WeWork Craters 36% After Hours On WSJ Bankruptcy Report

Less than 3 months after warning investors in its SEC filing that:

“Our losses and negative cash flows from operating activities raise substantial doubt about our ability to continue as a going concern.”

...and after a series of increasingly dire warnings over the financial condition of WeWork (WE) - and skipped payments - WeWork's inevitable bankruptcy is imminent.

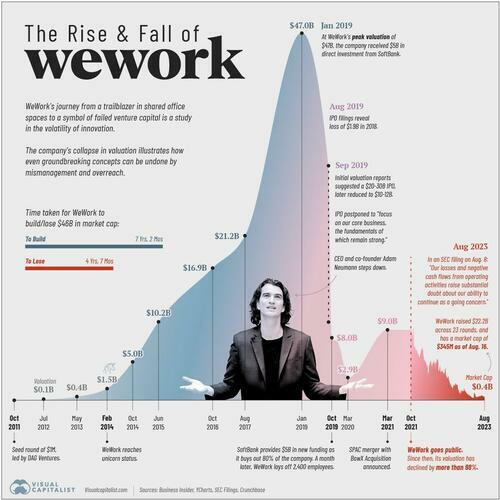

According to a report from the Wall Street Journal - which sent WeWork shares spiraling to the tune of 36% as of this writing - the failed workspace company, once valued at $47 billion, is planning to file Chapter 11 as early as next week.

(Click on image to enlarge)

Will we get another explosive squeeze this time, or are they done?

The company missed interest payments to bondholders on Oct. 2, which initiated a 30-day grace period. Failing to do so means default - however on Tuesday the company said it had struck an agreement with bondholders which would allow it another seven days to negotiate before a default is triggered.

"The forbearance agreement provides time to continue in the positive conversations with our key financial stakeholders and engage with them to implement our ongoing strategic efforts to enhance our capital structure," a spokesperson told the Journal, pointing to an early Tuesday securities filing.

Things took a decided turn for the worse in August, when a management shakeup, followed by September comments from CEO David Tolley regarding the company's lease commitments foreshadowed bad things to come.

In August, the company shook up its board after three directors resigned due to a material disagreement regarding board governance and the company’s strategic direction, according to a securities filing. WeWork appointed four new directors with expertise in large, complex financial restructurings. Those directors have been negotiating with WeWork’s creditors over the past several months about a restructuring plan as they prepare for the bankruptcy.

The flexible-workspace provider has been aiming to renegotiate leases with landlords after signaling that it has substantial doubt about its prospects for survival. Chief Executive David Tolley said during a September conference call with landlords that WeWork’s lease commitments must be “right-sized” to accommodate its operations in the current market because the office real-estate market has fundamentally changed. -WSJ

In early September, Tolley announced that the company would be renegotiating all leases, as well as a plan to cut all 'underperforming' offices.

WeWork had 777 locations across 39 countries as of June, which included 229 locations in the US. The company has an estimated $10 billion in lease obligations ranging from the second half of 2023 through the end of 2027, as well as an additional $15 billion that starts in 2028.

The company incinerated $530 million in cash during the first six months of this year, and had around $205 million of cash on hand as of June.

Going forward, as we detailed previously, since WeWork doesn't own any offices (it pays landlords), if the company can't renegotiate leases or flat-out cancels, it would inflict pain on building owners.

The ripple effect of a WeWork bankruptcy leaves 16.8 million square feet of office space at risk. We suspect building owners with heavy exposure to WeWork aren't entirely pleased about its tenant being on the verge of bankruptcy.

WeWork might be a ticking timebomb for office markets.

More By This Author:

AMD Tumbles On Disappointing Revenue Guidance, Drags Chip Names Lower

Yen & UST Yields Tumble After BoJ's Mixed Messages, But...

Stocks Jump... Everything Else Dumps

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more