traditional cycle indicators.

The ones that assume we’re operating in a “normal” monetary environment. The ones built on historical patterns from decades when the Fed wasn’t the largest actor in every market.

We don’t have a normal environment. We have a managed system with periodic stress fractures. We’ve been living in one for the last four months.

So I’ve stopped trying to predict cycles the old way.

Find the companies with the balance sheets to endure.

Watch where insiders are putting their own money.

Look for quality at reasonable valuations.

And stay alert to regime shifts in monetary policy that can change everything.

The people who get this right in the next two years will do very well.

The people chasing “beats” and “raised guidance” will wonder what happened.

If that sounds boring compared to chasing “AI optionality,” good.

Boring is how you survive.

More By This Author:

Optimism Builds On Trade Deal And Palantir Beat

My Conversation With StockTwits On Gold, Silver, And Monetary Policy...

Super Dry Federal Reserve Analysis