Weekly Market Pulse: The Return Of Tariff Man - Monday, Oct. 13

Image Source: Unsplash

You knew something had to shatter the calm. The market had become too complacent, making money was too easy lately. It has been 27 trading weeks since the last big tariff announcement – Trump’s “liberation day” when he announced reciprocal tariffs on the entire world last April – and in 17 of those weeks, the S&P 500 traded higher, a 63% win rate. Since the beginning of September there have been 28 trading days and 17 of them were up (61%) with one run of 7 out of 10 days higher. For perspective, according to Crestmont Research, since 1951 53.7% of trading days were up versus 46.3% down. In the secular bear market that ran from 1966 to 1982, 51.1% of days closed higher while in the 90s bull market 54% of trading days ended higher. Obviously, stocks have a tendency to rise but a win rate over 60% is rare territory.

What spurred the selloff last Friday was a President Trump social media post that he was “calculating massive tariffs” because China was recently “becoming very hostile” wanting to “impose Export Controls on each and every element of production having to do with Rare Earths”. He also said this hostility “came out of nowhere” and that “(o)ur relationship with China over the past six months has been a very good one, thereby making this move on Trade an even more surprising one.” China has certainly dialed up the pressure on the US with their export controls on rare earth minerals but to say it “came out of nowhere” is not quite correct. Our pressure on China, with tariffs and export controls, has been persistent since the first Trump administration. Right or wrong, expecting them to not respond seems willfully naive, especially when new negotiations are due to start soon.

Later in the day, the President announced additional 100% tariffs on Chinese goods starting November 1st or maybe sooner, depending on China’s response I guess. If you’re getting a sense of deja vu, that’s because we already did this once this year. I thought the Trump Show was too new to be resorting to re-runs but I guess I was wrong. The last time Xi and Trump did this dance, a compromise – or something that looked like a compromise – was found pretty quickly since to continue would have been painful for both sides. I don’t think that has changed but Xi only has a few ways to apply pressure before the next round of negotiations, which Trump has now threatened to cancel. In his social media post, President Trump said there were “many other countermeasures that are, likewise, under serious consideration” so maybe we have some cards yet to play. Still, I think it is best to see the new restrictions from China, and the response from the US, as negotiating tactics to try and gain some edge before they sit down to, hopefully, strike a deal later this month.

The US and Europe have both been frantically investing in rare earth mining and refining operations but gaining independence from Chinese supply won’t happen overnight. In fact, there are no operating rare earth mines in Europe and the ones under development – in Norway and Sweden – are expected to take another decade to be in consistent production. Europe does have two rare earth processing plants, which isn’t enough, but still beats the US by one. That facility is run by MP Materials which is also our only operating rare earth miner. The US government now holds a stake in MP as well as Trilogy Metals and Lithium Americas. Another company, USA Rare Earth, is supposedly in discussions with the White House about an investment. The DoD has contracted to buy all of the magnets produced by MP over the next 10 years, so supply for non-military uses will have to come from somewhere else. So, yes, Xi’s rare earth card is valuable and while its life may be limited it is still measured in years if not decades.

The problem for the rest of the world is that these materials have become critical to the modern economy and China controls roughly 90% of the market. We may have some cards left to play but China truly has the trump card (pun so obvious I couldn’t resist). These latest restrictions on rare earths are aimed directly at the semiconductor industry which shouldn’t be surprising with the US and its allies restricting exports of high end semiconductors to China. In what is probably not a coincidence, the US Senate passed an annual defense policy bill recently that included new restrictions on export of chips to China from Nvidia and AMD. China’s new export restrictions, which require a license to sell any product with even a trace of Chinese rare earths, take aim directly at ASML, the Dutch company with a monopoly on semiconductor manufacturing equipment critical to AI chip production.

Trump’s standard response of more tariffs may give us more leverage than it first appears. China seems to have weathered the previous tariff onslaught pretty well so far, but that is a bit of an illusion. They have certainly cut prices on their products to sell more outside the US but Chinese companies were operating on thin margins before the tariffs. The Chinese have traditionally taken a shotgun approach to developing new industries, throwing capital at whatever they think the next big thing will be, but that gets you 100 electric car companies (500 at the peak) and very thin margins, if any at all. They might come out the other end of that funnel with a very competitive set of companies in the targeted industry but a lot of capital gets wasted along the way. So, while the US needs to make a deal to secure access to rare earths, China needs to make a deal too – capital is not infinite.

The issue for investors in US stocks – particularly the S&P 500 – is that this move by China directly targets the AI boom that has been the driver of stock prices and possibly the US economy more broadly. The S&P 500 – “the market” – is very vulnerable to any hiccup in the AI boom narrative because the Magnificent 7*, which make up 35% of the index, are all dependent, to some degree, on AI. And index performance is very dependent on the Magnificent Seven. Nvidia, the biggest weight in the Mag 7 and the index (8.2%), is dependent on ASML for equipment and ASML will, at a minimum, face delays in securing the needed supply of rare earth minerals. If Nvidia is throttled, everyone downstream – OpenAI, Oracle, Alphabet, Meta, Microsoft, Amazon, etc. – will see delays – or worse – too. The longer the delay, the more the market will have to recalibrate.

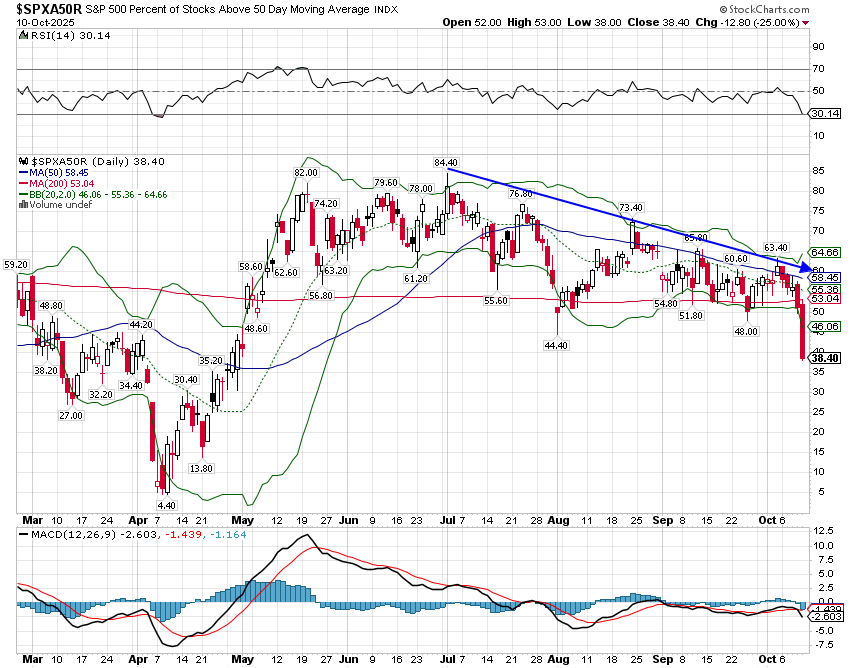

The S&P 500 advance was already narrowing ahead of this latest trade tiff with the number of S&P 500 stocks above their 50 day moving average peaking in early July at 84%. That percentage was already down before Friday to around 50% and is now 38%.

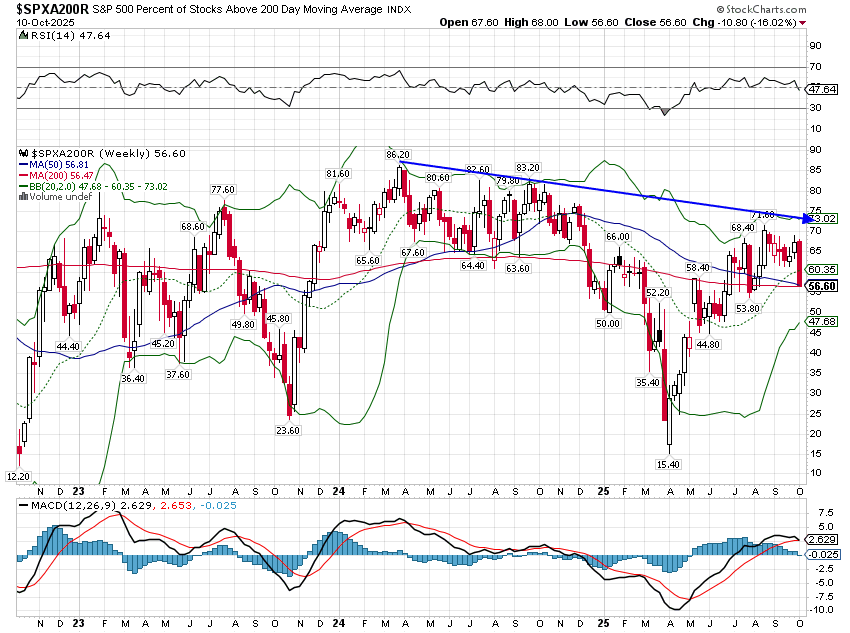

As you can see, bottoms are usually found even lower, usually around 10 but sometimes even lower. I also monitor the number of stocks above the 200 day moving average which peaked in 2024, has been trending steadily lower and after Friday stands at 56.6%.

If this is a correction in an ongoing bull market, this measure might bottom in the 30s but in a bear market the low will be 10-20. A really bad bear market would take it to single digits.

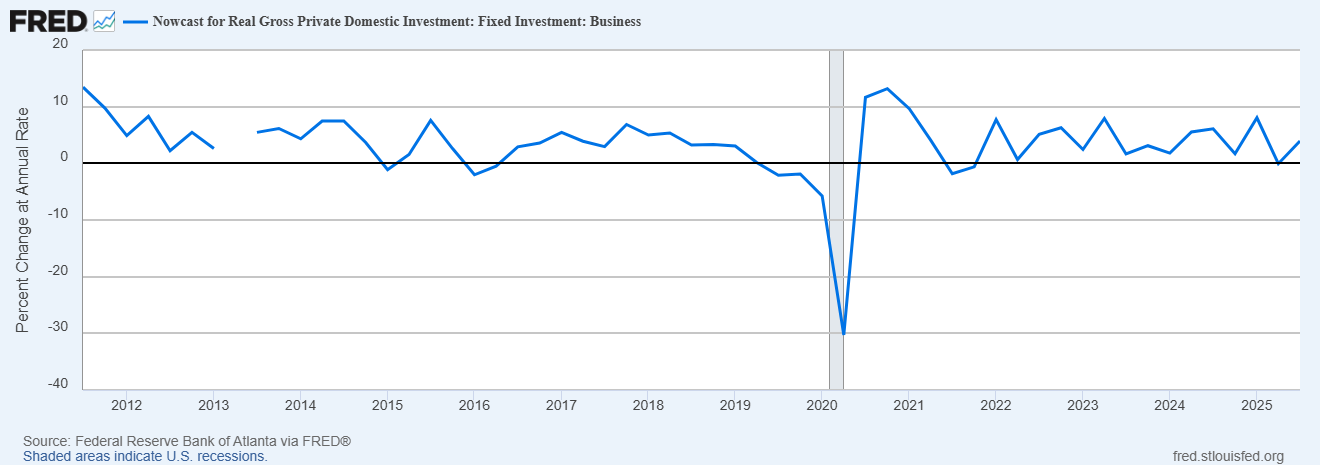

The narrative around the market this year has been that AI is the driving force for the market and the economy. I’m sure there is some validity to that – especially when it comes to stock prices – but AI isn’t the only thing going on in the US or global economy. There are a lot of promises being thrown around about future spending on AI but so far the impact on GDP has been fairly modest. The Atlanta Fed’s GDPNow breaks out the components of GDP and right now the Q3 change in business fixed investment from Q2 looks positive but unremarkable.

I think earnings also show that AI isn’t the only game in town. For full year 2025 S&P 500 earnings are expected to rise 10.4% from 2024 but only six of the eleven economic sectors are expected to show growth: healthcare, industrials, technology, materials, communication services and utilities. However, earnings have accelerated as 2025 has progressed and expectations for Q3 25 vs Q3 24 show 8 of 11 sectors with profit growth (including FFO growth in REITs). The picture for 2026, if estimates are anywhere near correct, shows more broadening with 9 of 11 sectors expected to show not just growth, but double digit growth with index earnings expected to rise 17.6%. Is that earnings growth all AI related? I have my doubts.

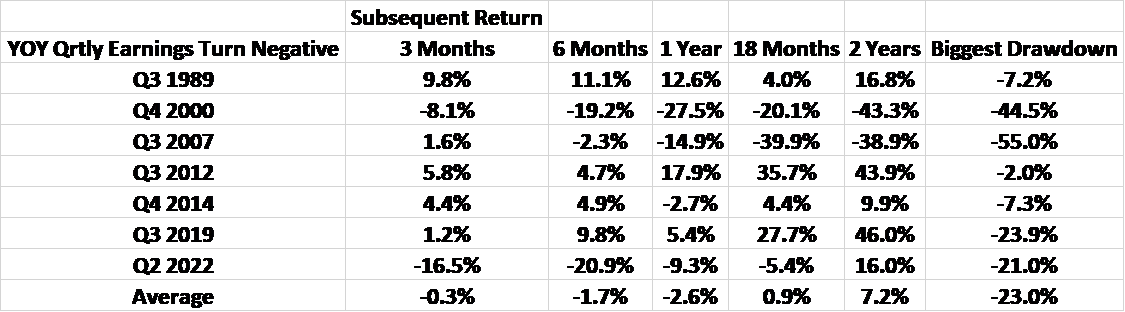

The outcome of these upcoming trade talks with China are important but I expect another deal, of some kind, because neither side benefits from the status quo. Things that can’t go on, don’t and I think 130% tariffs and “no rare earths for you” fall into that category. As for stocks, prices usually follow earnings and on that front the outlook continues to improve. Stocks don’t generally start to perform poorly until the year over year change in same quarter earnings (say, Q4 ’00 vs Q4 ’99) turns negative. Earnings usually deteriorate as the economy slows but economic data lags so earnings estimates are a better early warning sign. Right now Q4 2026 earnings estimates are 15.8% above Q4 2025 earnings estimates so there is no warning in sight.

What happens to stocks after year over year earnings turn negative

I think the greater potential problem for the market is interest rates. I’m not convinced the inflation genie is back in the bottle and the Fed has already cut rates once this year. The only real sign of economic weakness has been from the labor market, where job growth has slowed considerably. However, with jobless claims still very low, it appears likely that the jobs slowdown is mostly about changes in immigration policy. If that’s true, cutting short term interest rates isn’t going to solve that problem and it could easily lead to a resurgence in inflation. Higher inflation means higher interest rates which leads to lower stock prices even if earnings remain robust.

This complexity – and there is way more going on that China tariffs and a potential Fed policy mistake – is why a diversified portfolio is your best friend right now. Lots of assets have outperformed the US stock market this year and if the dollar stays weak (or gets weaker as I expect) then that list is likely to expand. Don’t miss the forest by concentrating on one tree.

*Nvidia, Microsoft, Apple, Broadcom, Amazon, Meta and Alphabet. I think you could probably add Oracle now and make it the Exceptional Eight.

More By This Author:

Macro Monthly: Status QuoWeekly Market Pulse: No Data, No Problem

Weekly Market Pulse: The Most Interesting Chart In The World

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more