Optimism Builds On Trade Deal And Palantir Beat

Last week's jitters look short-lived on metals... macro and earnings dominate

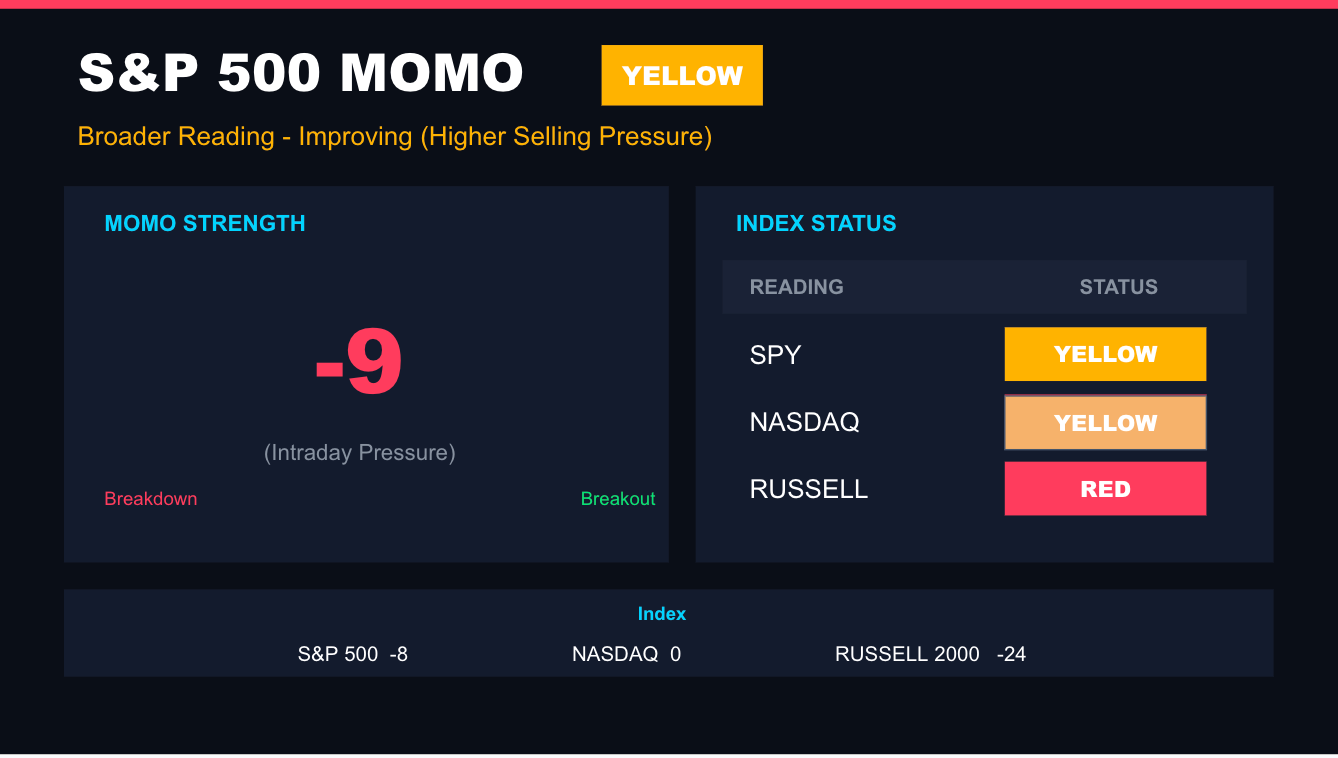

Strength in buying returned on Monday, bringing the S&P 500 to new highs, although selling pressure in the Russell 2000 remains under the surface. We are now pushing back into a period of some strength, as dip-buying continues across the board.

The ongoing support from central banks and policy actions has helped steer markets amid concerns about banking reserves, repo issues, and geopolitical tensions. With the Nasdaq pulling back toward equilibrium on risk and reversion possibilities, it’s hard to keep the top performers on the S&P 500 down.

The ongoing yo-yo effect of markets has been quick reactions and sharp reversals in specific sectors, followed by the

But I must stress. From a liquidity perspective, the markets appear to be behaving in line with expectations. Speculation around commodities remains rampant, especially when backed by national policy like the new Project Vault initiative.

Silver has surged, copper is bouncing on news of Chinese supply building, and the U.S. is now seeking to accelerate its own strategic reserves of rare earths. This will reignite conversations about Greenland and Venezuela.

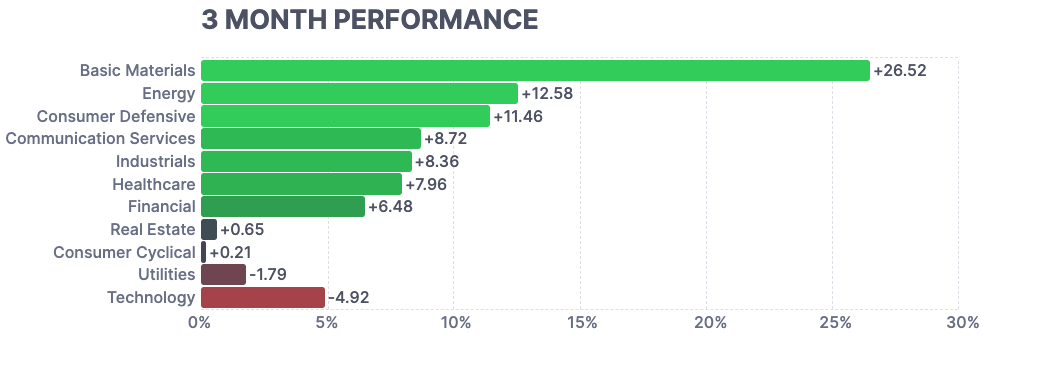

All the while, consumer defensive stocks - which typically start to do well as we move on the backside of these financial cycles - have been the third-best-performing sector over the last three months, outperforming technology and cyclicals, which are typically more aligned with the building of a liquidity cycle.

Finviz

Just an Update…

It’s been a month since we laid out a list of equities for 2026 with strong F scores, low Graham numbers, and the 20-day EMA. It’s been a busy month of analysis… so I will start circling back on those names and this trading strategy this month. Farm Partners (FPI) and Cal-Maine (CALM) have led the charge. If you’re in FPI, just note that the stock has moved into overbought levels…

(Click on image to enlarge)

More By This Author:

My Conversation With StockTwits On Gold, Silver, And Monetary Policy...Super Dry Federal Reserve Analysis

Charts To Consider This Weekend